CATL buys into Neo Lithium

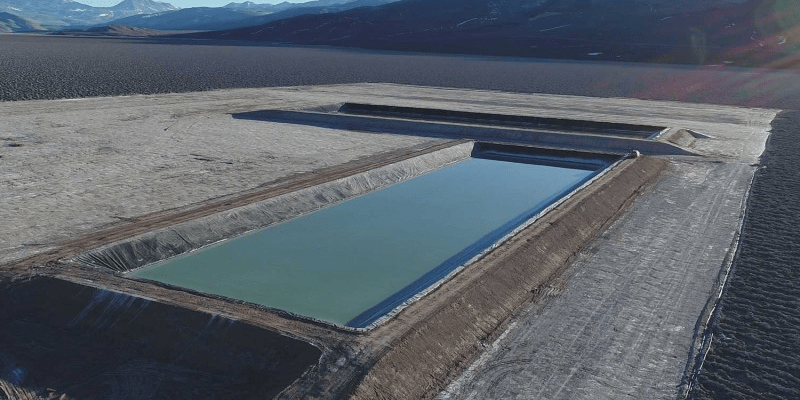

Chinese battery giant CATL is taking a roughly $8.5 million Canadian dollar-stake in mining company Neo Lithium in exchange for about eight per cent of the company’s stock. The Canadian company holds mineral and surface rights to a newly discovered lithium salar and brine reservoir complex in Argentina.

The Chinese battery cell manufacturer has taken out around ten million common shares in Neo Lithium at a price of 0.84 Canadian dollars via a subsidiary, resulting in the above-mentioned gross proceeds of around 8.5 million Canadian dollars (just under 5.5 million euros). In return, CATL will send a director to Neo Lithium’s board, receive a right of first refusal on future share issuances, and will be given a seat on the technical committee advancing the final feasibility study for the Argentina project called 3Q (Tres Quebradas).

As part of Q3, Neo Lithium aims to reach a production capacity of approximately 20,000 tons per year of battery-grade lithium carbonate in the Argentine province of Catamarca. The Canadian company maintains the ability to increase capacity to as much as 40,000 tons per year. In May 2019, Neo Lithium prepared a pre-feasibility study for this purpose. With CATL now onboard, the Canadian company is now backed by the biggest player in the battery industry.

“The closing of the CATL strategic investment validates the quality of our 3Q project and the capabilities of our management team,” says Constantine Karayannopoulos, chairman of Neo Lithium. He added that the company will work with CATL to bring 3Q to full development through the establishment of a comprehensive financing plan.

CATL manager Changdong Li said, “CATL is very pleased to complete this strategic investment in Neo Lithium. We believe that the 3Q Project is an attractive development project that may benefit from our expertise and know-how in the battery manufacturing and technology space.”

There is a lot of competition for lithium reserves in Latin America’s “lithium triangle” between Bolivia, Argentina and Chile. At the end of 2018, the Chinese group Ganfeng Lithium bought all of Chilean lithium producer SQM’s shares in the so-called Cauchari-Olaroz project in Argentina. Since then, the Chinese company has held 37.5 per cent and Canada’s Lithium Americas Corp 62.5 per cent of Cauchari-Olaroz, an 82,500-hectare mining area in northern Argentina that is tangent to two salt lakes, among others.

Tesla was also said to have been in talks with SQM, according to an earlier report in the .Financial Times, although this news was never confirmed. Toyota bought into Australian lithium producer Orocobre through its trading company Toyota Tsusho in early 2018. Both partners founded a joint venture back in 2010 to extract lithium from the Salar de Olares salt lake in Argentina.

neolithium.ca (CATL shares), neolithium.ca (Q3 project)

0 Comments