EU trade spokesman denies plans for tariffs on Chinese hybrids

EU Trade Spokesperson Olof Gill has clarified that there are no ongoing investigations by the European Commission into hybrid vehicle exports from China to the European Union. This statement follows a report by the news portal Euractiv last week, which cited an source from the office of EU Industry Commissioner Stéphane Séjourné as suggesting that an expansion of tariffs to include hybrid vehicles was under consideration. The context for this discussion is the rising imports of hybrid vehicles from China.

However, some stakeholders are likely to support such a measure. According to media reports, EU Industry Commissioner Stéphane Séjourné has ‘repeatedly’ questioned why the measures applied to battery-electric vehicles (BEVs) should not also extend to hybrid vehicles. He argues that hybrids are ‘produced under the same conditions’ and that European manufacturers ‘require the same protection and equal conditions.’

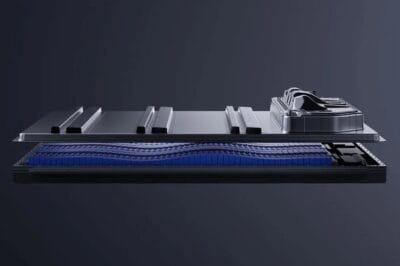

In addition to his denial, Trade Spokesperson Olof Gill stated that the EU’s anti-dumping investigations, which form the basis of the current additional tariffs, ‘exclusively’ focused on battery-electric vehicles. He emphasised that such an investigation is a prerequisite for any tariff measures under World Trade Organisation rules. Expanding these measures without new investigations is therefore not possible. Gill also highlighted that the battery sector had been identified as a ‘problematic trade pattern that could pose a threat to the European Union’s industry.’ While batteries are also used in plug-in hybrids, they are significantly smaller in such models.

For context: since 2024, the European Union has imposed additional duties on battery-electric vehicles from China, ranging from 7.8 percent to 35.3 percent per manufacturer—on top of the standard 10% import tariff. These tariffs aim to protect the EU market from competitive distortions caused by heavily subsidised BEVs from China.

The debate surrounding hybrids has gained momentum recently, as Chinese hybrid vehicle exports to the EU surged by 155 percent in 2025. In contrast, exports of battery-electric vehicles, which are already subject to high tariffs, increased by only 12 percent last year. While the absolute numbers of Chinese hybrids in the EU are not yet significantly higher than those of pure electric cars, industry observers note that the rapid growth in hybrid imports reflects a strategic shift by Chinese manufacturers to mitigate the impact of tariffs on BEVs. This trend is also evident globally: according to a recent article in The Economist, hybrid vehicles now account for a third of China’s passenger car exports.

The EU tariffs introduced in 2024, based on the preceding anti-dumping investigation, have provoked strong reactions from Beijing. After protracted negotiations, China’s government recently secured a compromise from the EU: as an alternative to the tariffs, Chinese manufacturers may commit to minimum prices when importing BEVs into the EU. Both protective mechanisms—tariffs and minimum prices—are currently set to remain available in parallel. However, it remains unclear when the minimum price regulation will come into force. Earlier last week, the EU merely announced that it had prepared guidelines for Chinese importers outlining general provisions for price commitments.

While China’s Ministry of Commerce and affected manufacturers have hailed the move as a breakthrough, Brussels has cautioned that the release of the guidelines does not guarantee the eventual abolition of tariffs on battery-electric vehicles. Many sceptics of the minimum price rule argue that the EU has not secured a favourable outcome from the deal. Unlike tariffs, which generate revenue for the EU budget, manufacturers can retain the margins from higher minimum prices.

0 Comments