ICCT study shows 5,300 MCS chargers in the EU sufficient for electric trucks

Even though the acceptance of electric drives has already increased in all segments in Europe, the pace is set to pick up significantly in the near future. This is because truck manufacturers will have to rapidly increase their sales of electric trucks over the next five years in order to meet the EU targets for reducing CO2 emissions from heavy-duty vehicles (HDVs).

As was once the case with electric cars, this naturally raises the question of where and how all these expected electric trucks will be charged. Because one thing is also clear: the vast majority of these locally emission-free trucks will be battery-electric for the time being. Although there are a few hydrogen trucks, manufacturers such as Daimler Truck have postponed their plans for fuel cell models until the next decade. In the short term, therefore, the electrification of freight transport will primarily be battery-powered. And those batteries will need to be charged.

With the AFIR adopted in 2023, the EU has already set targets for a ‘minimum infrastructure for alternative fuel vehicles’, but these are only minimum targets. The International Council on Clean Transportation (ICCT) has now determined how high the charging demand of the expected electric truck fleet in EU countries really is. To do this, it first modelled the expected fleet numbers for the various truck segments up to 2030 in order to deduce the charging behaviour of most truck classes in Europe based on typical driving scenarios, energy consumption and usage.

More private truck charging points than public ones

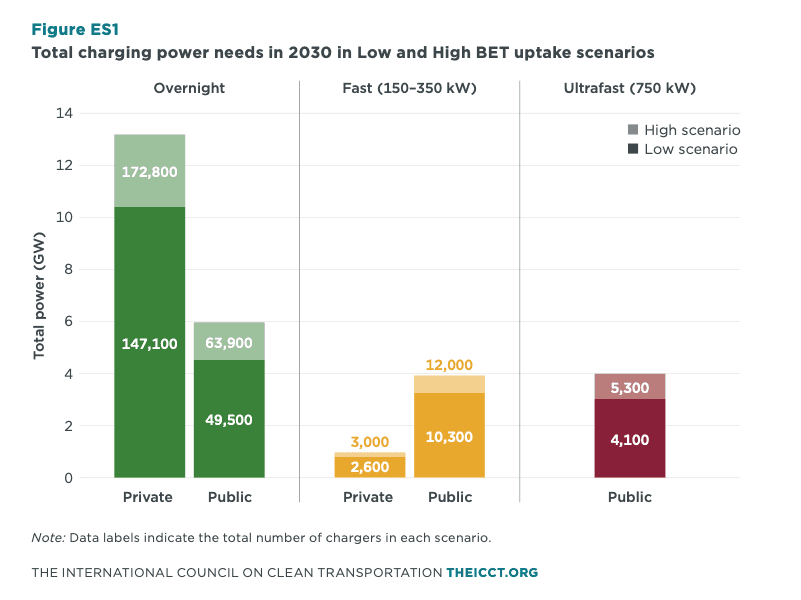

The ICCT estimates that the charging capacity required for electric trucks in 2030 will be between 22 and 28 gigawatts. According to the study, around 70 per cent of this will be installed in the top five countries in terms of truck charging demand – Germany, Poland, France, Spain and Italy. This is due in part to the expected vehicle fleet, but also to important transit routes that run through Germany and France, for example.

However, it will be interesting to see how this capacity will be distributed. According to the study, the 22 to 28 GW will be divided almost equally between private charging points ( in depots) and public charging points. Since the vast majority of private charging points are used for overnight charging rather than for short charging sessions during breaks, lower charging capacities are sufficient here. Despite the 50:50 split in total power, the ICCT therefore expects between 150,000 and 175,000 private truck charging points and 60,000 to 80,000 publicly accessible truck chargers in five years’ time.

And of these 60,000 to 80,000 public charging stations, only 4,000 to 5,300 will be in the megawatt range. “MW chargers are expected to comprise almost 15% of the total installed charging power needs, but only 2% of the total number of chargers. Lower-power chargers, such as 350 kW chargers, can cover more than half the public fast charging needs for long-haul trucks,” the study says. The ICCT goes even further: if long-haul trucks are equipped with larger batteries in the future (720 kWh compared to 600 kWh today), the need for MW chargers could be reduced by 40 per cent, which could significantly reduce these trucks’ dependence on public ultra-fast charging stations.

And how does that fit in with the AFIR targets? “The AFIR is expected to cover between 50% and 70% of public charging needs in the EU-27 by 2030,” according to the ICCT. ‘On the core road network, AFIR targets are expected to cover between 65 and 85 per cent of total charging demand, while coverage across the entire road network will fall to 35 to 45 per cent.’ However, there will be significant differences between individual EU Member States, which are not apparent from these average values. In half of the countries, including Belgium and the Netherlands, the ICCT assumes that AFIR will only cover 30 to a maximum of 50 per cent of actual charging demand – meaning that more than twice as much infrastructure will need to be built as envisaged in AFIR.

“This is because the distance-based AFIR targets do not accurately reflect actual traffic activity, resulting in a large gap between the AFIR targets and actual toll demand for countries that have a high proportion of truck traffic but a small share of the road network,” explains the ICCT. “The opposite is true for countries such as Romania, where the AFIR target is twice as high as the expected load demand.”

This actual charging demand for electric trucks will therefore pose challenges for the electricity grid – “especially at high-power charging stations in the Trans-European Transport Network (TEN-T).” In other words, those locations where MCS chargers are likely to be installed. “However, the scale of the required charging infrastructure is likely to pose challenges to local grids, especially at high-power charging sites across the TEN-T network, mainly due to grid congestion challenges, lengthy permitting procedures, and investment hurdles. Many of those challenges can be addressed in the review of the AFIR and other complementary policies on grid planning, permitting, and investment,” the study states.

This article was first published by Sebastian Schaal for electrive’s German edition

0 Comments