China imposes export ban on rare earths

According to the New York Times (NYT), the ban applies not only to the US, but to all countries. Without access to these raw materials, the production of electric motors and microchips could grind to a halt – with serious implications for the global automotive, semiconductor, aerospace and defence industries.

The report states that exports were abruptly halted at Chinese ports. However, the general export ban may only be a temporary measure ‘while the Chinese government drafts a new regulatory system,’ the NYT notes. It is believed that the new system is intended to ensure that ‘certain companies, including American military contractors’, will no longer have access to these supplies from China.

Already on 4 April – just two days after US President Donald Trump’s sharp tariff hike – the Chinese government imposed export restrictions on six rare earths that are exclusively refined in China, as well as on rare earth magnets. These magnets, typically containing neodymium, account for around 90 per cent of global production and are mainly manufactured in China. Since 4 April, special export licences were required – until the current full suspension of exports came into effect.

The New York Times cites industry executives who had already anticipated global supply issues due to the licensing requirement, as China is only just setting up this system. Michael Silver, CEO of Los Angeles-based chemicals firm American Elements, said his company was told that issuing such an export licence could take up to 45 days. This could lead to delays in tightly synchronised supply chains if the licensing process proves time-consuming. Without access to these raw materials – or the magnets already manufactured in China – production could come to a standstill in many places.

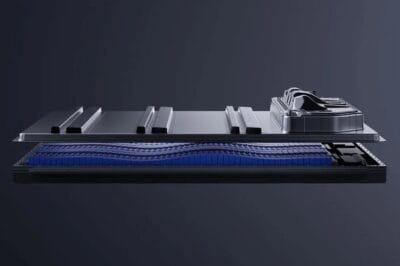

The export ban primarily affects the production of permanent magnet-based electric motors, known as permanent magnet synchronous machines (PSM). Due to their high power density, PSMs are among the preferred electric motors in electric vehicles. Carmakers relying on asynchronous motors (ASM) or externally excited synchronous machines (EESM), by contrast, are likely to face fewer problems – these motor types do not require permanent magnets and thus no rare earths. However, such companies could still be indirectly affected, as could manufacturers of internal combustion vehicles: electromechanical power steering systems also frequently use electric motors with permanent magnets.

Rare earths are also found – in some cases in smaller quantities – in lasers, car headlights, and spark plugs, as well as in computer chips, capacitors and smartphones. As the semiconductor shortage of recent years has shown, supply bottlenecks in these areas could once again hit the global automotive industry hard.

nytimes.com (paywall)

0 Comments