Change of view: The EV as end device in the tech stack

In our latest feature, Paul Gumienny of Cosmic Cat Group is reminded of his experience in the early telco industry when looking at e-mobility today. Much like in the telecommunication sector before, he says fleet managers and the industry better start rethinking their business now.

Rethinking e-mobility and fleet applications in this sense means to apply stack thinking – more of that below – to new business models and a connected car world. The electric vehicle here becomes a “beautiful hardware base” and ideally “interchangeable” says the consultant, while fleet data is the new gold standard. Regular readers may remember the messaging style from previous contributions by the Cosmic Cat Group consultancy by some former Hubject employees and founders.

***

Message #1: The EV is an end device now

We are still talking too much about the functional characteristics of the EV as such: Praising the design, the charging speed, the battery size, the laser-based windshield wipers or the automated valet parking. Let us zoom out a few kilometres and see the EV from another perspective – that of a telecommunication provider.

Telco providers have always considered the smartphone an end device, and we suggest, carmakers begin to consider doing the same. Most important for such an object is that it speaks the same language as its friends or competitors at, well, the other end. For a telco provider, such a device can easily be interchangeable, as long as it is a slave to the standards, agreed-upon by international telecommunication boards. At least that is the simplified version. But communication happens on multiple layers.

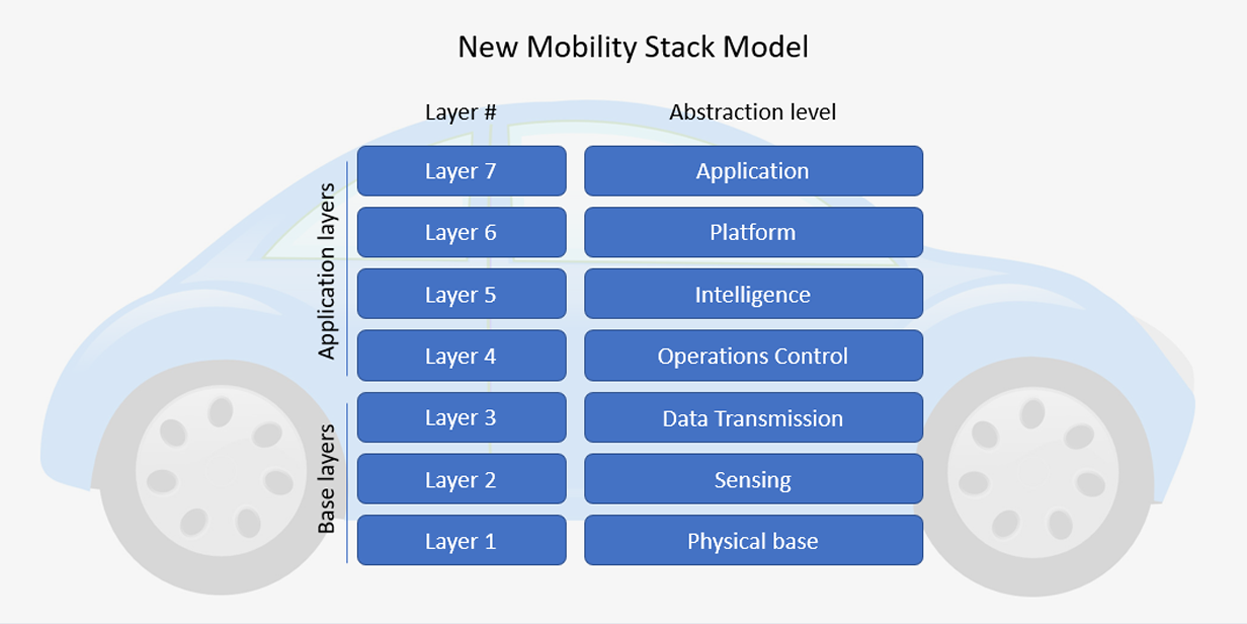

Looking at layers of communication as a stack is a concept called the OSI-7-layer model – later simplified to the TCP/IP model. Internet pioneers started to connect devices based on this thinking and made protocol stacks a fundamental basis for all things internet, including the internet of things (IoT). These protocol stacks define how digital communication works and handle various increasingly abstract layers of information, creating connectivity and context between the lowest, a physical world layer, the phone hardware and communication cable, and the highest, a flexible application layer, represented by e.g.mobile app functionality.

Projecting this structural model onto e-mobility allows a new point of view for the industry. In this model, the base layers are the ones most constrained by physics and standardizations, whereas the upper application layers are increasingly flexible in design. The physical EV at the bottom of the stack functions as a beautiful hardware base that carries the software solutions built on top. Ideally, the EV would be interchangeable and able to communicate in a standardised language which other vehicles can understand as well.

Message #2: Digital EV fleet services are the new mobile phone apps

So much for the basics. But what does this say when transferred to managing entire EV fleets vs using a single, isolated, EV service? To stay within the image, compare the potential use of a group of smartphones to a single mobile. A group enables distributed business models such as tools for communication and collaboration as well as virtual, and gamified social experiences that even allow individuals o fall in love with each other.

While we have yet to see a dating app for electric cars, although there have been cases of a shared love for EV brands leading to marriage, the technical connectivity of electric cars, in particular, adds a new socio-technical dimension to the given space.

Besides, the latest vehicle generation demonstrates a quantum leap from hitherto known ICEs in terms of services based on data and APIs. Spend a minute contemplating what kind of value can be generated for digital fleet services by utilizing untapped software layers.

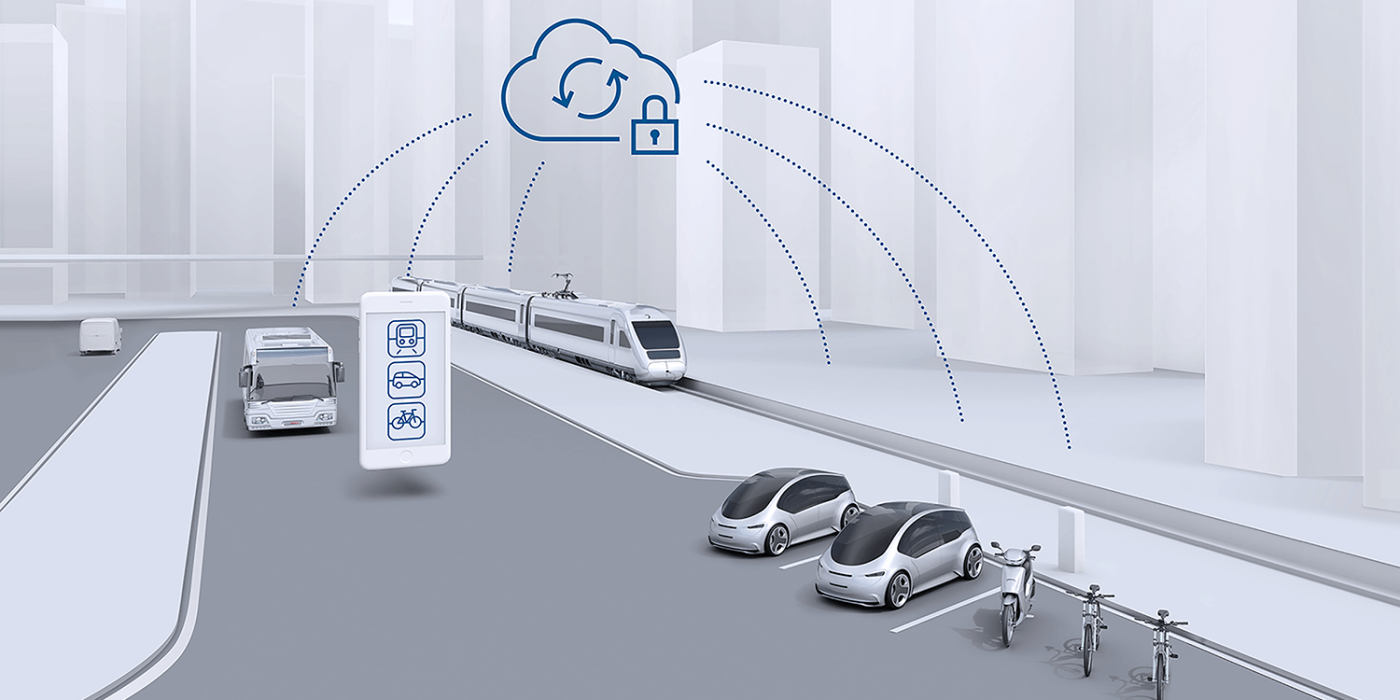

Fleet service digitization in this sense goes beyond translating booking spreadsheets into software tools and fleet management optimization software. Think instead of value generated by B2B marketplace providers on the platform layer, e.g. provide deep AI-driven real-time fleet information to app providers, or provide an app that monitors ideal smart charging time slots directly to end-users based on systemic pricing information from the energy network. The results will make fleet services, such as booking engines, commercial tracking tools or optimization of charging statuses and cycles look like low-margin commodities.

Message #3: The more the merrier – EV data means business models

Digital transformation is reading all possible static and dynamic data from the standing and moving object and translating it into added value for your fleet. It is a drastic shift, not only in terms of the necessary cultural transformation but also an opening to untapped revenue streams and new opportunities for business models.

Have you thought about potential real-time pricing, EV crowdsourcing model applications for collecting qualitative data, or in-car commuting real-time business use-cases in this context? It is the gold-digging time right now or, you could say, new software fleet services are the new gold mines, and the rush has yet to start.

If you do not run a fleet service yourself or are an OEM with deep API control, entering this market can be easy despite little or no value chain participation. Data-centric business model enabling platforms for the mobility world have not only set up shop but are already managing more than four billion data points while having raised funds north of 50 million within the last few years.

Even if you don’t come up with a creative idea for a new fleet service business model, these data pools will surely highlight business opportunities that can spark ventures or corporate spin-offs. Or you could look for existing marketplaces to attach your stand-alone service if you are new in Mobility Town.

Message #4: Stack-think now or risk becoming a commodity

In the telco world, vast opportunities have arisen while the industry was still asleep with dreams of SMS, MMS, and voicemail, while the real progress happened on the OTT, that’s the Over-The-Top-Layer, where Whatsapp or Youtube began to flourish and even sparked debates about net neutrality. In e-mobility too, this is the layer where fleet services still have a great deal of space to take root and expand to the top.

Who will be dominating the space of future fleet services? Will we see OEMs, traditional fleet service verticals, fleet business managers, energy companies,or innovative digital mobility newcomers taking to the top?

This is a business capability, a strategic positioning, a digital transformation ambition and last but not least – a question of persistence and longevity. Integration into the evolving mobility software stack can be as justified as strategically defending a self-controlled stack in an ecosystem. Traditional fleet business verticals, however, could be squeezed out by digital native over-the-top fleet players and end up in low-margin commodity dumps, if they do not burst out of the current monolith.

It depends particularly on how much space will be given to established digital companies and rising, digital-native fleet stars which impose their mobility stack driven business model thinking capabilities to become global players, and how fast traditional fleet service players will be able to manoeuvre on higher technology stacks layers.

History tends to repeat itself. Better get ready.

About the author

The author Paul Gumienny had advised companies in the digital and telecommunication industries in the late 2000s/early 2010s when drastic change made the telco industry start to struggle with new digital market entrants. He soon moved on into the mobility space, where he supports businesses in making the right strategic moves and avoiding pitfalls of the known digital past, first at Hubject and now as part of Cosmic Cat Group.

0 Comments