AAMG is looking to acquire Lilium’s assets & expertise

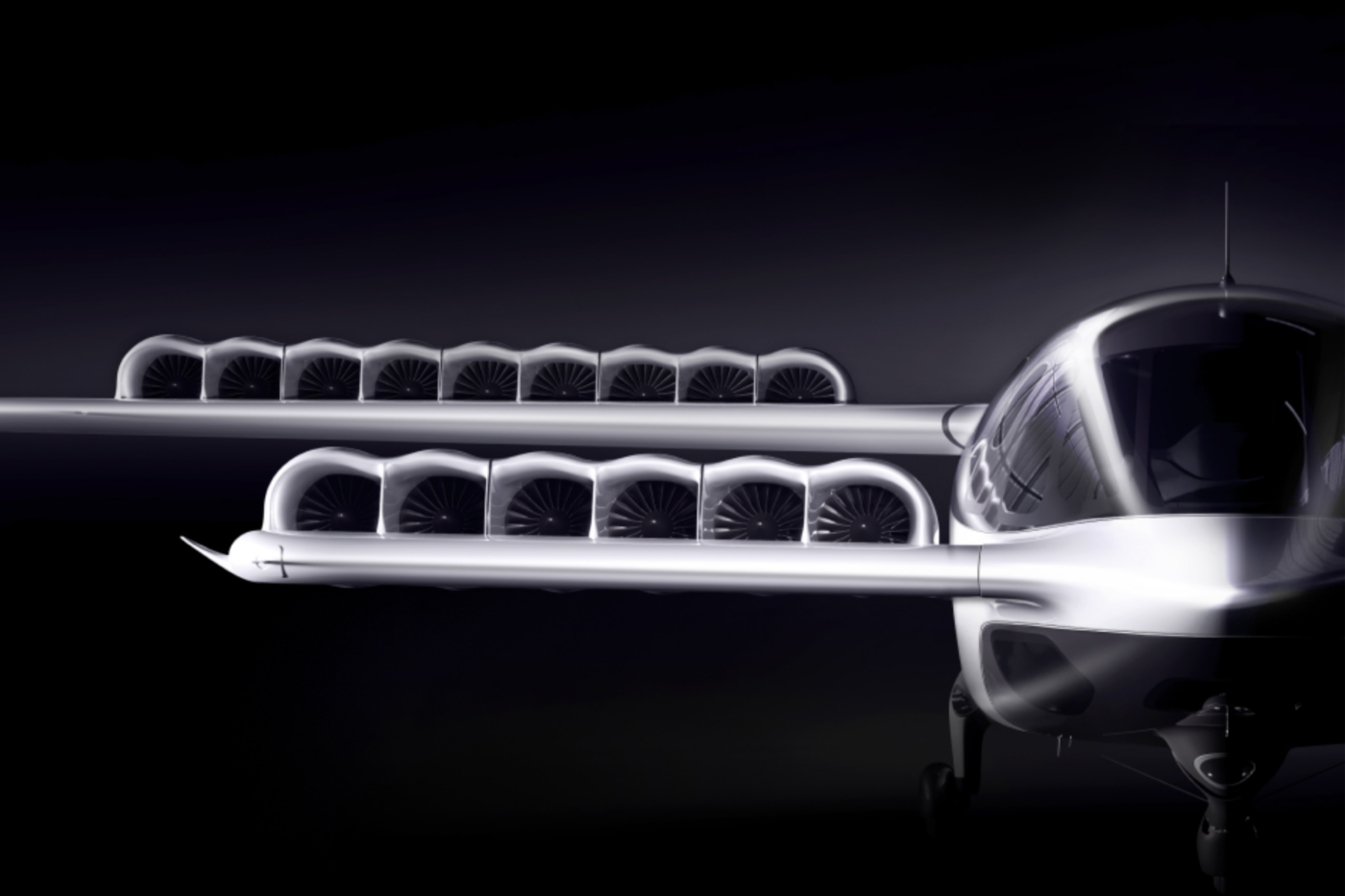

AAMG is now offering to acquire the intellectual property, including Lilium’s assets and testing facilities, as well as the staff, who are to be kept on, at least regarding key technical and certification teams. Lilium’s aircraft platform is to be continually developed and certified, as well as setting up a supply chain to build the aircraft in Europe, should Lilium take the deal.

Before the insolvency proceedings began, the Ambitious Air Mobility Group had already ordered 16 Lilium aircraft and is preparing to revitalise Lilium, according to a company statement. The group has capital of over 250 million euros at its disposal for this purpose. There is also mention of access to a further 500 million euros in capital for the expansion of operations in Europe and beyond.

“We are convinced that what has been developed here in Bavaria is groundbreaking and both technically and economically feasible. The Lilium platform is the result of years of endeavour by some of the most talented engineers in the world. We are excited about the opportunity to take this platform forward, invest in and realise its full potential,” explained Dr Robert Kamp, CEO & Senior Partner of AAMG.

AAMG has also already planned out cooperation with a broad spectrum of actors, including suppliers, authorities and government partners. While no mention was made of where the funding is coming from specifically, AAMG has international ambitions, according to its press release: “AAMG has joined forces with Japan’s AirMobility Inc. to expand access to the Asia-Pacific markets and coordinate international development at.”

Source: Info via email, stayambitious.world

10 Comments