EV sales in the US plummet – as expected

While the decline for the full year—just two per cent—was relatively moderate despite the weak fourth quarter, this can partly be attributed to stable sales performance in the first three quarters. However, the announced end of the US tax credit at the end of September led to a surge in advance purchases to secure the incentive. This one-off effect resulted in an exceptionally strong September, during which numerous carmakers set new sales records for their electric vehicles.

Although dealers and manufacturers attempted to mitigate the post-incentive slump, they were unable to prevent the sharp decline in sales during the fourth quarter. Of course, the raw statistics do not reveal what the outcome might have been without such measures.

The figures tell a clear story: in 2025, a total of 1,275,714 electric vehicles were sold in the US, according to statistics from Kelley Blue Book. A year earlier, the figure was 1,301,441 EVs. The difference is even more pronounced in Q4: sales dropped from 365,830 EVs in the final quarter of 2024 to 234,171 in Q4 2025. These figures refer solely to battery-electric vehicles. However, the statistics for fuel cell vehicles are also far from positive, albeit for partly different reasons: Toyota sold 57.9% fewer fuel cell electric vehicles (FCEVs) in the US in 2025, with sales falling from 499 to 210 Mirai. Meanwhile, Hyundai saw sales of the first-generation Nexo collapse from 94 to just six vehicles—a decline of 93.6%.

While Hyundai experienced the sharpest year-on-year decline with the Nexo, the drop was less severe in a single quarter. In Q4, Nexo sales fell by ‘only’ 60.0%, a decline that was surpassed by some brands in the battery-electric vehicle sector due to the well-known effects of the incentive phase-out. For instance, Acura saw its EV sales plummet by 97.9%, effectively grinding to a halt—dropping from 4,377 sales in Q4 2024 to just 90. However, the declines at Acura and Honda also reflect a strategic shift. Honda lost 86%, with sales falling from 18,838 to 2,641. Similarly, Nissan saw a 93.2% decline (from 8,546 sales to just 577 units), with a comparable strategic decision evident in its Q4 results.

The fourth quarter was also challenging for the major US manufacturers, though the full-year picture for 2025 tells a slightly different story. Ford experienced significant losses (-51.9% in Q4 and -14.1% for the year), while the situation for GM brands was somewhat better. For example, Chevrolet also suffered in Q4, losing a substantial 65.8% (with sales falling to 9,814, returning to four-digit figures). However, on an annual basis, the result remains positive, with a 39.3% increase—Chevrolet narrowly missed the 100,000 mark with 96,951 sales. Cadillac (+69.1%) and GMC (+50.7%) also achieved notable sales growth in 2025.

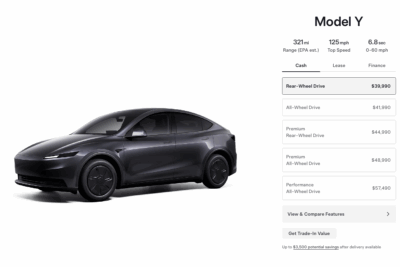

Tesla remained the undisputed market leader in the US. Although Tesla also saw a 15.0% year-on-year decline in the fourth quarter, it still dominated with a clear lead of 138,000 sales. Only Ford (14,513) and Cadillac (11,001) managed to reach five-digit sales figures in Q4. All other brands—some despite gains—remained in the three- or four-digit range. For the full year, Tesla sold 589,160 vehicles, falling just short of the 600,000 mark (compared to 633,762 EVs in 2024), but still secured a 46.2% market share. While the days when more than every second EV in the US was a Tesla are over, no other brand has achieved a six-figure annual sales figure. Chevrolet, with nearly 97,000 sales and a 7.6% market share, ranks a distant second.

What about the German brands? Mercedes recorded a 54% decline in 2025, with just 12,942 sales for the year—a disappointing result for the manufacturer. In fact, Mercedes has even fallen behind Porsche within the Stuttgart group, as the electric Macan drove a 117.5% increase in sales to 14,107 units. BMW fared better, with a 16.7% decline but still achieved 42,483 sales, while Audi managed to grow by 30.5% to 30,214 EVs—despite a near-collapse in Q4, with sales plummeting by 91.1% to just 584 EVs nationwide. For the VW brand, the final quarter saw a 19.6% decline, but the full year still delivered 56.8% growth. With 28,513 units sold, Wolfsburg remains behind Audi in the internal group comparison.

coxautoinc.com (PDF)

1 Comment