Battery production for electric cars: It’s just not enough.

There is this rumour that has been circulating for a while now that the Volkswagen AG wants to invest ten billion euros – in a battery cell factory. And in Germany’s Salzgitter, of all places. That’s the same locations of the carmaker’s massive TDI and TSI production site. VW is daring to go all out to be at the top the industry, it says. But the news begs one question: Will the production capacity suffice once the EV market really gets going?

There is this rumour that has been circulating for a while now that the Volkswagen AG wants to invest ten billion euros – in a battery cell factory. And in Germany’s Salzgitter, of all places. That’s the same locations of the carmaker’s massive TDI and TSI production site. VW is daring to go all out to be at the top the industry, it says. But the news begs one question: Will the production capacity suffice once the EV market really gets going?

The answer is simple. No. Still, no one seems to be scrambling to find a good a location. Why is that?

Germany’s National Platform for Electric Mobility (NPE) outlined in its “Roadmap for integrated cell and battery production in Germany” that the worldwide production capacity of traction batteries reached about 27 GWh in 2014. 26 percent are manufactured in Japan, followed by Korea (24%), China (22%) and the U.S. (also 22%). A mere 6% are made in Europe.

The public’s attention is meanwhile focused on Nevada, where Tesla’s Gigafactory is taking shape. The EV maker is working with Panasonic and aims for an annual output of 35 GWh by 2020. In other words, the factory would crank out more battery cells than all others combined.

ENOUGH FOR 1 MILLION EVS

Tesla continues to increase battery capacity with every model, as do other manufacturers. Assuming the Model 3, S, and X boast an average of 70 kWh, the Gigafactory could supply 500,000 EVs per year. When adding together EVs across the rest of the world, and even when assuming that the VW e-Golf, Nissan Leaf and co. sport more like a 50 kWh battery on average, we get roughly another half a million. The goal here is to look at the big picture, not at the decimal.

If those calculations are correct and 2020 will see 100 million new cars hit the road, about 1% could be electrified. At the same time, carmakers are outbidding each other with proclamations that need to become concrete for them to stay credible or to regain the buyer’s trust.

PROCLAMATIONS THAT ARE PROMISES

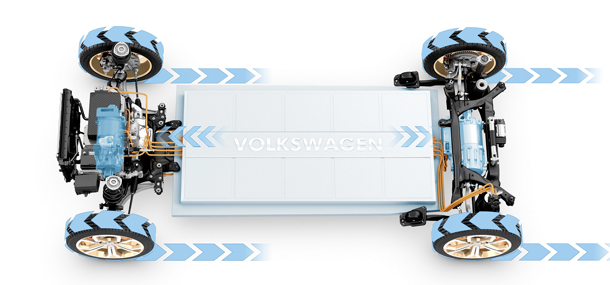

Here are some examples: VW promises at least one Audi, Porsche and VW with more than 90 kWh using the Modular Electrification Platform (MEB). Nissan says the next Leaf will sport a 60 kWh battery pack, doubling its current capacity. And France’s PSA is working with Dongfeng Motors from China to launch four electric models with a 450 km range between 2019 and 2021. All those cars need batteries that are made from individual cells. The German industry has kept saying that the implementation was the real skill and that there was no need to produce batteries themselves. Behind closed doors, everyone points at Daimler, who gave a joint venture with Evonik a shot – and failed.

The situation is ambivalent. One can be too early – see Daimler -, but also too late. Bosch summarises the situation as follows: It’s all a question of when the demand will increase. “The current situation shows that there is a surplus of similar cell technologies. Bosch wants to first see a technological advance – meaning double the energy density, but at half the cost – before it will make a decision with regards to cell production.”

Bosch is playing for time or is clever enough, to not let anyone see its cards.

VDMA WARNS OF SHORTAGE

The German Engineering Federation VDMA has a different point of view: Dr. Sarah Michaelis from VDMA Battery Production would welcome a battery cell production facility in Germany, because “the country has a good reputation and it would be a great reference for our members.” A number of VDMA members, especially medium-sized companies working in the field of electrode manufacturing or cell assembly, have acquired a lot of know-how over the past years. German-based battery cell production could be their chance to show their expertise. A survey shows that still 50 percent of battery machines and facilities are exported to Asia; another 24 percent are shipped to North America.

Michaelis knows that there could be difficult times ahead: “When demand increases but there are not enough factories, then we will face a shortage.” The construction of a production facility would take too long for the industry to quickly react to a change in pace. “The case of silicon-based solar panel production sites in 2007 should be ample warning. Prices increased tenfold almost over night,” Michaelis says.

Everyone who, unlike Asian carmakers or Tesla, has no access to battery cells, could be left behind. A predicament that manufacturers could only escape by planning and building more production sites – which would take three years.

MAKE A DECISION AND PERSEVERE

What is the right decision for Germany? There are a few options. On one hand, it is possible to ask an established Asian supplier to set up shop in the country. LG, for example, is looking to set up a factory in Poland and Samsung is also looking for a new location in Europe. But for them to even consider Germany, there would be a need for incentives and subsidies.

The second option is for a national electronics or chemical company to take initiative. Not only Bosch or Continental could set up something. It would be a classic model: A German supplier working hand in hand with a carmaker.

The third option, which currently dominates the headlines, is for VW to expand its factory in Salzgitter, adding a cell production site. Or maybe it will go for the city of Emden, where it would be easy to use offshore wind energy to power the operation. That would also be a great story for the PR department, but the result would be the same: the net value stays in-house.

The German automobile industry faces a difficult decision. If it does nothing, it runs the risk of falling behind. Some pessimists are already prophesying the fall of BMW, Daimler and Volkswagen. Is the industry overly zealous, the move could, on the other hand, turn into a bad investment. Because, let’s not lose sight of reality: demand for battery-electric cars is still low.

If we beam ourselves a few years into the future, to the year 2025, it is not unthinkable that the EV market is still stagnating. It is more likely, however, that market shares have well surpassed the 1% mentioned at the beginning of the article. Meaning, thee who decides to invest in a battery production plant now, needs one thing above all: perseverance.

Text: Christoph M. Schwarzer

Translation: Carla Westerheide

4 Comments