Evergrande shares raise over three billion dollars

Evergrande New Energy Vehicle, the electric car offshoot of the Chinese Evergrande Group, has again raised capital equivalent to around 3.35 billion US dollars by selling further shares to six China-based investors.

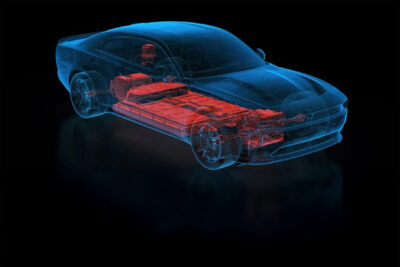

In September 2020, the company had already raised around half a billion US dollars in capital through a share sale; at the time, Tencent and Didi Chuxing were among the investors. Evergrande was pursuing extremely ambitious electric car plans and announced its first six models to be offered under the Hengchi brand at the beginning of August 2020. They are numbered from 1 to 6 (Hengchi 1 to Hengchi 6) and include various body styles from sedans to SUVs to a seven-seater van. Series production of the first model, Hengchi 1, is scheduled to start in 2021.

As for Evergrand’s shares and financial expansion, Evergrande agreed to sell a good 950 million new shares at 27.30 Hong Kong dollars (about 3.5 dollars or 2.9 euros) each, which represents a discount of nine per cent compared to the last traded price of 29.90 Hong Kong dollars per share. For the electric car manufacturer, this means revenues of the equivalent of 3.35 billion US dollars. The six share takers are all based in China, including Greenwoods Global Investment Ltd. and the founder and chairman of China Gas Holdings Ltd.

According to reports, Evergrande will use the new capital to plan further investments in research and development and the production of NEV vehicles (BEV, PHEV and FCEV in China), among other things. The company also plans to pay off debt. Gasgoo and other media outlets quote Evergrande as saying that the subscription can strengthen the Evergrand’s capital base, accelerate the development of the NEV segment and help realise “the group’s strategic goal of becoming the world’s largest and most capable NEV group.”

Xu Jiayin, chairman of Evergrande Group, also is quoted in the report, saying his group plans to invest 45 billion yuan (about $6.87 billion or 5.71 billion euros) in NEV development within three years, set up ten production facilities around the world and bring its NEV capacity to one million units in three to five years. According to Gasgoo, Hengchi has 14 Hengchi models in the works.

Evergrande has charged ahead with massive expansion since its entrance in the world of electric cars and has now been a household name in the Chinese electric car market since 2018. At the time, the group announced ambitious plans in the electric car sector through its subsidiary Evergrande Health. Subsequently, the group subsidiary was renamed from “Evergrande Health Industry Group Ltd” to “China Evergrande New Energy Vehicle Group Limited” – or Evergrande Auto for short.

The Chinese group originally grew up with real estate and now wants to become one of the largest producers of new energy vehicles. Up to now, Evergrande has mainly purchased know-how – either utilizing a takeover as in the case of NEVS, by partial entry as in the case of Koenigsegg, via joint ventures as in the case of Hofer or by cooperation as in the case of FEV Group, EDAG, IAV Group, AVL and Magna.

Including reporting by Cora Werwitzke

0 Comments