Next.e.GO Mobile receives investment from Western Asset

German electric car manufacturer Next.e.GO Mobile has raised $75 million in fixed-rate debt financing, the equivalent of around €68 million. The financier is the asset management company Western Asset.

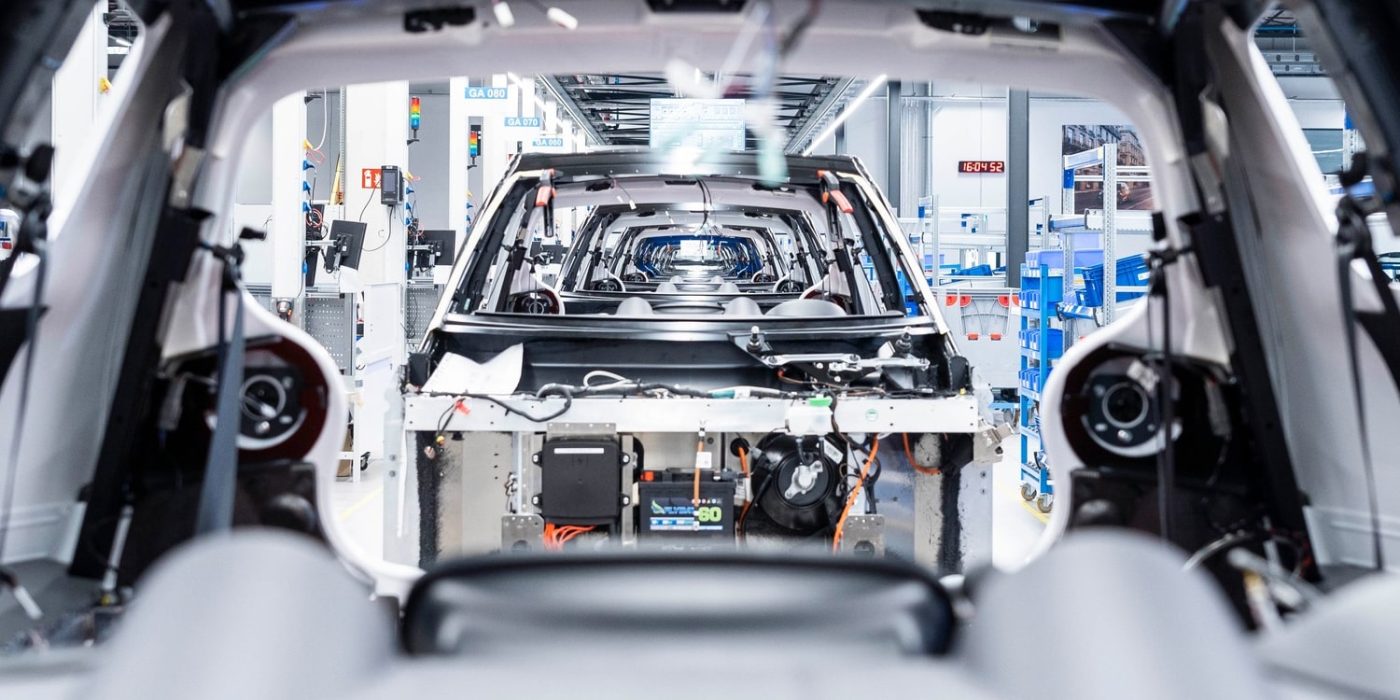

With the net proceeds of the financing, the Aachen-based e.GO intends to accelerate its corporate strategy, with a particular focus on the production of the e.wave X as well as global growth. A particular focus is Next.e.GO Mobile’s microfactory strategy to rapidly scale manufacturing in multiple locations. Currently, the company plans to have three of these factories. In addition to the microfactory already in production in Aachen and the microfactory under construction in Bulgaria, a third factory location is planned in Northern Macedonia.

The latter two plants are each expected to build up to 30,000 vehicles annually from 2024. However, Next.e.GO Mobile is still a long way from such figures in terms of sales. To date, only a good 1,300 e.GO vehicles are in use, according to the manufacturer. The company plans to add a cargo version called e.Xpress to the e.wave X small car, was unveiled at the beginning of May 2022. However, both are still largely based on e.GO’s debut model, the Life.

The background is that Next.e.GO Mobile emerged from the insolvent manufacturer e.GO Mobile, which RWTH professor Günther Schuh founded. The new company is aiming for the US stock market via an SPAC merger. As a result of the merger with the stock exchange shell Athena Consumer Acquisition, shares in the company are to be traded in future under the ticker symbol ‘EGOX’. The transaction is “expected to close in the second half of 2023,” according to current information.

To bridge the gap, the financing now announced should serve well. “We are pleased to partner with Western Asset, one of the world’s leading fixed-income managers that has been providing customized financial solutions on behalf of their clients for over 50 years,” said Ali Vezvaei, chairman of e.GO’s board of directors. “As we focus on bringing convenience, practicality and affordability to everyday urban mobility, this financing gives us the opportunity to continue towards our planned production and grow our MicroFactory footprint.”

“This successful debt financing is a testament to e.GO’s robust technology foundation as an innovative producer of electric vehicles. We are truly excited about our partnership with e.GO and looking forward to its continued growth upon closing of the envisioned de-SPAC transaction,” said Isabelle Freidheim, Chair of Athena SPAC.

0 Comments