EU-wide new electric car registrations rise by 30%

With 1.88 million new battery-electric cars registered in EU markets, pure electric vehicles accounted for 17.4 per cent of all new registrations, according to the latest publication from the ACEA. In 2024, this figure stood at 13.6 per cent. With a 29.9 per cent increase in new registrations, electric cars grew significantly more than the overall market, which expanded by just 1.8 per cent in 2025—and remains below pre-Covid pandemic levels, as the industry association notes.

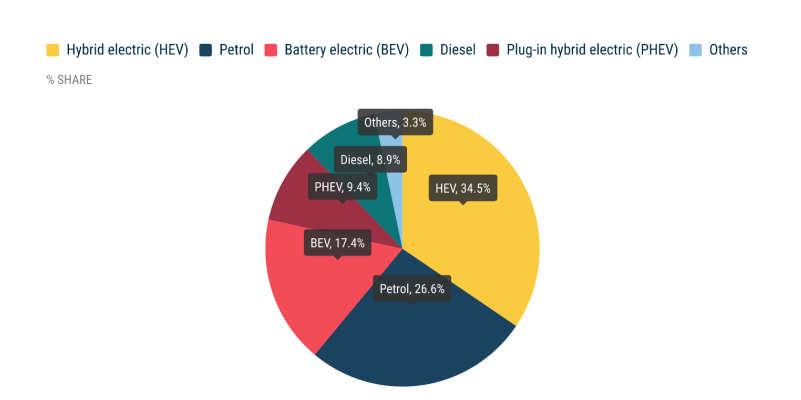

In its report on the 2025 annual figures, the ACEA reiterates its well-known stance that there is still room for growth in electric vehicles. “The battery-electric car market share reached 17.4%, in line with projections for the year, yet still a level that leaves room for growth to stay on track with the transition,” the statement reads. “Hybrid-electric vehicles lead as the most popular power type choice among buyers, with plug-in hybrids consolidating their position in the market.”

Plug-in hybrids achieved a market share of 9.4 per cent, surpassing pure diesel vehicles (8.9 per cent). Combined with battery-electric vehicles, this means 26.8 per cent of all new registrations featured a charging connection. The aforementioned hybrids, classified as Hybrid Electric Vehicles, hold a dominant 34.5 per cent share. However, the ACEA groups all hybridisation levels except plug-in hybrids into this category—without distinguishing between 48-volt mild hybrids and full hybrids capable of short electric-only distances.

Despite the decline in internal combustion engine registrations—petrol vehicles fell by 18.7 per cent and diesel by 26.6 per cent—the ACEA data does not allow for a reliable conclusion as to whether customers are truly shifting towards electric mobility. This is because a 48-volt mild hybrid with a small electric motor assisting the drivetrain still relies entirely on its combustion engine—yet it is counted as a hybrid in ACEA statistics, not as a pure ICE vehicle. The actual share of ‘true’ combustion engines is therefore higher than the 26.6 per cent market share for petrol or the 8.9 per cent for diesel.

A closer look at pure electric cars reveals that the four largest EU markets, which together account for a substantial 62 per cent of the market, all recorded significant growth in 2025. In Germany, BEV registrations rose by 43.2 per cent, while the Netherlands saw an 18.1 per cent increase, Belgium 12.6 per cent, and France 12.5 per cent. Denmark also entered the six-figure range with 126,542 new electric cars (+42.0 per cent), as did Spain with 101,627 new electric vehicles (+77.1 per cent). Sweden narrowly missed the 100,000 mark with 99,723 electric cars (+5.7 per cent). The highest growth was recorded in Poland, where registrations more than doubled with a 161.5 per cent increase—from 16,564 electric cars in 2024 to 43,311 units.

Overall, only five EU markets experienced a decline, most of which are smaller markets such as Croatia, Estonia, or Malta. In these cases, one-off effects—such as an incentive programme or a manufacturer’s discount campaign for a few hundred vehicles—can have a relatively significant impact.

Battery-electric cars have also seen across-the-board growth in non-EU European markets. Among EFTA countries, Norway, the poster child for electric vehicles, leads with over 172,000 vehicles (+50.6 per cent), though Iceland achieved the highest growth rate at 125 per cent—albeit from a smaller base, increasing from 2,661 to 5,988 electric cars. The United Kingdom recorded a 23.9 per cent rise, with 473,348 new BEVs registered. In a pan-European comparison, the UK ranks second, behind Germany but ahead of France. When combining the EU, EFTA, and the UK, the ACEA recorded 2,585,187 new electric cars and a 19.5 per cent market share.

In the manufacturer statistics, the ACEA does not differentiate further by drivetrain type. Thus, this analysis of battery-electric vehicle sales performance only provides insights for Tesla, as a pure electric car manufacturer, since all other manufacturers include plug-in hybrids or combustion engine vehicles in their figures. In December, Tesla achieved 21,485 new registrations in the EU, corresponding to a 2.2 per cent market share—but this represents a 31.9 per cent decline compared to the 31,567 Teslas registered in December 2024. For the full year 2025, Tesla registered 150,504 new vehicles in EU markets, a 37.9 per cent drop from the previous year. In 2024, Tesla had achieved 242,436 registrations and a 2.3 per cent market share, but this has now fallen to 1.4 per cent—on par with Suzuki. BYD, with its mixed portfolio of electric cars and plug-in hybrids, recorded 128,827 EU registrations and a 1.2 per cent market share, but saw a 227.8 per cent increase. In 2026, BYD is likely to overtake Tesla in the EU—though it remains unclear from this data whether this will be achieved solely with its electric cars or what share plug-in hybrids will contribute.

acea.auto (PDF)

0 Comments