BYD expands megawatt charging for cars in China

The increase in megawatt charging for BYD electric cars quickly follows announcements made in March of plans for 500 “Megawatt Flash Chargers” that entered operation in April, ahead of the launch of BYD’s Han L and Tang L electric cars. According to CNEV Post these 500 units are now also connected to the grid in “more than 200 cities”.

According to CNEV Post this week, the Han L and Tang L electric cars’ first month on the market saw sales of 10,483 and 11,406 units, respectively. This drives the total April sales of the Han and Tang families to over 40,000 units.

BYD is now expanding its network of megawatt charging for cars in new partnerships with major charging operators Xiaoju Charging and LongShine with its Xindiantu charging platform, aiming to build 10,000 units and 5,000 units of megawatt fast chargers, respectively. Xiaoju Charging is the operator of the charging infrastructure of ride-hailing giant Didi, while LongShine has access to over 90 per cent of the public charging stations in China, covering over 400 cities.

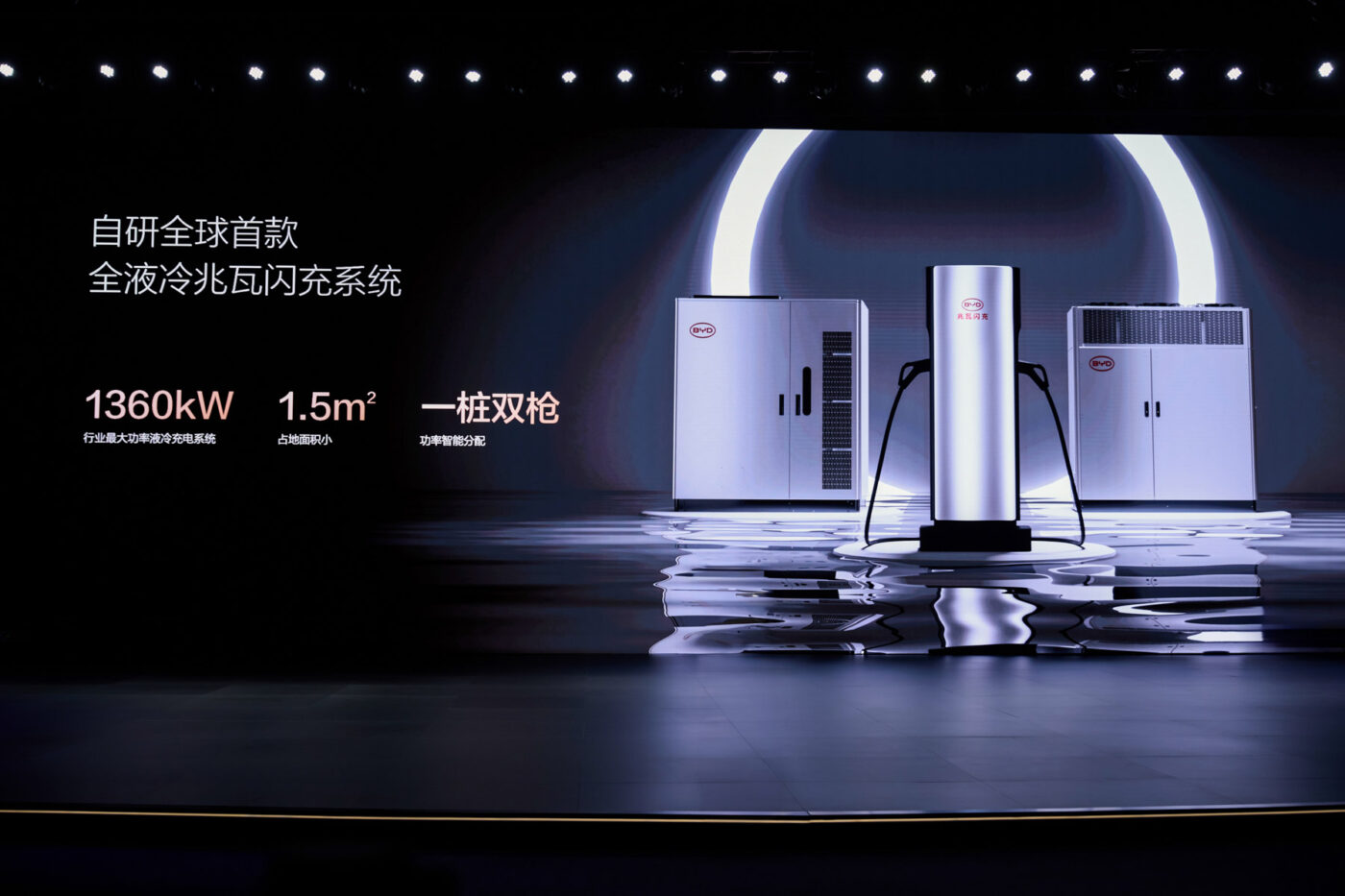

BYD’s proprietary technology includes a 1,000V/1,000A/1,000kW battery system and “smart voltage boosting” compatibility. This allows vehicles to charge across various public fast-charging platforms without compatibility issues. The system also features new “dual-gun charging”, nearly doubling the power output and reducing charging time by 70% compared to current industry standards.

Charging providers in other global regions are also ramping up megawatt charging, which is generally intended for electric trucks and eventually long-distance coaches, for example, for whom the extra time at the charging column is a significant economic factor.

In China, Huawei is planning an even bigger megawatt-level charger, reportedly reaching 1.5MW, but has indicated that this technology is intended for the commercial truck market, similar to Tesla’s 750kW mobile Supercharger designed for its Semi truck. BYD is not alone in seducing the electric car drivers with the lure of 5-minute charging. Zeekr has also introduced a passenger car-focused liquid-cooled charging station with a peak power of 1.2MW using a single connector, which is close to the output of BYD’s dual-connector.

Megawatt charging is not without drawbacks. Megawatt chargers cannot just be installed anywhere and require significant electrical power to operate at full capacity. Megawatt charging for cars significantly increases grid load, a factor that means the promised speed is not always possible. According to Car News China, real-world experiences for electric car drivers do not always match the advertised charging speeds for this reason. The Chinese publication reported in April that even vehicles marketed as being capable of charging 80% in 15 minutes generally require closer to 30 minutes or longer in practical scenarios.

Hurdles to this type of charging for widespread electric car use include the power output of charging stations constrained by voltage and current. A sustained 1000V and 1000A required by BYD megawatt flash chargers is often difficult to consistently maintain in real-world applications. Achieving power levels above 500kW typically requires liquid-cooled charging cables and systems. These can cost anywhere from 80,000 to 120,000 yuan (11,200 to 16,800 USD) per unit, which is 3-5 times the cost of traditional air-cooled chargers. Liquid cooling systems also require periodic coolant replacement, increasing operational costs.

In April this year, Car News China wrote that “BYD has acknowledged the potential strain megawatt charging could cause on the power grid.” According to Car News China, the three companies are targeting a more comprehensive and accessible megawatt charging network that supports highway and urban coverage. The Chinese publication reveals that “BYD is actively discussing with other leading charging operators to expand its network further and maintain momentum.”

While BYD envisions a future where electric cars can be charged as fast as an ICE car, the reality of using this technology on a large scale for cars in many regions will be limited by renewable energy production and local grids. Grids in many regions already struggle with insufficient grid infrastructure for essential logistics pathways across longer distances for intra- and interregional transport.

0 Comments