Is there hope for Canoo yet?

With the acquisition, the financial company WHS Energy Solutions led by Aquila, would also waive eleven million dollars in debt that Canoo borrowed before filing for bankruptcy. Although the purchase price seems very low, given that in February there was still talk of 145 million dollars in assets. However, the bankruptcy trustee considers the sale to Aquila to be the “best course of action.” Canoo itself lacks the money “necessary to maintain the integrity of the assets.” Moreover, bankruptcies of other EV startups have led to a “glut of EV related assets” – which is why prices are low.

Interested parties can submit “higher and better offers” for the company’s assets until 28 March. If no offers are received, WHS Energy Solutions would take over Canoo’s production facilities, finished vehicles, intellectual property, contracts and other inventories and assets, but not leases or liability for the claims of other creditors.

Before its bankruptcy, Canoo had only delivered a few electric transporters to a few government agencies, including the Department of Defense, the US Postal Service and NASA. Aquila apparently hopes to pick up where Canoo left off. He told the bankruptcy trustee that one of his main motives was to “honour [Canoo’s] commitment to provide service and support for certain government programs.” However, Aquila did not respond to TechCrunch‘s request for comment. And since US President Donald Trump took office, it is unlikely that there will be many more government contracts in the near future.

Hopes for Canoo to resume operations thus appear slim for the time being, but it could continue under a new name. Without a statement from Aquila, however, his exact plans remain unclear for the time being. We can expect news at the end of March, when the bidding deadline expires.

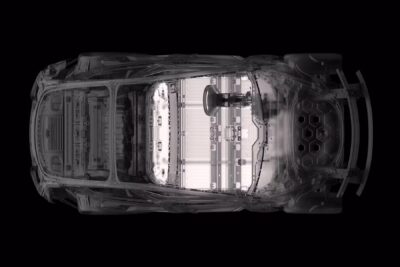

Canoo was once founded as Evelozcity and in its early years was led by, among others, German automotive executives Ulrich Kranz, Stefan Krause and Karl-Thomas Neumann. Both later left the company. The plan was to develop four electric vehicles optimised for urban use, based on a specially developed skateboard platform, and to offer them exclusively by subscription. Financial expert Tony Aquila came on board in 2020 in the course of the SPAC IPO and took over the CEO position in 2021 – Aquila was also one of Canoo’s largest investors. Under his leadership, the former subscription focus was discarded and partnerships to build EVs from other manufacturers on the Canoo platform were also terminated – since this happened shortly after the IPO and was not announced in the IPO prospectus, Canoo was later forced to pay a million-dollar fine. However, the company was never really able to meet the targeted delivery date for the vehicles, which then led to insolvency at the beginning of the year.

0 Comments