AAMG signs trust agreement for Lilium purchase

This new development does not mean that the sale is not guaranteed, however, as AAMG CEO Robert Kamp emphasises that there are still considerable risks. These risks are currently being reviewed from a legal perspective in order to secure guarantees. Only then will the opportunities and risks be weighed up against each other.

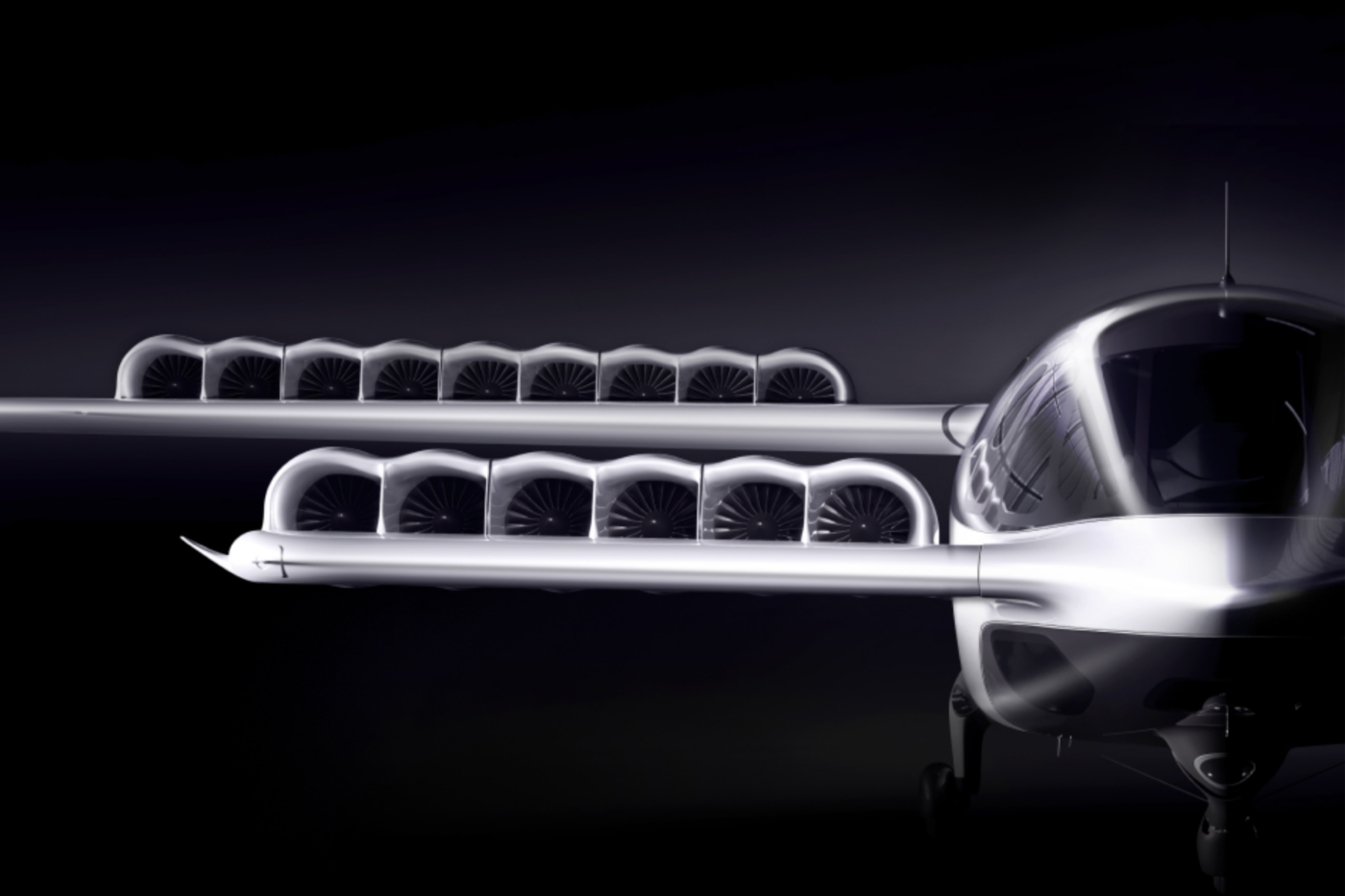

The review is by no means an unproductive step, however, as it will provide AAMG a clear view of the composition of Lilium’s valuable intellectual property rights, technical data and physical assets.

“We have been waiting a long time to find out what is actually for sale. We still have major concerns, which we are currently reviewing with our lawyers in order to resolve them and agree on guarantees. If we succeed in doing so, we will weigh up the opportunities and risks. The latest developments regarding Lilium’s assets and the significant risks for creditors, combined with a considerable capital expenditure for us, are the reasons why we remain cautious about this transaction,” explained Dr Robert Kamp, CEO and Senior Partner at AAMG.

The proceedings surrounding Lilium’s insolvency started back in late 2024, when funds got tight and financial support from the German government did not materialise as the company had hoped. Just a few days later, it was revealed that Lilium’s subsidiaries in Germany were insolvent. The main company followed just a few days afterwards. By December, several bids had been made to take over the company’s assets, before a last-minute rescue was lauded with a last-minute investor. By February 2025, the rescue had failed, and a second insolvency proceeding was started.

In August of this year, AAMG then entered the field as a rather unknown player, and has been working to take over the company since. The company is not the only one keen on acquiring Lilium’s old assets, as a production building was taken over by the Munich-based startup Vaeridon earlier this month.

Source: Info via email

0 Comments