Canoo issues further shares

California-based electric car start-up Canoo is looking to raise around 52.5 million dollars through share sales at a steeply discounted rate. Agreements with several investors have already been reached, but the deals have yet to be completed.

Investors will pay 1,05 dollars per share, a 16 per cent discount from Friday’s closing price. Each share comes with a warrant that can be exercised at 1,30 dollars per share.

Some 50 million shares have already found potential buyers. Shares are sold with warrants, meaning potential investors also have the option to buy as many as 50 million additional shares.

Canoo says the net proceeds from the stock offering will be used for “general operating purposes”. The company is expected to report fourth-quarter and full-year 2022 financial results later this month. At the end of the third quarter, Canoo still had around 6.8 million dollars in available funds.

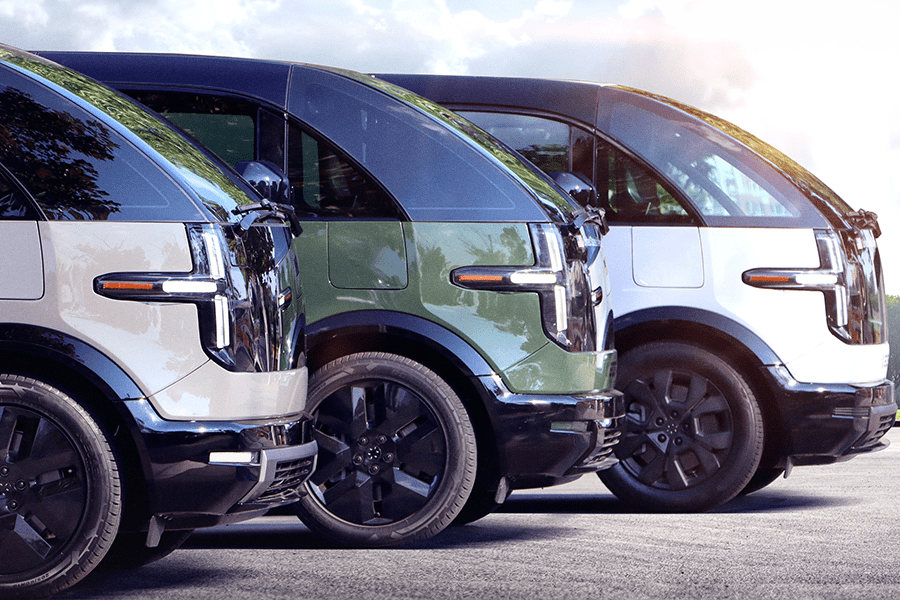

The start-up has been cash-strapped for some time, as expenses for its planned production ramp-up are high. As recently as November, Canoo announced that it was acquiring a vehicle plant in Oklahoma to produce its Lifestyle Vehicle (LV) and its cargo variant, the Lifestyle Delivery Vehicle (LDV).

This came after Canoo had begun to question its own future back in May 2022, since its operations were not secure without external funding. Soon after, the company did win some major contracts, such as from Zeeba, Kingbee and Walmart, but had to accept some tough conditions in the process. For the Walmart deal, Canoo must forgo selling vehicles to Amazon for the duration of the deal.

Still, because of the deal, Canoo is said to have more than one billion dollars in sales in the pipeline. Walmart agreed to purchase 4,500 units, with an option to buy as many as 10,000. But Canoo has had difficulties delivering the ordered vehicles.

In the past twelve months, Canoo’s stock value has declined 80 per cent. After the discounted sale was announced, the share price fell even further. On Monday, shares opened at 1.20 dollars lower than at closing on Friday.

Until now, Canoo had issued 356 million shares. If 50 to 100 million more share certificates are added, the participation of existing investors will be significantly diluted.

0 Comments