How the semiconductor crisis really affects electric cars

Long waits, unscheduled handover dates – disrupted semiconductor supply chains significantly impair battery-electric car production. Management consultancy P3 has analysed the supply chain problems – and identified the issue as repeat mistakes, similar to those made in battery cells.

* * *

The phenomenon of missing semiconductors also affects combustion engine vehicles but to a lesser extent. That is the core result of P3 Group’s analysis. “Four years ago, we realised that the semiconductor would become the new battery cell,” says Markus Hackmann, managing director at the consulting firm. He adds that car manufacturers who had prepared for potential bottlenecks would come through the current challenge much better. P3 conducts at the root of the problem: What has caused the current semiconductor crisis?

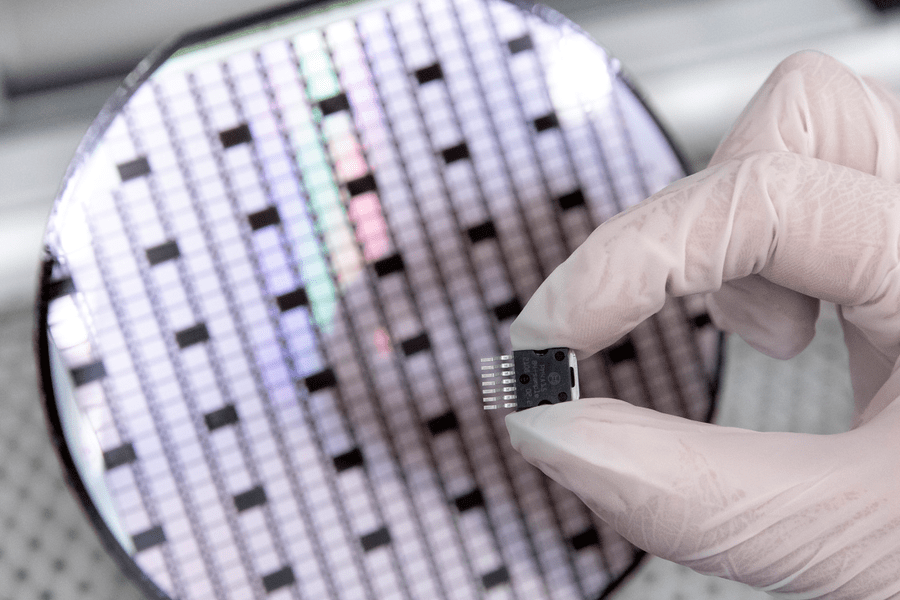

A battery-electric vehicle (BEV) has easily twice as many semiconductors as an ICE car. Specifically, P3 talks about a difference of 1,300 to 600 per car. And they are mainly in the powertrain (600 to 300). The inverter is particularly dependent and heavy in semiconductors.

“Repeat mistake like with battery cells”.

In terms of value creation, the German car industry has become dependent on Asian suppliers – which the P3 Group calls a “repeat mistake” that had been made with batteries before. This time, however, the big trigger was the Covid pandemic: fearing a slump in demand, quite a few automakers have cancelled orders in 2020. However, the consumer dip in the car market remained small, and at the same time, demand for semiconductors in the entertainment industry grew enormously.

The subsequent alternation of lockdowns and opening booms combined with other negative factors – remember, the container ship transversed in the Suez Canal – has led to a regular stall. A problem that continues to this day. For example, the lockdown in Shanghai is only gradually reduced, so the traffic jam in the world’s largest port is far from resolved.

If you look at the seaports with the highest container throughput, almost all of them are in Asia: Shanghai is followed by Singapore, Ningbo-Zhoushan, Shenzhen and Guangzhou-Nansha. Currently, ships are sailing at high speed without regard to heavy oil consumption to compensate for the shortfall. The prices paid for semiconductors have multiplied, making this spurt financially possible. The next bottleneck looms after arrival in Europe, i.e. in Rotterdam, Antwerp and Hamburg, because the ports must laboriously handle the immense volume of goods.

Eight per cent of chip production for cars

At the same time, the market power of the automotive industry is not as great as usual: Only eight per cent, according to the P3 Group’s calculations, of all semiconductors are purchased here. In contrast, 80 per cent are used in consumer electronics.

For a relatively simple passenger ICE car in 2017, about two per cent of the total costs were due to semiconductors. A BEV of 2030 will require six per cent, three times as much. In addition to electrification, drive automation is essential to this development.

Let’s mention just some components that require semiconductors: In the powertrain of a BEV, for example, these are the charger, the inverter, the DC/DC converter, the high-voltage battery, the central processor and the motor itself. For autonomous driving, various cameras, multiple radars, ultrasonic sensors and steering and braking by wire will be essential in the future (automation levels 4 and 5). Add to this the digital control unit and the infotainment system.

Semiconductors are also produced in different sizes for different purposes; for example, the demand for semiconductors with small structure sizes below 150 nanometers will increase by 10, according to P3.

Supply chain transparency

And now?

“In the acute situation, we are building transparency about supply chains at P3 Group,” says Mauritz Schwartz, a semiconductor specialist. Many parties involved in the automotive industry are unclear, for example, who could be a producer and who is just an agent. From this analysis, improvements and more accurate delivery forecasts could be made. At present, it can take up to 72 weeks from the time an order is placed for semiconductors to arrive.

In the medium term, however, the overall situation could improve with new locations in Germany. For example, Intel has announced plans to build a large plant in Magdeburg and invest 17 billion euros. Intel is not a typical automotive supplier but will find its way into this role. The short distances – to VW in Wolfsburg, for example – also remove intermediate stages in orders. But really large volumes are not to be expected here until 2027. Much sooner, probably in 2023, Bosch from Dresden could contribute to easing the semiconductor crisis.

Conclusion

The automotive industry needs to reorganise itself. The self-evident tendency to relegate semiconductors and battery cells to the status of arbitrary supplier components is over. However, it will probably be years before supply chains can function smoothly again and (re-) localise some in Europe. The disaster that exists due to the lack of semiconductors must not remain without consequence: It must be regionalised. Because the importance of semiconductors will increase, a particular focus should be placed here. For those interested in buying, the only thing to do is wait and see. At some point, the system will be back in balance.

p3-group.com (in German)

1 Comment