Vertical Aerospace shares take-off since listing on NYSE

Britain’s electric air taxi startup Vertical Aerospace made its debut on the New York Stock Exchange on Friday after a blank-check SPAC deal valued at $2.2 billion got the go-ahead. It injects the company with 300 million in cash and has Vertical Aerospace looking to set up shop, perhaps in Ireland.

However, first to the numbers. Vertical Aerospace’s IPO through a merger with SPAC firm Broadstone Acquisition Corp. had reportedly been planned since June. The combined company is now trading under the ticker symbol “EVTL”. The IPO was accompanied by a capital increase in the form of a PIPE (“Private Investment in Public Equity”). Here, mighty bidders and future clients such as Microsoft, American Airlines, Avolon, Honeywell, and Rolls-Royce remained committed.

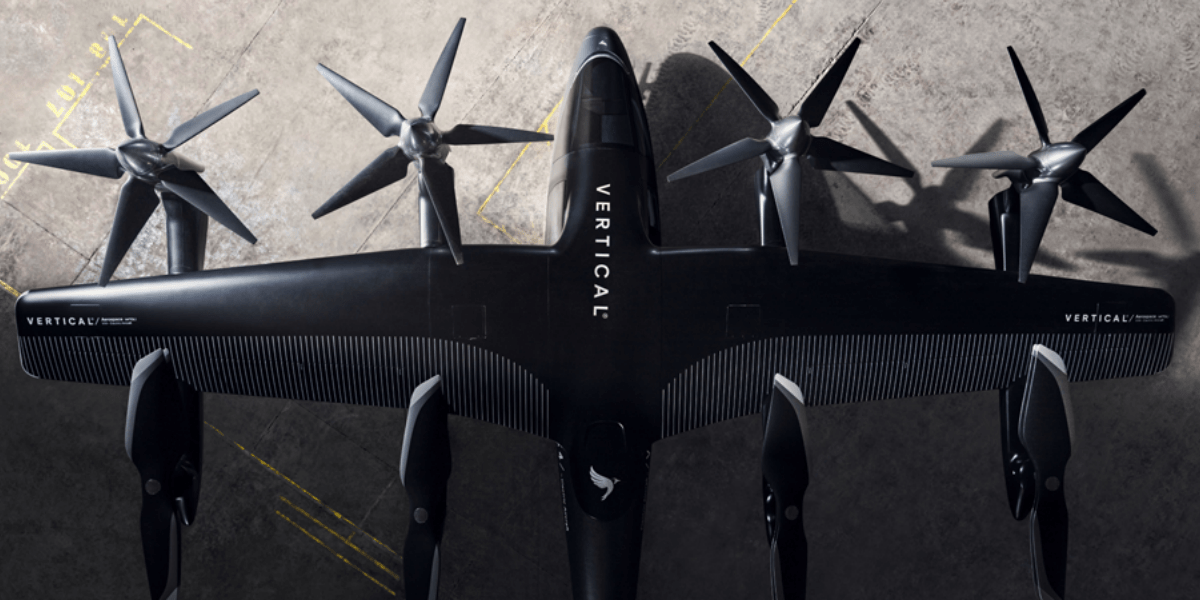

In concrete terms, Vertical Aerospace has also reported pre-orders for up to 1,350 aircraft worth $5 billion from customers, including American and Virgin Atlantic. In addition, in September, the company received an order from Japanese trading company Marubeni to bring its VA-X4 electric vertical take-off aircraft to Japan.

These investments are also flanked by partnerships to build the complete ecosystem of eVTOL operations. Unlike other companies in the competitive airspace, Vertical wants to focus on hardware only, leaving MaaS to others. States Vertical: “This allows Vertical’s airline partners and other customers to deploy the aircraft as opposed to Vertical developing its customer-facing operations or ride-share platform.”

For example, American Airlines and Vertical plan to cooperate in developing passenger operations and infrastructure in the US. Another example: Virgin Atlantic is seeking a joint venture with the British to launch an eVTOL short-haul network under the Virgin Atlantic brand in the UK. Vertical’s other partners include GKN and Solvay.

This all bears the question of manufacturing, and in today’s news, Vertical Aerospace, for the first time, made a bid for it. “We have been speaking to a number of different governments about where we might build the production facility. Domhnal is very keen on us taking it to Ireland,” founder and Chief Executive Stephen Fitzpatrick said in New York after trading opened. Domhnal Slattery is Irish and among the latest Vertical backers through his company Avalon.

However, the company is based in Bristol, a traditionally strong city in aviation, and discussion of where to place the plant is for now “hypothetical,” Fitzpatrick said. He founded Vertical Aerospace in 2016 and was formerly the chief executive of Ovo Energy and owner of Formula One racing team Manor Racing. Fitzpatrick remains the largest shareholder.

What is more, once production is set, Vertical’s value will be determined by actually being able to fly. Certification will be critical here, and the company, in earlier reports, stated the intent to get EASA certified to current standards by 2024. When now speaking to Reuters in New York, Fitzpatrick confirmed they were “on the programme for the end of 2024; we are giving ourselves a window of 2024-2025.” He added he was also banking on support by experienced partners Honeywell and Rolls Royce.

In an older report from 2018, the executive also said they would rely on pilots, making certification easier. Unlike most of its counterparts which rely on autonomous electric aircraft from the outset, Vertical Aerospace believes it can sidestep regulatory and safety issues by piloting the vertical take-offs on board. Whereas this remains unconfirmed, the company recently appointed Justin Paines as its Chief Test Pilots.

0 Comments