Less stations, more power sharing: How ChargePoint intends to tackle the “big EV” business

According to its VP of Sales, ChargePoint considers itself a leader in the charging business regarding big EVs, like trucks and buses. That position might not apply globally, as the company is not present in the Chinese market, but it is true for Europe and the US, says Andre ten Bloemendal.

It is also a positioning rather than a position yet and appearing among industry changes. ChargePoint and Blink Charging reportedly showed dwindling cash funds this year, also due to Tesla pushing into the public charging market.

At the same time, ChargePoint received fresh capital and is focussing more firmly on the literally next big thing in commercial EV charging.

The company reportedly has deals with companies such as Iveco in Europe or Nikola in the US. Commercial cooperations like this are crucial as ChargePoint approaches the “big EV business”, as ten Bloemendal calls it.

He gives the example of electric trucks that travel varying routes and rely on public charging on parts of the way. Transport companies will, therefore, need to be able to reserve charge points along their route to ensure that an electric truck can be plugged in when drivers need to take their mandatory break, ten Bloemendal explains.

“Because, even if you do a 20- or 25-minute charge and it doesn’t coincide with the moment the driver needs to rest, you have a double resting time instead,” he says. “So there is a lot of telematics associated with that.”

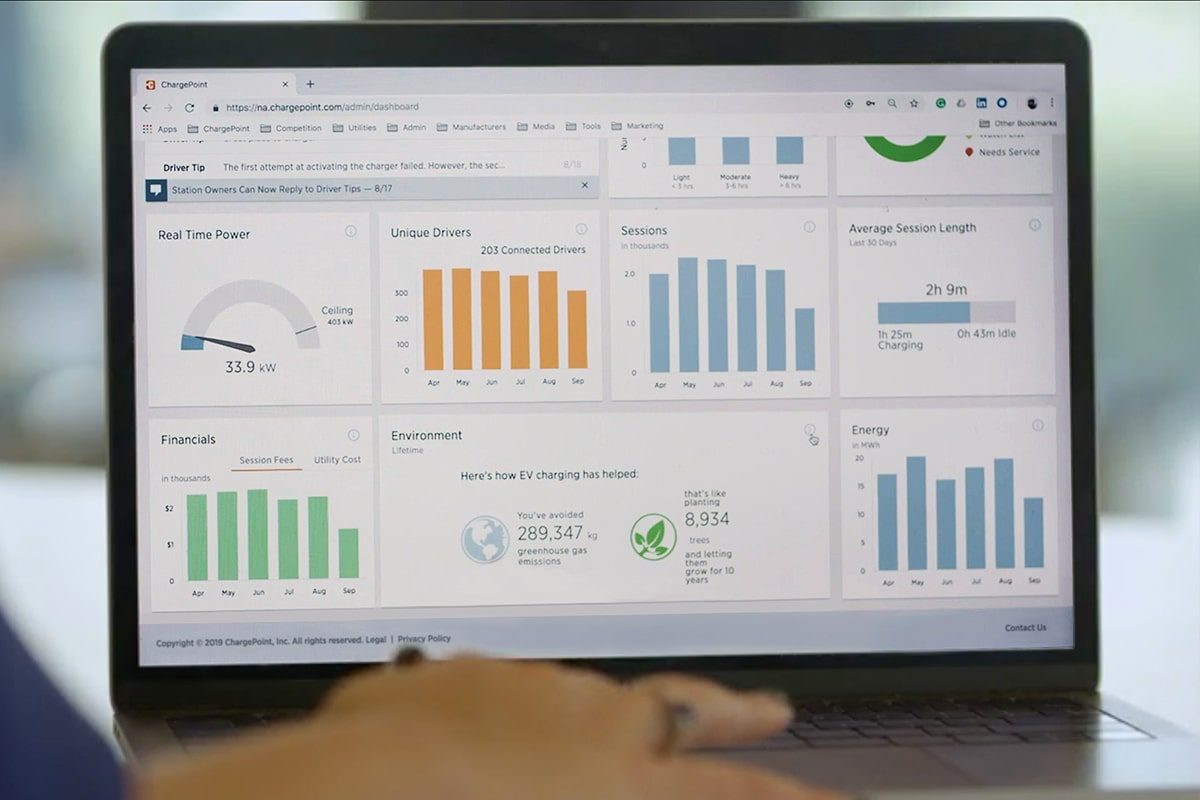

The manager here points to ChargePoint’s integrated software solution to help optimise routing and charging. In October, the company also launched a version for mixed fleets which optimises “route-readiness”.

Staying with trucks, when navigating, the system also takes into account the weather (especially if it is cold), as well as the battery’s State of Charge (SoC) and State of Health (SoH). “Even the driver’s behaviour is essential,” says ten Bloemendal.

“Thanks to artificial intelligence, the system can now learn all these things to help plan the routing and charging in the most optimised way,” he adds.

Distributing energy as needed

And he sees more room for optimisation than just reserving chargers. According to ten Bloemendal, setting up enough megawatt charging stations will be nearly impossible. It is simply too expensive. What he proposes is that companies cannot only book a time slot for charging but that they should also be able to reserve the amount of kilowatt (or megawatt) that they need to charge with.

“We need distributed power solutions,” he says. “If a site has a two-megawatt connection to the grid, power can be distributed across maybe 20 chargers. And I can then not only reserve the charge point but also a certain part of those two megawatts for a certain time.”

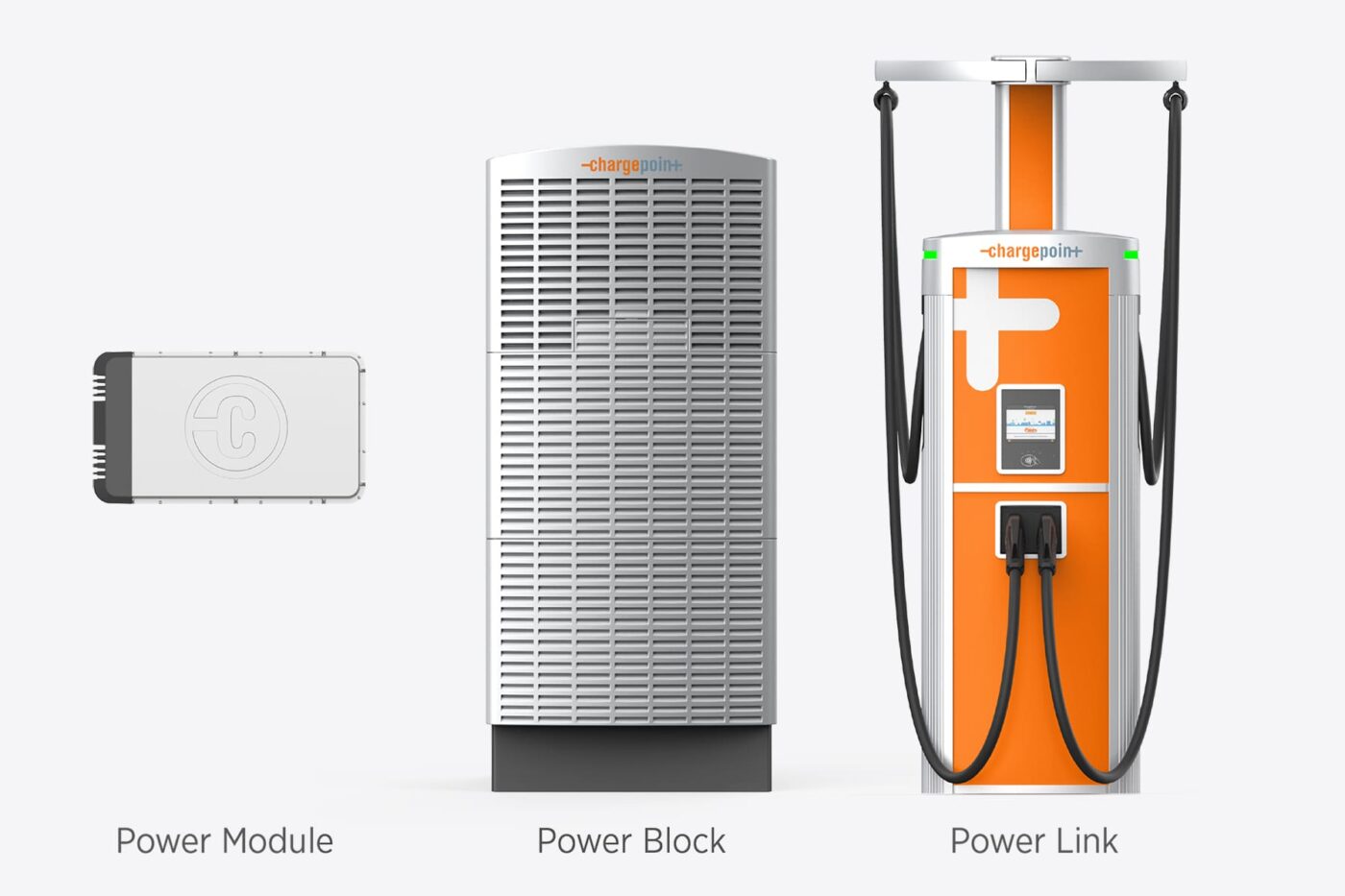

ChargePoint recently launched its latest solution, Power Link 2.0, under its ‘Express Plus’ architecture. It started rolling out the new technology for Mercedes in the USA. When announcing the cooperation in November, ChargePoint told electrive it could lead to at least 400 high-power charging hubs in future. It will also launch in Europe.

Generally, Express Plus is a modular DC charging platform that uses so-called Power Blocks, which dynamically allocate power based on the energy vehicles can accommodate as they charge.

According to ChargePoint, the latest version can charge two cars simultaneously at speeds of up to 500 kW – which most EVs cannot take yet. However, it could become increasingly useful as more EVs with higher power needs hit the road.

“We want to be one of the top three companies offering such a solution in the future,” says ten Bloemendal.

But back to the heavy-duty EVs. The solution is also aimed at bus operators, the ChargePoint manager explains. Operators know the route, the timetables, the battery’s state of charge, and other values, meaning they can optimise charging in terms of time and kWh based on how much range a bus needs to have.

“Instead of thinking that, when a bus comes in, the battery needs to be fully charged, you can optimise the location capacity and reduce your CapEx by only charging what the vehicle really needs to operate properly,” explains ten Bloemendal.

Companies like the San Francisco Municipal Transportation Agency and the Pinellas Suncoast Transit Authority have deployed Express Plus in the US. According to ChargePoint, they are also using the telematics solution he mentioned earlier.

“We are a software company,” he adds. “We want to maintain our position concerning the hardware. But particularly on the software side, we want to be the leader.”

Taking on Europe’s local heroes

The focus on the commercial segment and smart charging already showed in 2021. In August of that year, ChargePoint acquired ViriCity, a Dutch specialist in telematics and provider of electric bus and commercial vehicle management systems.

ChargePoint also acquired the Austrian eMobility software specialist has.to.be for around 250 million euros in the summer of 2021. The acquisition expanded the company’s customer base and its “capability in software engineering in the European region.” Something that ten Bloemendal is still “delighted” about.

Still, ChargePoint remains a complete supplier to CPOs and delivers the hardware “where it makes sense to have vertically integrated solutions,” as well as the ChargePoint Management System (CPMS) and E-Mobility Service Provider (EMSP) services.

“And then, of course, we have the platform that enables roaming, which is a vital element for our success in Europe and expanding payment services in the sense of reimbursement to, for example, LeaseCo customers,” ten Bloemendal mentions.

He also considers ChargePoint among the top companies in the segment. “However, there is a clear ‘but’ at the end of that sentence.”

As the manager explains, “the European charging market has been built around local heroes,” mainly as a result of national or regional certification and legislation, not the least of these the German Eichrecht. He finds nothing wrong with that, but “since local companies often met local requirements, they were the first choice in many cases”.

Ten Bloemendal also believes many of these “local heroes” were, or still are, hardware providers. “But if you look at the second or even the third wave of electrification that we are currently in, customers have realised that it is no longer about hardware,” he says. ChargePoint already sees CPOs utilising different types of hardware depending on the use case while seeking a single CPMS to keep things simple and reduce cost.

“There are few players in Europe that offer pan-European solutions on the software side. And that’s where we benefit from our pan-European presence. All of a sudden, it’s all about who can provide CPMS relevant to a specific use case, which is hardware agnostic and which allows roaming.”

For the ChargePoint manager that explains why his company speaks to the bus industry as well as to fleets of smaller EVs, such as company cars. And, ten Bloemendal emphasises that he, or ChargePoint, intends to continue to drive the market and innovation.

Interview by Carla Westerheide.

0 Comments