electrive LIVE: High Power Charging networks in Europe

With the European Alternative Fuels Infrastructure Regulation (AFIR) in effect since mid-April, how can manufacturers and CPOs ensure seamless charging across borders? Furthermore, how can they ensure that they comply with the European Alternative Fuels Infrastructure Regulation, and how are the 27 member states doing when it comes to public fast-charging infrastructure? The first person to answer these questions was Marcus Groll. He is the Managing Director and COO at Ionity and is thus in charge of one of the largest HPC networks in the European Union, spanning 24 countries.

Bottleneck grid connection

Ionity offers chargers with 350 kW and is looking to add chargers with up to 600 kW in the next two years. Currently, the company operates around 600 sites with a total of 3.639 charge points. According to Groll, the goal is to almost triple the number of chargers by 2027. At that point, Ionity hopes to have 1,000 sites and around 9,000 charge points online.

The biggest markets (in terms of revenue) are Germany, France and the UK. Ionity operates 223 sites in Germany, while another 23 are under construction. The network in the UK, on the other hand, is relatively small, consisting of 27 sites (plus 16 under construction). “But the market shows a lot of potential,” said Groll. “The EV market share is also promising. Therefore, we are looking to grow there and expand the number of sites to around 80 to 100 in the next two years.

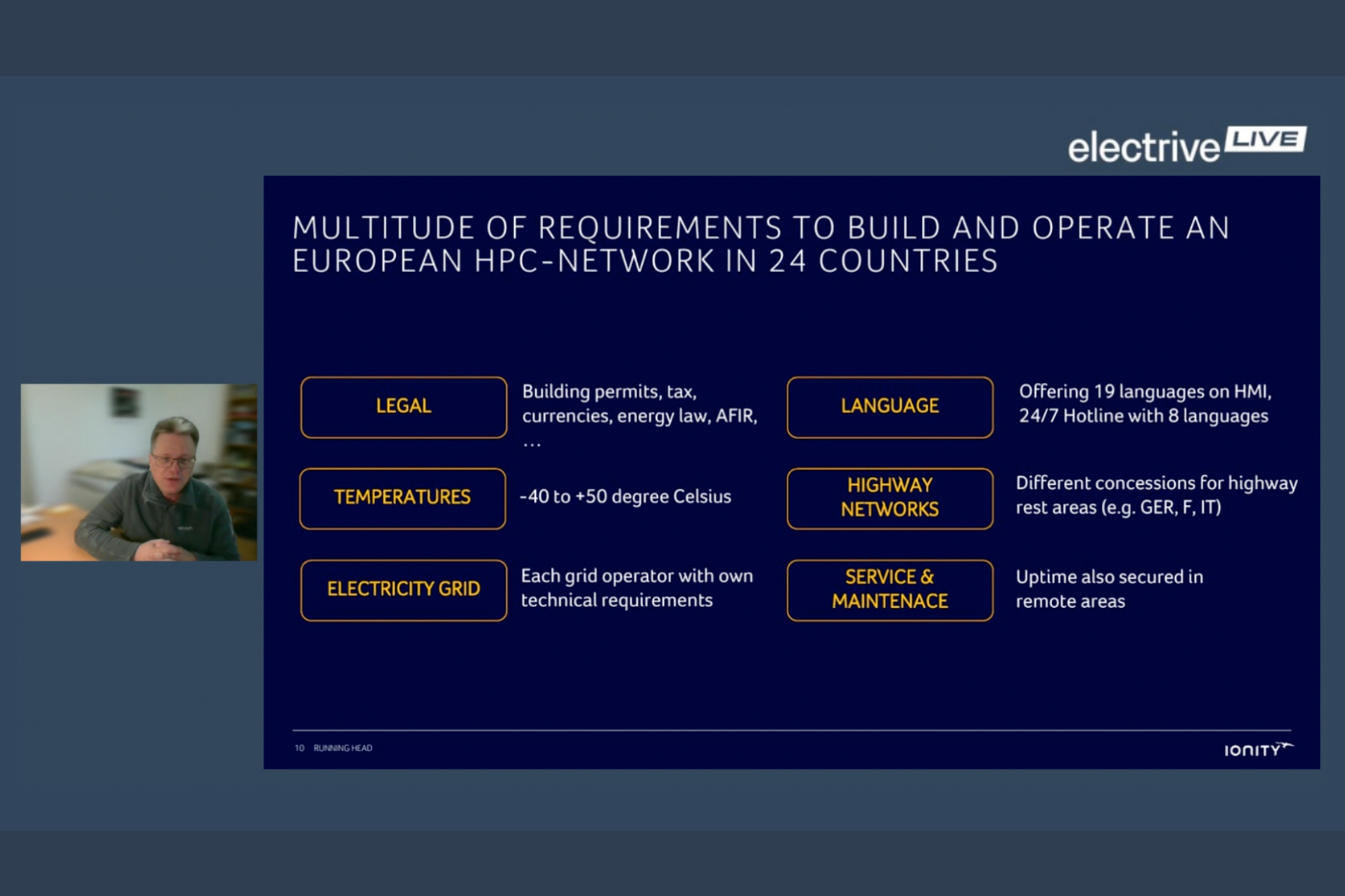

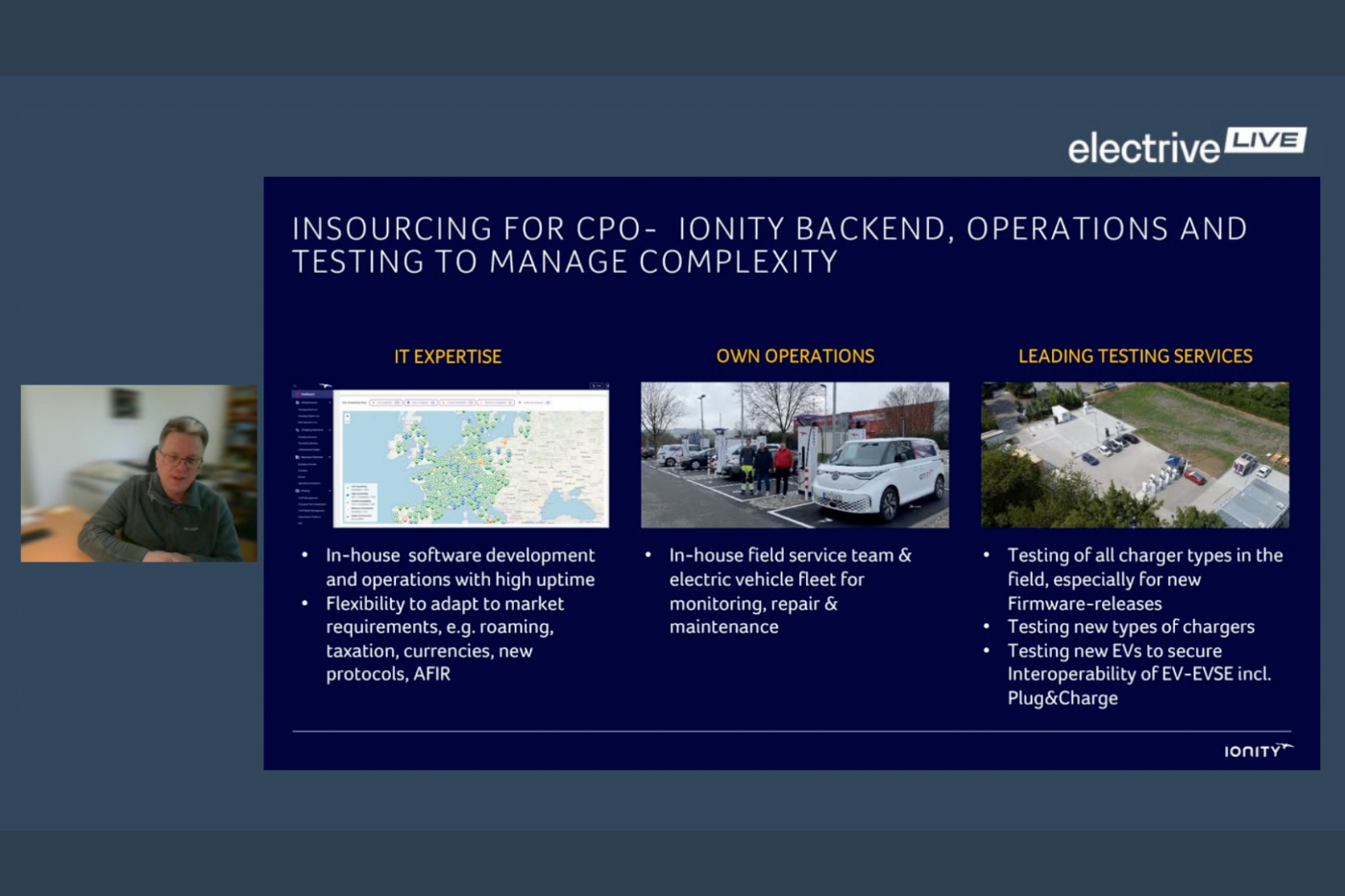

According to Groll, there are several challenges when setting up a pan-European charging network. There are legal complexities concerning building permits and tenders, as requirements differ from country to country. The requirements for the chargers also vary depending on the site. Groll mentioned the extreme temperature differences between Norway and southern Spain, for example, that the hardware needs to withstand. To ensure customer service, Ionity customers can choose the information on the chargers’ displays to be displayed in one of 19 languages.

However, the biggest challenge is the connection to the grid. “Not only does it often take a long time to get access, grid operators often have special technical requirements,” Groll said. “That is a challenge. Because when you need substations that fulfil these individual requirements, you cannot have hardware in stock and bring them to the site.”

“No priority for green activities”

Next up were Thea Tyvold from CMS Norway and Gerd Leutner from CMS Germany. The lawyers outlined the requirements for CPOs, now that AFIR is in effect. Leutner called it “a detailed roadmap with enforceable rules.” However, he also pointed out that in some cases, it is still unclear how the rules will or can be enforced, even though the EU had published a Q&A a few days before the conference.

The AFIR came into effect on 13 April, 2024. “For the member states, that means, above all, that they have to provide a draft policy framework, national policy framework, by the end of December of this year,” Leutner explained. In Germany, the government is said to be working on it. You can read more about AFIR and the requirements for CPOs and MSPs here.

“Norway has the most electric cars per person,” Tyvold said. About one in every four new cars has a plug. The charging network is also well established, as she pointed out. However, there is still a long way to go for heavy-duty vehicles, such as electric trucks, that are increasingly put into service.

Interestingly, even though Norway is not part of the EU, Tyvold says the country will implement AFIR. In some aspects, Norway is even ahead. For example, the AFIR stipulates that fast chargers will need to have a credit card terminal for ad-hoc payments. That has already been the case in Norway. However, the regulation will not take effect immediately, as in the EU. Norway needs to implement its own regulations, which it is already working on. However, it could take years before it is signed into law.

As the previous speaker already pointed out, access to grid connections are the main issue for operators. “In Norway, grid connection is an issue. There’s a first come, first served principle. There is generally no priority for green activities,” the CMS partner explained. Moreover, many areas in Norway experience grid congestion, and getting access can take a long time. “The process can be a bit unpredictable,” said Tyvold.

“We can ramp up production quickly”

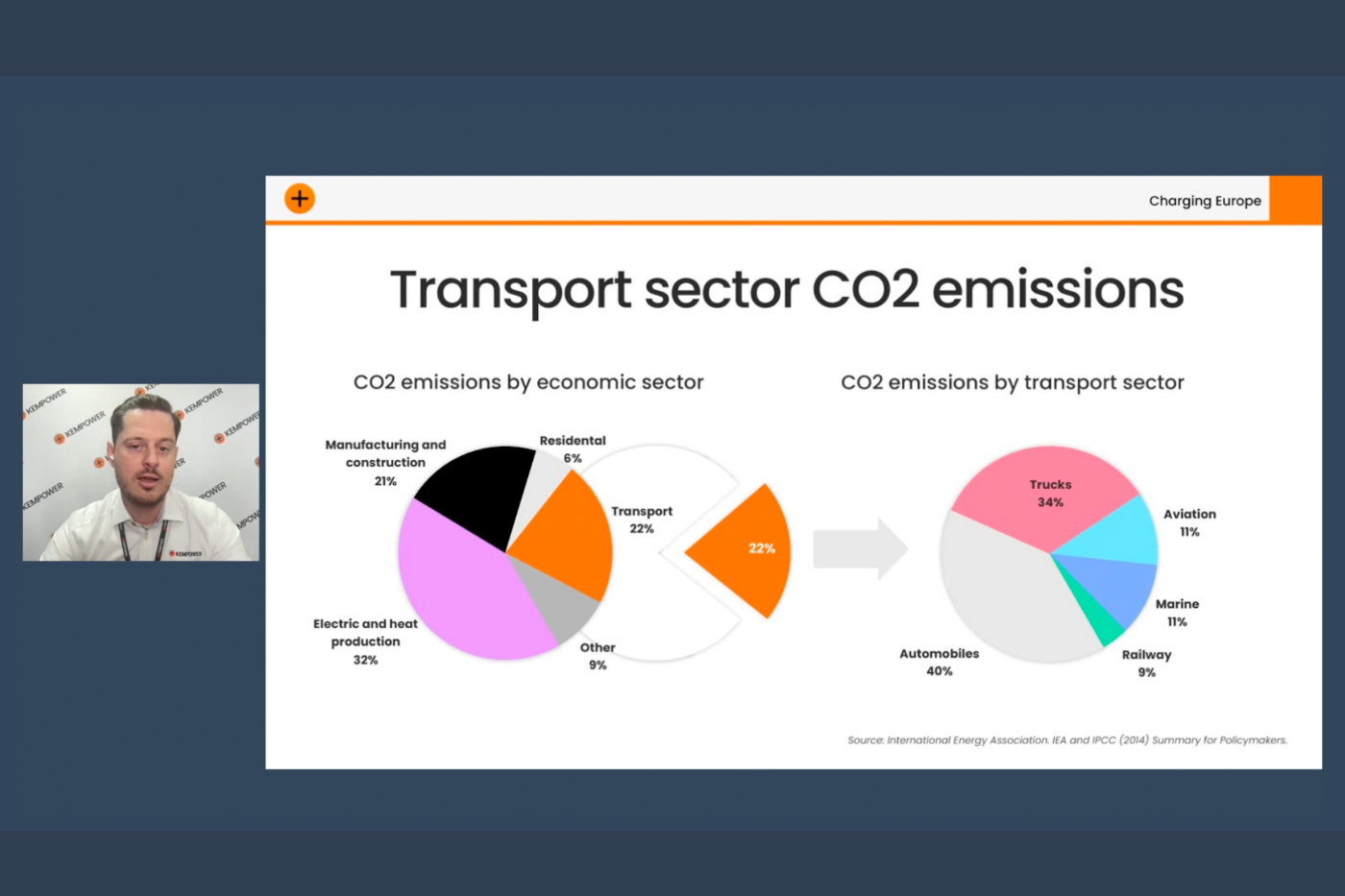

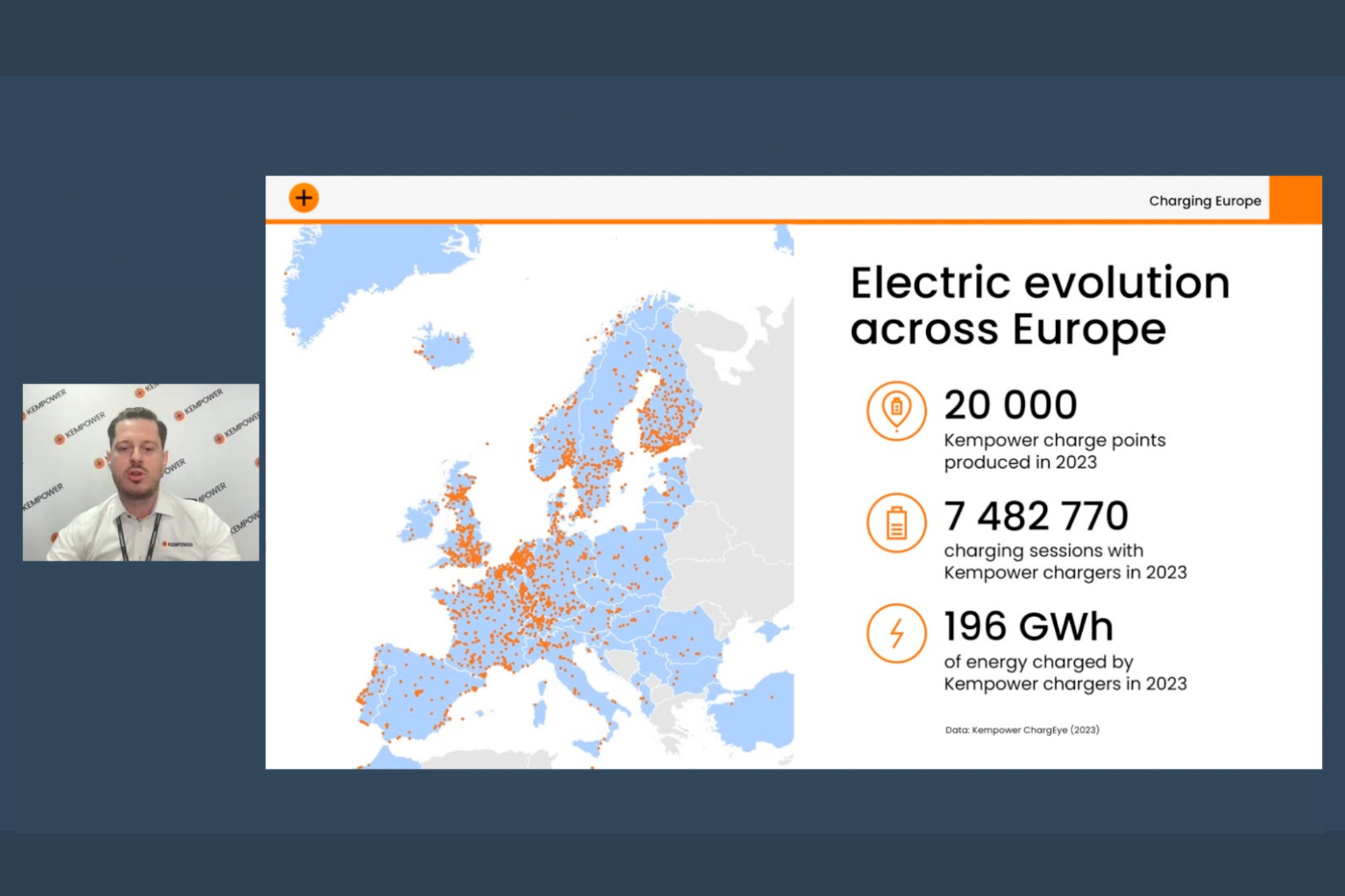

When looking at HPC networks in Europe, one obviously has to also speak to a charging station manufacturer. In this case, Philipp Oppolzer, Business Development Director for Central Europe at Kempower, had a chance to present. The company is based in Finland and operates the manufacturing sites there, as well as a fourth one in North America. Oppolzer pointed out that Kempower only produces charging stations once they have been ordered, and can hand them over to customers a few weeks after the order was placed. So far, the company has produced around 20,000 DC chargers, and Oppolzer said that Kempower could ramp up production on short notice if demand for its chargers increases.

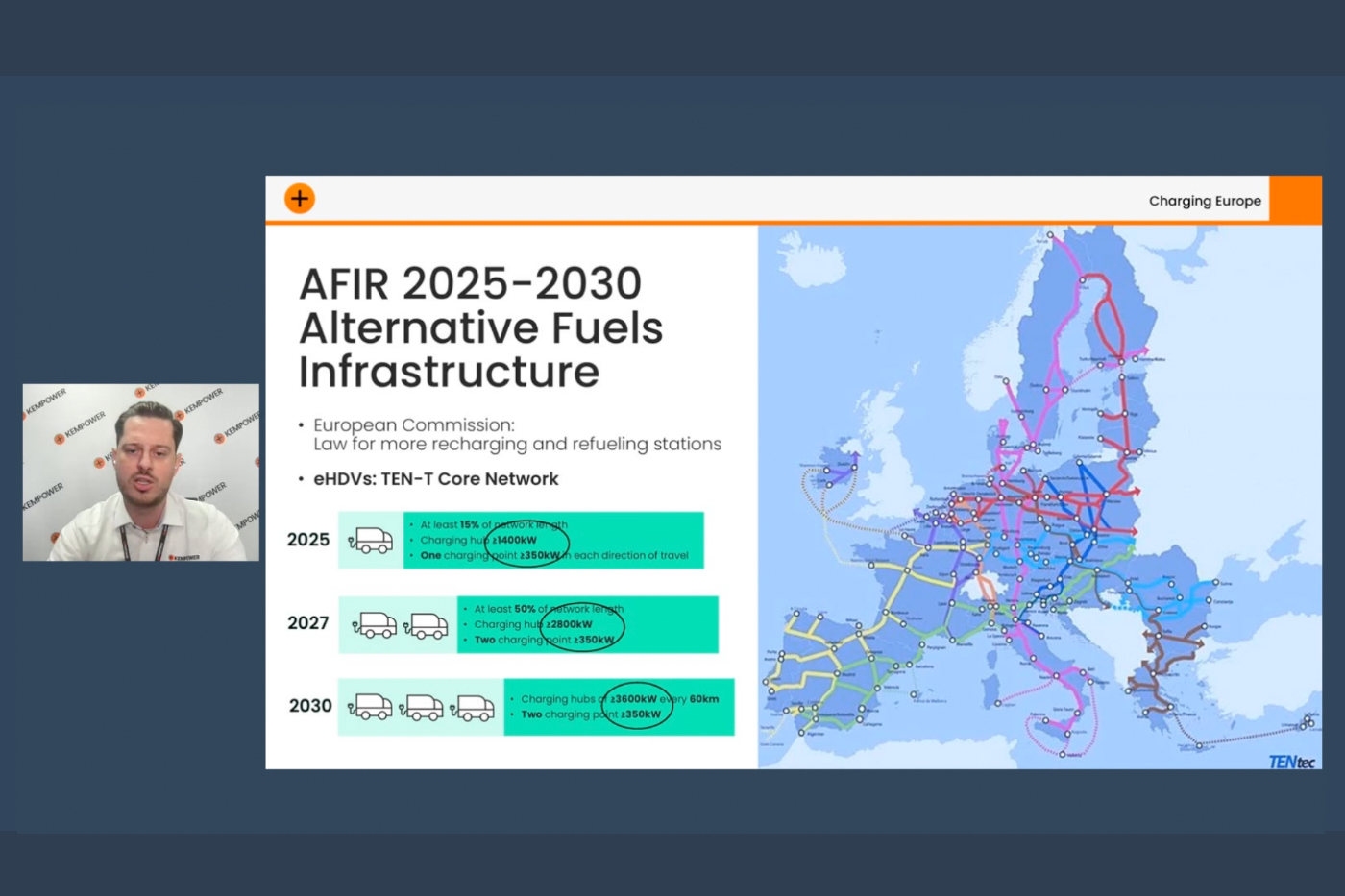

Oppolzer welcomed one important aspect of AFIR – the distance between charging stations along major highways in the European Union. The regulation says that electric cars will need to be able to charge every 60 kilometres along the main routes in the European Union by 2026. For trucks, charging stations must be available every 120 kilometres along major highways (TEN-T). For a manufacturer, that is obviously good news.

Oppolzer also took the time to explain Kempower’s charging solution concept. It consists of a central unit and so-called ‘satellites’, or charge points that share the available power. “The central power unit can then distribute the installed power to up to eight simultaneously usable charge points,” said the Kempower manager. “It gives the operator maximum flexibility on how to design the site and makes it as user friendly as possible by not putting big chunky charges right where the space is needed most – directly around the vehicle.”

The power units provide up to 600 kW and distribute energy to the charge points in 25 kW increments. Moreover, this set-up is already MCS-ready. Two power units can be joined together, providing up to 1.2 MW – making it easier to also accommodate electric trucks. “You just need to make sure that the overall power available on site is sufficient for the use case. It lowers the initial investment, and you tend to get a significantly higher return on your investment.”

“AFIR breaks through the chicken-or-egg logic”

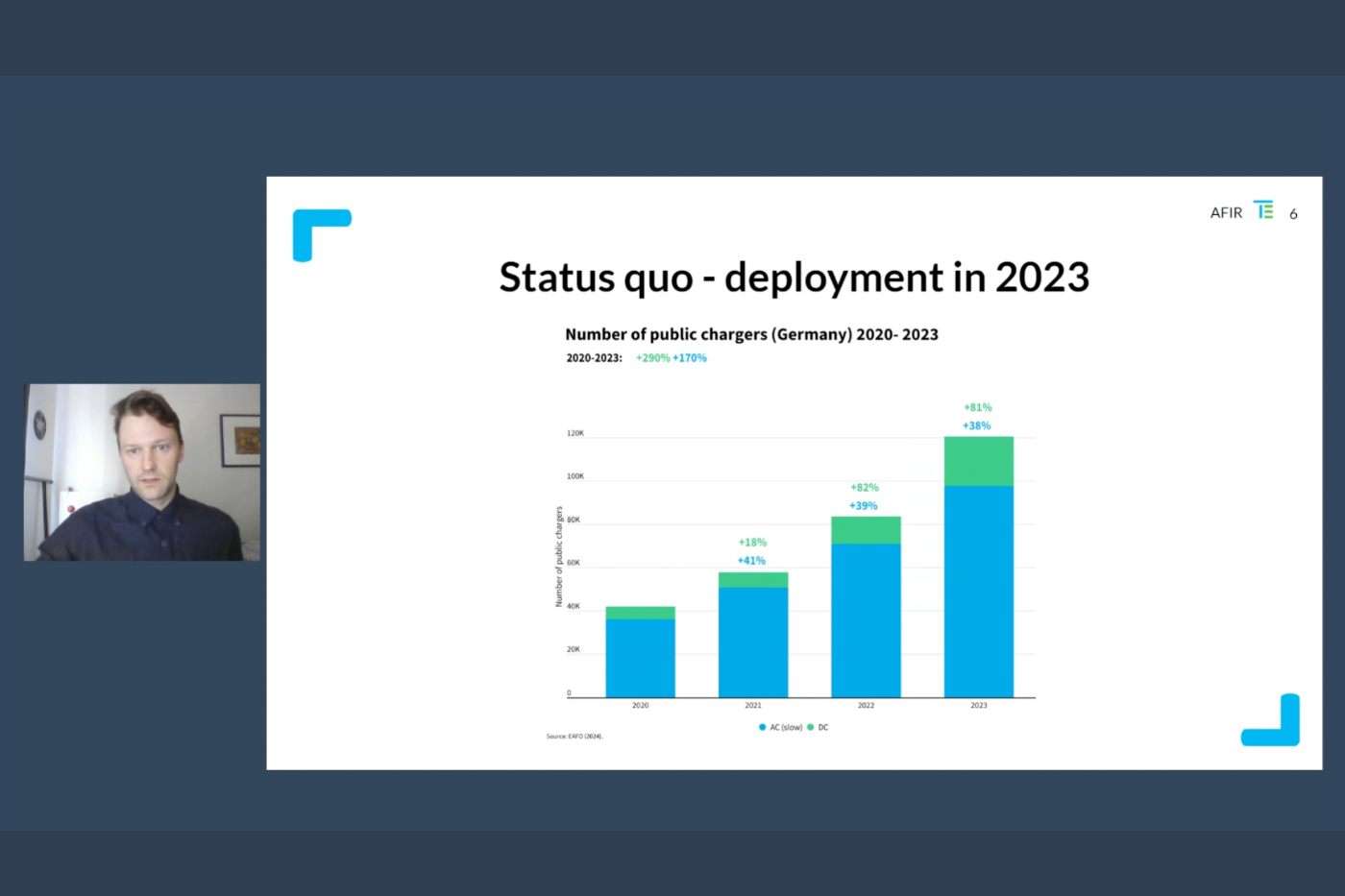

The last person to take to the virtual stage was Fabian Sperka, Vehicles policy manager at Transport & Environment, a leading NGO based in Brussels, Belgium. He also looked at AFIR, providing some analysis on how the individual EU member states are doing regarding the regulation’s fleet base target. It says that the number of charging stations and available charging power must grow proportionate to the uptake of light electric vehicles.

Firstly, Sperka mentioned that the number of fast chargers has been growing faster than the number of EVs on the road for the past years. “And if we would boil that down to the publicly available charging power, the growth would be even more significant, as we have more and more fast-chargers in Europe,” Sperka explained. The number will increase even further in the coming years, as AFIR requires charging infrastructure every 60 kilometres along TEN-T routes.

“What AFIR is doing is breaking the chicken-or-egg logic,” says Sperka. “CPOs used to say, hey, OEMs, you need to provide EVs; otherwise, the infrastructure is not used. OEMs said that CPOs needed to provide more infrastructure, otherwise no one would buy electric cars.” With AFIR, everything needs to come at the same time.

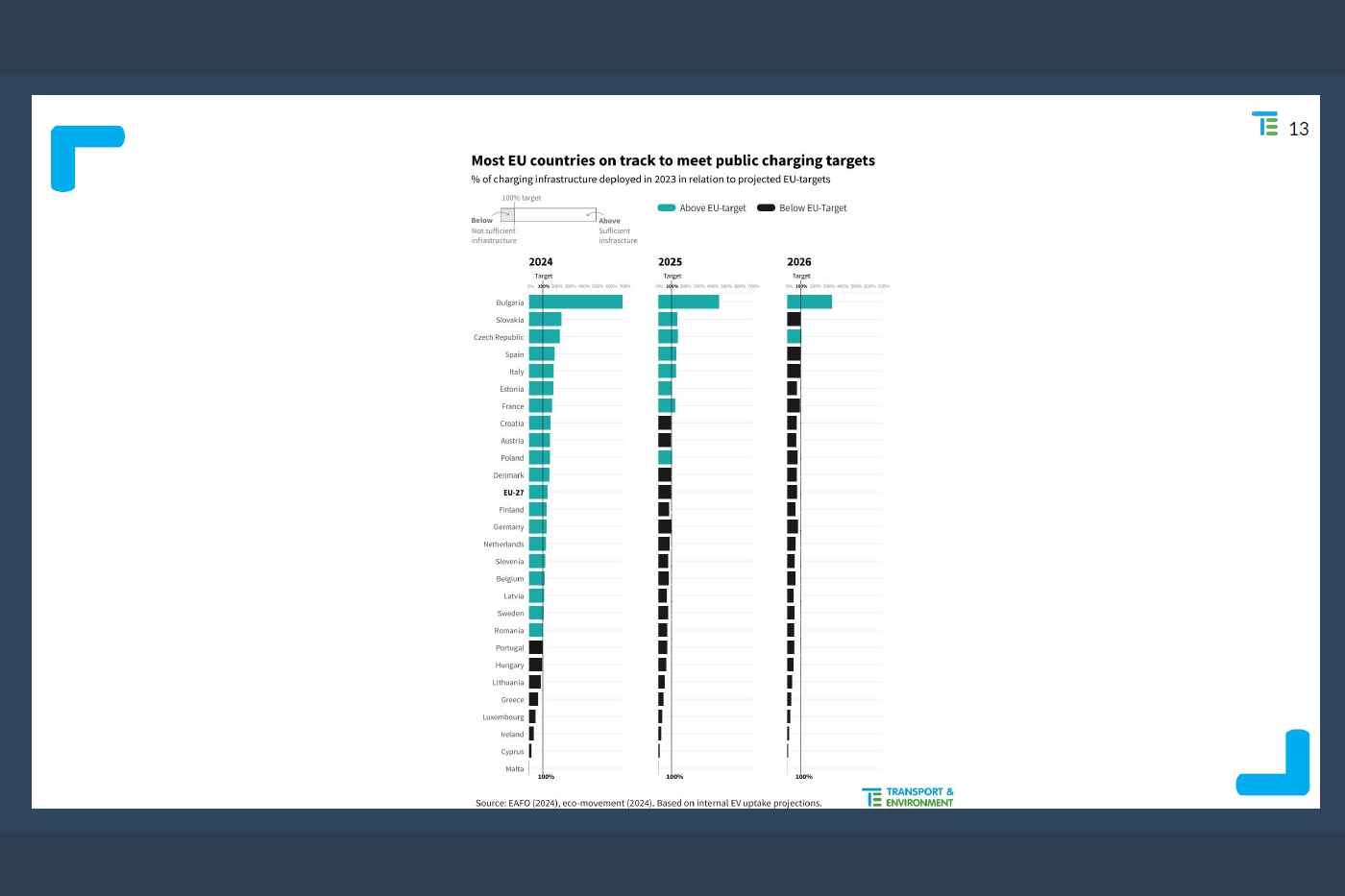

Nearly all EU countries have already met the AFIR fleet base target for 2024. However, that is no longer the case in 2025. And according to Transport & Environment’s projections, only two countries will comply by 2026. Interestingly, Bulgaria leads the chart. Sperka explains that though it may seem surprising at first, it is quite logical. “Because there are several fast charging hubs in Bulgaria, but Bulgaria itself has only a couple of thousand registered EVs. That is why it is relatively easy to fulfil their official target.” Moreover, T&E estimates that EV uptake there will be relatively slow in the coming years, so the EU member state will continue to comply with AFIR regarding available charging power per electric vehicle.

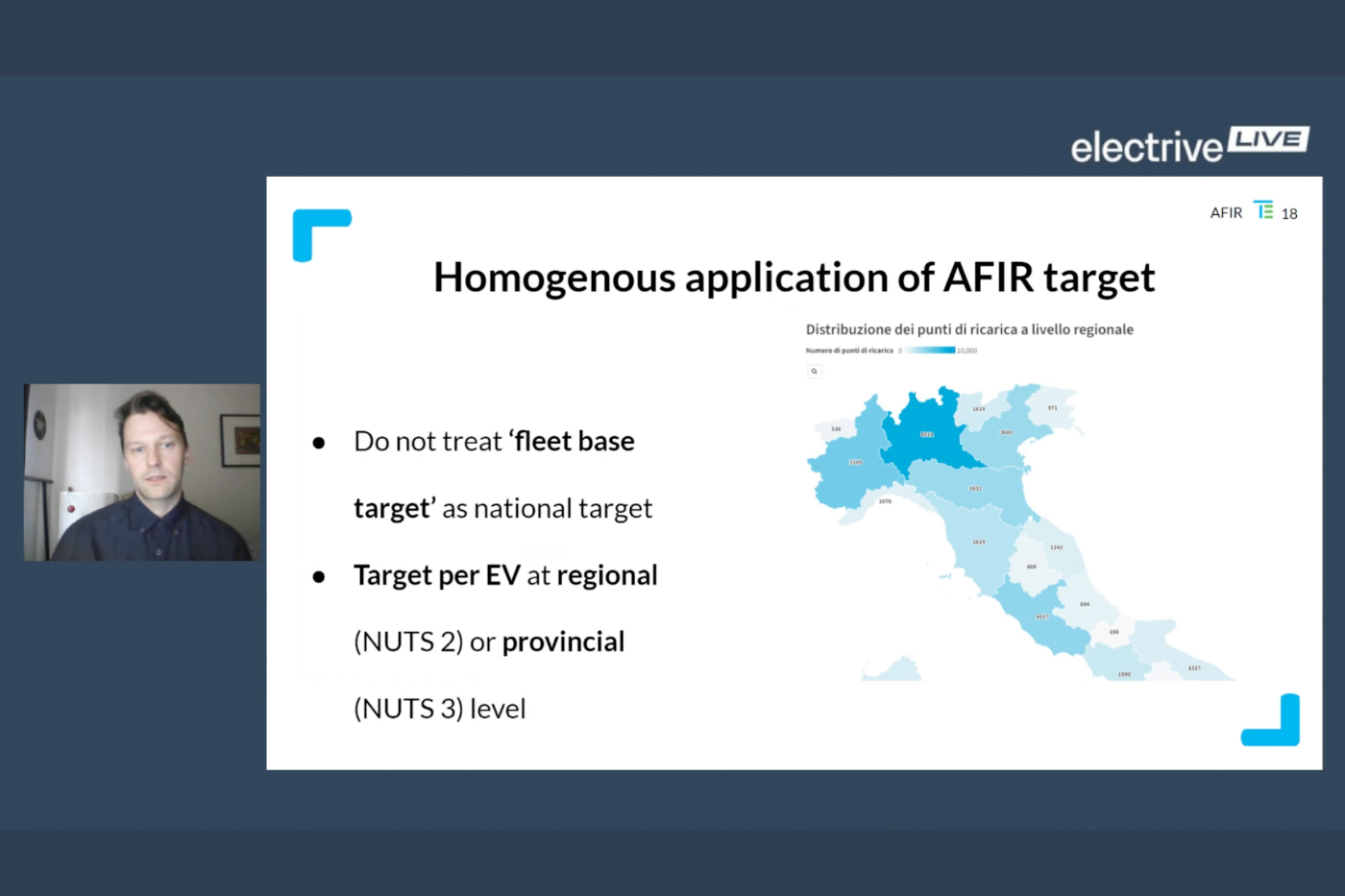

Sperka also provided recommendations on how the fleet base target could be more effective. Mainly, he suggested that instead of making it a national target, it should be regional or even provincial to ensure there are no white spots on the map. He also mentioned that grid connections can pose a problem, especially as the need for energy will grow as more heavy-duty electric vehicles hit the road.

Grid connections remain the main hurdle

The main hurdle standing between CPOs and getting cross-border HPC networks up and running is grid connections. That is a point that all participants could agree on in the subsequent panel discussion.

One issue is that many grid operators often issue access on a first-come, first-serve basis, Antje Becker-Boley from CMS Germany explained. So when a CPO applies for a grid connection, there is no way of knowing “which spot you hold in the queue.” Another big obstacle is building permits, as Marcus Groll and Becker-Boley point out. As a CPO and its legal counsel, the two have gotten a taste of what it means when every country has different requirements for setting up fast chargers.

Even though charging station manufacturers don’t really have to worry about grid connections, as they deliver the charging solution that “just needs to be put in the ground,” as Oppolzer says, Kempower is well aware of the problem. He mentioned the Netherlands, where there are areas with such high grid congestion, that a connection is nearly impossible. In one case, “the solution was to put a wind turbine up and then run the charge par with 3.6 megawatts of installed charging power.” And though it seems like a clever solution, he added that the cost would probably be too high for charge parks for passenger cars. But solutions like this could “glaze over some of the challenges caused by limited grid capacities.”

Sperka proposed another solution that could help in the long run: grid capacity maps. If CPOs know ahead of time, they would not apply for a grid connection in areas without capacities. It would save time and money for CPOs and grid operators. “If you go to a certain location and what a grid connection. And then after four months, the grid operator tells you, there is none available, you could have gone somewere else in the first place,” Sperka said.

Though all participants believe that the EV charging landscape will change drastically in the coming years and that there is no stopping the electrification of the transport sector, they are aware of the hurdles they face. Groll has little hope that this will change any time soon. “These are the main obstacles, but nobody is really working on that,” he said. “We just have targets that we have to build more. But nobody is really improving the process.”

0 Comments