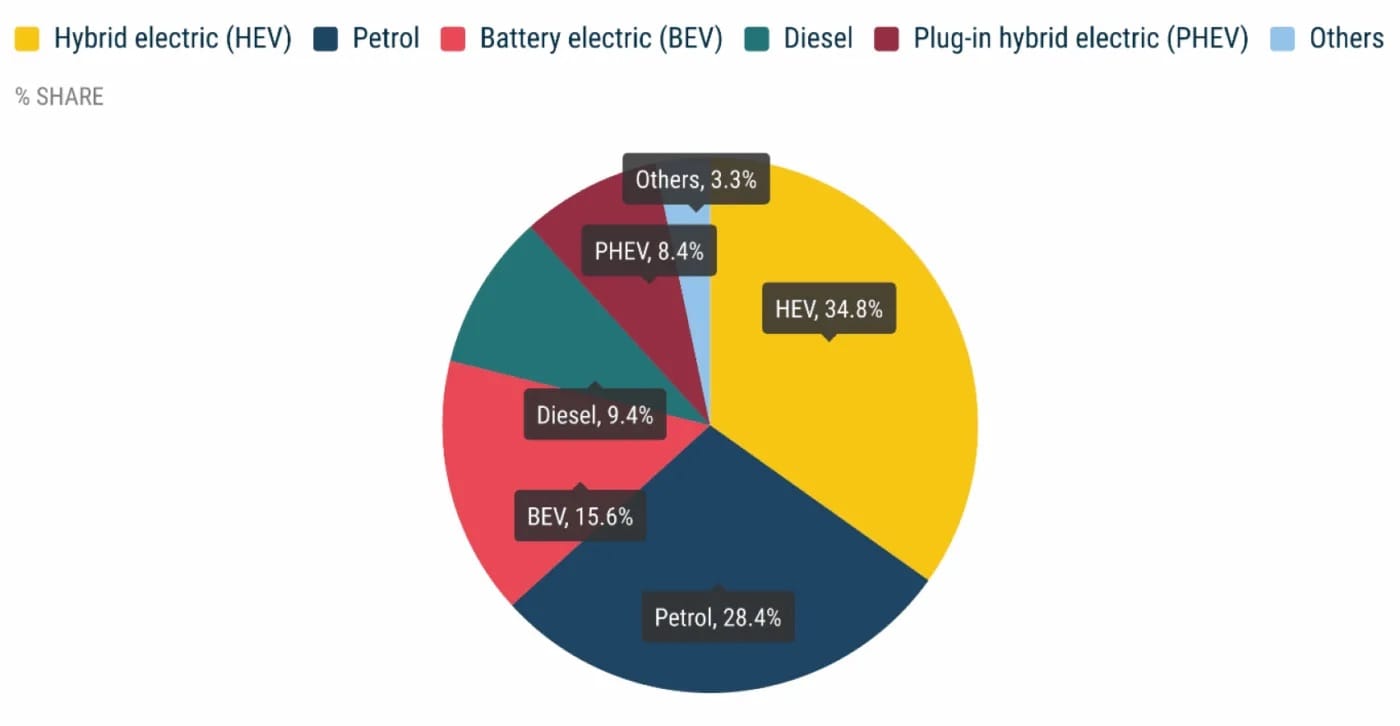

H1 2025: EV market share in EU rises to 15.6 per cent

According to ACEA, a total of 869,271 EVs were newly registered in the EU in H1. That represents an increase of 22 per cent year-on-year. Notably, regional developments vary greatly: Germany impresses with a 35.1 per cent rise in EV registrations – despite a lack of state subsidies for private buyers. France, on the other hand, saw a decline of 6.4 per cent. Belgium (+19.5 per cent) and the Netherlands (+6.1 per cent) also contributed to the growth. These differences reflect the impact of national incentive schemes, tax benefits, and charging infrastructure.

Plug-in hybrids also recorded solid growth of 19.5 per cent, now holding an 8.4 per cent market share – thanks in part to sharp rises in Germany (+55.1 per cent) and Spain (+82.5 per cent). Overall, there were 469,410 new PHEV registrations in the EU in H1.

Overall market decline

Despite positive developments for EVs and plug-in hybrids, ACEA points out that the European car market is shrinking overall. Total passenger car registrations in the EU fell by 1.9 per cent to 5.58 million vehicles in H1, with a 7.3 per cent decline recorded in June alone. The challenging global economic situation and high interest rates continue to weigh heavily on the industry.

Conventional drivetrains are under particular pressure. Petrol registrations fell by 21.2 per cent year-on-year, making up just 28.4 per cent of the EU market. Diesel registrations plummeted by 28.1 per cent to only 9.4 per cent. France and Germany recorded the largest declines. Combined, the market share of combustion engines (petrol and diesel) dropped from 48.2 per cent last year to 37.8 per cent.

However, simple hybrid vehicles – which cannot be externally charged and carry only small batteries charged via recuperation – are currently growing even faster than pure EVs and plug-in hybrids. Their market share climbed to 34.8 per cent in H1, with 1.94 million new registrations. Major markets such as France, Spain, Italy and Germany all saw double-digit growth.

This development makes it clear that the combustion engine has passed its peak. Still, a complete shift to electric mobility remains a major undertaking – both for industry and consumers. The comparatively weak growth rate of just 7.8 per cent for battery-electric vehicles in June 2025 suggests that many potential buyers remain hesitant – due to high prices, insufficient charging infrastructure, or uncertain incentive policies.

Tesla sales shrink, SAIC shows strong growth

ACEA does not break down registrations by drivetrain type per manufacturer – meaning that it is not clear which carmaker sold the most EVs. Only two EV-exclusive manufacturers are listed: Tesla saw a sharp decline of 43.7 per cent to 70,655 registrations in the EU, likely due to the controversial political activities of CEO Elon Musk and the switchover to the revised Model Y Juniper. Smart recorded an even bigger drop of 67.3 per cent, as the prior-year period still included deliveries of the now-discontinued Smart fortwo city car. Today, Smart’s portfolio consists only of significantly larger vehicles.

From an EV perspective, the strong growth of Chinese group SAIC Motor stands out. SAIC is active in Europe with the Maxus and MG brands, both offering electric and combustion models. With an increase of 33.3 per cent to 107,171 registrations, SAIC is becoming an increasingly important player in Europe. It is also noticeable that other major Chinese EV brands such as BYD, Nio or Xpeng are not listed in ACEA’s figures, presumably because they are not members of the association.

In summary, ACEA’s figures confirm the long-term trend towards electrification. However, the transition is progressing more slowly than EU climate targets require. To fully unlock the potential of electric mobility, decisive political action and further investments in charging infrastructure and affordable models are needed. Only then can EVs move from a promise of the future to the new normal.

0 Comments