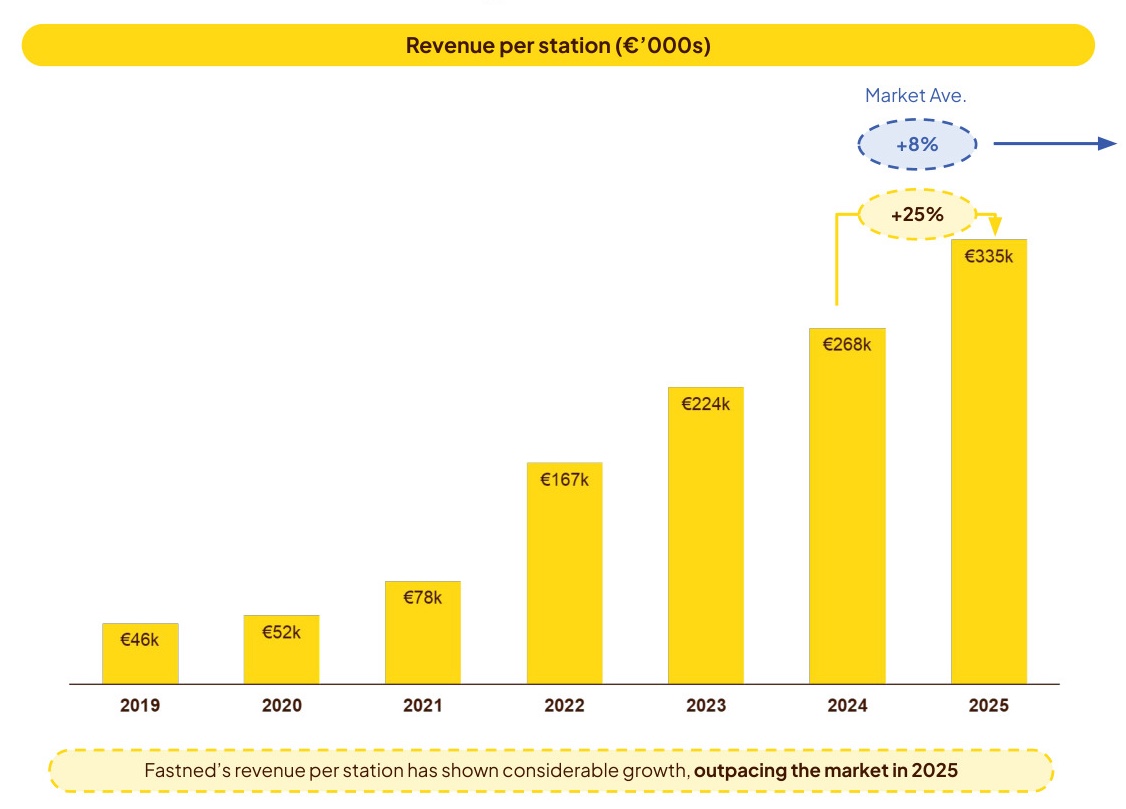

Fastned achieves €335,000 revenue per site

Last year, the Amsterdam-based company expanded its network to 406 sites last year across the Netherlands, France, Belgium, Germany, the UK, Switzerland, Denmark, Spain, and Italy—an increase of 60 new sites. This includes Fastned’s first motorway charging park as part of the Deutschlandnetz. Of these 406 sites, 50 are located in Germany.

Fastned has now released additional key figures for the fourth quarter of 2025 and the full year 2025. The Dutch company has shared an initial outlook ahead of its annual report, which is scheduled for publication on 19 March 2026.

In the fourth quarter of 2025, the company achieved revenue of €38.1 million from charging sessions—a 44% increase compared to the same period the previous year. This demonstrates consistent growth in the charging business: for the third quarter of 2025, Fastned also reported a 44% rise to €33.5 million. Similarly, in the first half of 2025, revenue grew by 44% to 54.3%.

Combining the four quarters, annual revenue from charging sessions amounts to approximately €123.9 million, with the final figure to be confirmed in March. As Fastned generates no other significant revenue streams, this figure is likely to represent its total annual revenue. In the full year 2024, Fastned reported revenue of €86.3 million. This results in a year-on-year revenue increase of around 44%—hardly surprising, given that this matches the growth rate seen in the individual quarters.

Of particular interest is the revenue growth per site, which Fastned has continuously improved in recent years. While the average revenue per site was €167,000 in 2022, it rose to €224,000 in 2023, €268,000 in 2024, and reached €335,000 in 2025. The increase from 2024 to 2025 alone was 25%, which Fastned states is significantly higher than the overall market growth of 8%.

There are two main reasons for this significant revenue increase per site. Firstly, Fastned’s new charging parks are, on average, larger than earlier sites and thus feature more charging points, which significantly boosts revenue potential. Secondly, Fastned’s charging points are now utilised far more efficiently than in the past. The company has benefited from the substantial increase in new electric vehicle registrations in its core markets, whose drivers charge their vehicles at Fastned sites, among others. Fastned emphasises that it is not solely relying on expansion through additional charging parks but also on increased capacity at 35 sites in the fourth quarter alone—through expansions, repowering measures, and upgrades to higher charging power. This enables Fastned to serve more customers, particularly during peak times.

“This was an outstanding fourth quarter for Fastned, and I am delighted to see how our team continues to expand our business across Europe. Our network now comprises over 400 stations, which continue to deliver industry-leading yields and give us great confidence in the future,” says Michiel Langezaal, Co-Founder and CEO of Fastned. “His company has positioned itself in an excellent starting position for 2026,” he adds.

However, this growth is extremely capital-intensive. Last year, Fastned launched three bond programmes, securing €110 million in financing. Building a large charging network requires substantial investment, including in rapid charging stations, transformers, grid connections, and canopies. Such costs must be depreciated over many years, meaning it is a marathon before a charging network provider can achieve a net profit.

Fastned reports that it continues to achieve a positive operating EBITDA, with the operating EBITDA margin for the full year 2025 expected to be between 35% and 40%. Exact figures will be provided in the annual report. However, while a high operating EBITDA sounds impressive, it does not necessarily translate into net profit for a charging network business. High depreciation costs effectively erode the operating EBITDA. For instance, in 2024, despite a positive operating EBITDA, Fastned reported a net loss of €26.6 million, and in the first half of 2025, a net loss of €18.3 million. The final figures for 2025 will be announced on 19 March 2026, as mentioned.

0 Comments