Dataforce: large car fleets in Germany aim to grow further

Market experts at Dataforce examined German corporate car fleets with more than 100 vehicles. A key finding of the “Dataforce 100+ Car Study” is that the majority of fleet managers for large fleets plan to maintain or increase their fleet sizes.

Dataforce collected its data using a two-stage approach. First, guideline-based interviews were conducted with 14 fleet managers to qualitatively capture key questions and challenges. Based on these insights, a follow-up survey of 50 additional managers in the sector was carried out to quantify and validate the findings. Dataforce states that the study’s focus was on the biggest pain points in large car fleets, the organisational structure of fleet management, and other central aspects of daily practice.

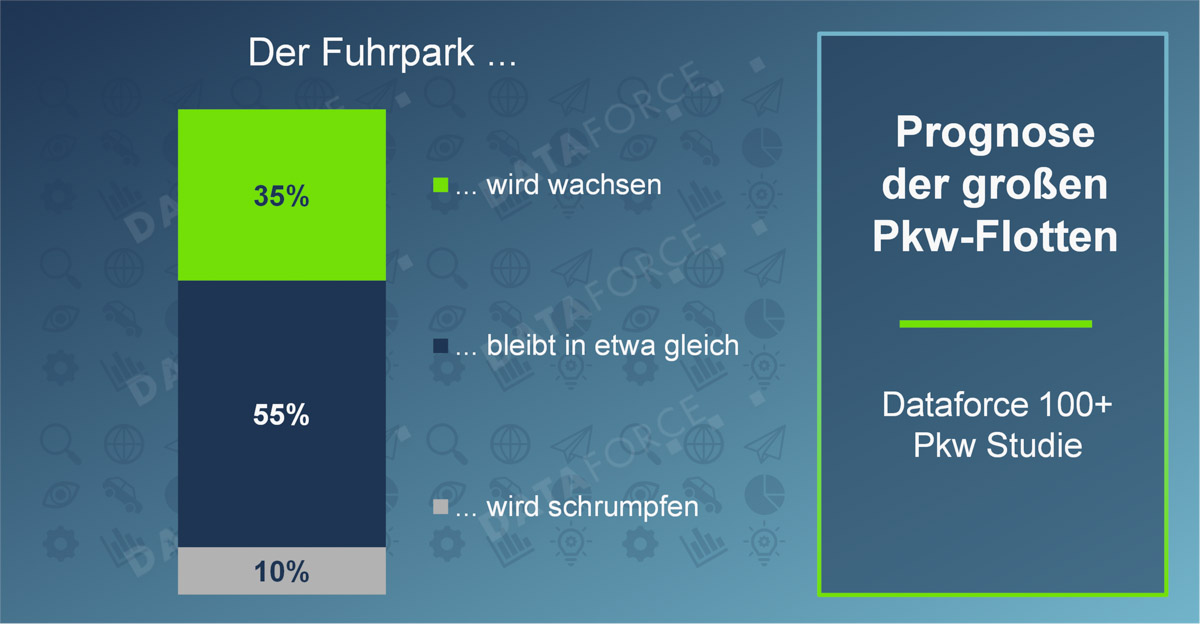

In this two-stage survey, 90 per cent of fleet managers indicated that they aim to maintain their fleet at least at its current level. For 55 per cent of respondents, the fleet is expected to remain roughly the same, while 35 per cent anticipate explicit growth. “The primary driver of this trend is ongoing corporate growth: as the number of employees increases, so does the need—and the desire—to reliably ensure mobility,” explains Dataforce. “Additionally, longer vehicle retention periods help stabilise fleet sizes overall and avoid short-term fluctuations.” Reductions in vehicle numbers are mainly expected where companies are undergoing structural downsizing, as fewer employees require fewer vehicles.

The majority of fleet vehicles are personally assigned company cars, rather than pool vehicles. “In an increasingly competitive labour market, the company car remains an essential tool for attracting and retaining skilled workers,” the announcement states.

These company cars are increasingly going electric—partly due to the tax advantages of company car taxation. Alongside tax benefits, key objectives in fleet organisation mentioned by fleet managers include sustainability (“By 2030, all cars should be electric—that is our goal”) and corporate image (“It is up to date to say: I drive an electric car”).

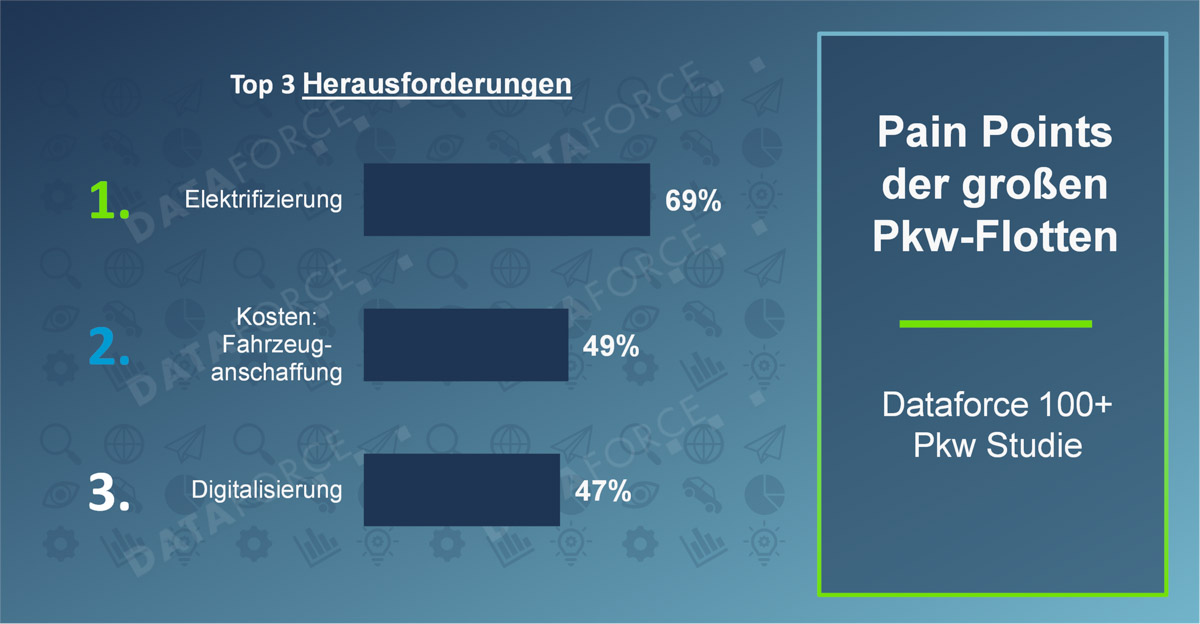

At the same time, fleet managers identified electrification as the biggest challenge, accounting for 69 per cent of responses. The issue is not the switch to electric cars itself, but rather the practical hurdles that did not exist with internal combustion engine vehicles, though these are not insurmountable. Key concerns include “insufficient charging infrastructure, particularly at employees’ homes” and the “complex organisation of home charging”. For example, charging electricity in home garages in Germany can no longer be reimbursed on a flat-rate basis; it must now be accounted for per kilowatt-hour. Dataforce notes that these factors are compounded by classic uncertainties and reservations, such as range concerns on the part of fleet managers and company car drivers.

Ranking second among the biggest hurdles, at 49 per cent, are the costs of vehicle procurement. Rising vehicle prices and leasing rates make acquisition more challenging—not just for electric cars, but across the board. This situation may improve in the future, as new electric cars have now reached the price level of many plug-in hybrids, and manufacturers are also introducing more affordable models. In recent years, the purchase prices of electric cars were often significantly higher than those of internal combustion engine vehicles and hybrids, a reality even large customers with volume discounts felt. Dataforce observes that many managers report that it is becoming increasingly difficult to find suitable models within the budget limits set by car policies.

Incidentally, the third-largest pain point for fleet managers, at 47 per cent, is digitalisation—or rather, the lack of its implementation. Common complaints include media disruptions, such as when documents must be printed, signed, and then scanned back in. “A driver app for reporting damage and defects would be useful; today, this is handled via editable PDFs sent via intranet or email,” was one piece of feedback from the discussions with fleet managers.

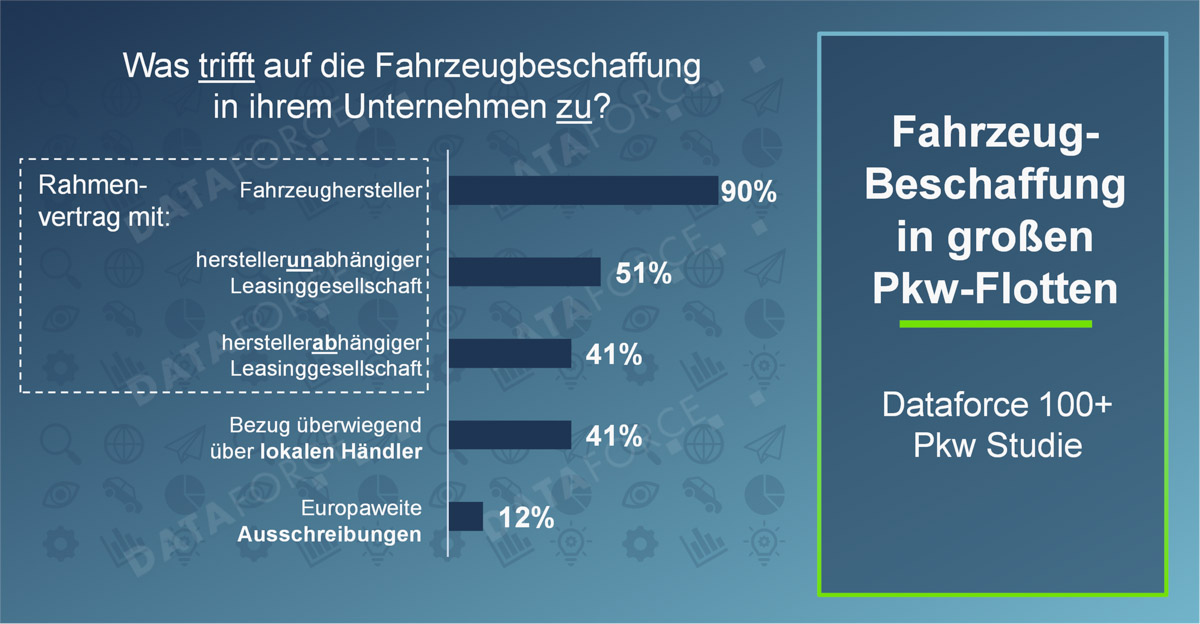

When it comes to procurement, most large fleets work with multiple sources for their vehicles. For example, 90 per cent have a framework agreement with a manufacturer, 51 per cent additionally with an independent leasing company, and 41 per cent with a manufacturer-dependent leasing company. Another 41 per cent primarily work with local dealers, while only 12 per cent procure their vehicles through Europe-wide tenders. The significant framework agreements and long-standing relationships initially pose a challenge for existing competitors and new market entrants. “At the same time, discussions with large car fleets show that opportunities continuously arise: fleets are in a constant state of flux—whether at an operational-structural level or in terms of the vehicle fleet itself,” Dataforce summarises. “This dynamic repeatedly opens up opportunities for new customer acquisition but also carries the risk of losing existing customer relationships.”

One thing is clear: a competitive price may open doors, but it is no guarantee of securing a deal or a new multi-year framework agreement. “To win over fleet customers in the long term, seamless collaboration processes are essential. Quick, professional, and competent support is particularly crucial,” reports Dataforce from the discussions. “Many fleets report breakdowns in long-standing business relationships arising from seemingly minor issues—such as technical errors, discrepancies in defect assessments, or support perceived as inattentive and too slow.”

Source: Information via email (announcement), dataforce.de (full study in German)

0 Comments