El desarrollador de baterías de estado sólido Factorial saldrá a bolsa mediante una fusión SPAC

A principios de diciembre, la empresa israelí de baterías StoreDot, que desarrolla tecnología para baterías de vehículos eléctricos de carga ultrarrápida, anunció su fusión con una SPAC para cotizar en bolsa. Una SPAC, o Special Purpose Acquisition Company, es una sociedad creada únicamente para adquirir otra empresa y que ya cotiza en bolsa.

Factorial sigue ahora el mismo camino y ha anunciado un acuerdo de fusión con una SPAC llamada Cartesian Growth Corporation III para acelerar la comercialización de su tecnología de baterías de estado sólido. Esta fusión permitirá a Factorial ampliar significativamente su base de capital, aportando hasta $376 millones de USD para impulsar su crecimiento.

Esta cifra incluye $100 millones de dólares estadounidenses en capital nuevo comprometido por inversores institucionales a través de una colocación privada de acciones ordinarias (PIPE). También comprende $276 millones de dólares estadounidenses mantenidos en un fondo fiduciario por Cartesian Growth Corporation III, aunque es posible que parte de esta cantidad deba reembolsarse a los inversores que, por ejemplo, no aprueben la fusión con Factorial.

Valoración objetivo de $1.500 millones de dólares

La valoración pre-money de Factorial es de aproximadamente $1,1 bn antes de la fusión. Si no se realizan reembolsos del fondo fiduciario de Cartesian Growth Corporation III, la fusión daría lugar a una valoración total de alrededor de $1.500 millones de dólares estadounidenses para la empresa combinada.

"Este acuerdo marca un punto de inflexión fundamental en nuestra progresión desde una tecnología probada hasta un amplio despliegue comercial en múltiples sectores", declaró el Dr. Siyu Huang, cofundador y consejero delegado de Factorial. "Hemos demostrado que nuestra plataforma de estado sólido ofrece lo que los clientes desean: mayor autonomía, menor peso y mayor rentabilidad". Se espera que la cotización en el Nasdaq proporcione el capital y una mayor visibilidad para impulsar la adopción comercial de nuestros productos transformadores."

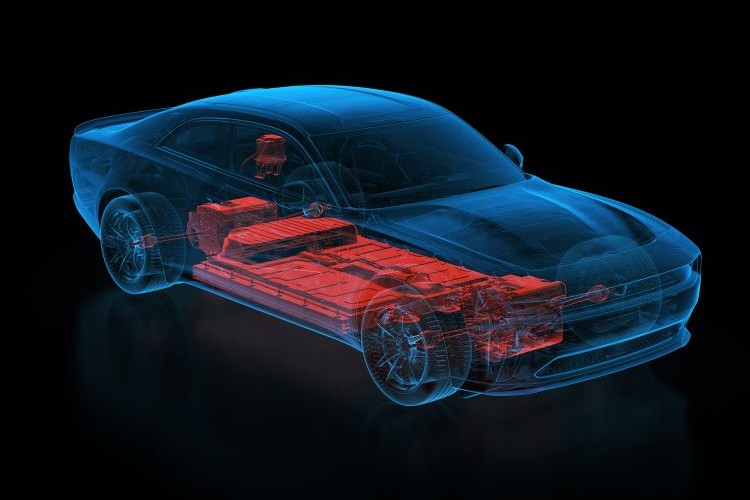

Mercedes, Stellantis y Hyundai son inversores

Factorial está lejos de ser una start-up desconocida: la empresa, con sede cerca de Boston, ya ha conseguido Mercedes-Benz, Stellantisy Hyundai-Kia como socios estratégicos e inversores. Los tres grupos automovilísticos tienen previsto utilizar las baterías de estado sólido ligeras y de alto rendimiento de Factorial en los futuros vehículos eléctricos, que se espera que permitan una autonomía superior a los 1.200 kilómetros. Además, las baterías de estado sólido de Factorial están diseñadas para aplicaciones en los sectores de defensa, aeroespacial, robótica e industrial.

Se espera que la fusión se complete a mediados de 2026, y que la empresa combinada cotice en el Nasdaq con el símbolo FAC. A diferencia de una OPI (Oferta Pública Inicial) tradicional, una fusión SPAC no implica una oferta pública de las acciones de la empresa. En el caso de Factorial, sólo se está llevando a cabo una colocación privada entre inversores institucionales (como se ha mencionado anteriormente en el apartado PIPE). Sin embargo, tras la fusión con la SPAC, las acciones de Factorial serán libremente negociables en el Nasdaq para cualquier inversor interesado.

0 Comentarios