Chevron announces plans to enter U.S. lithium market

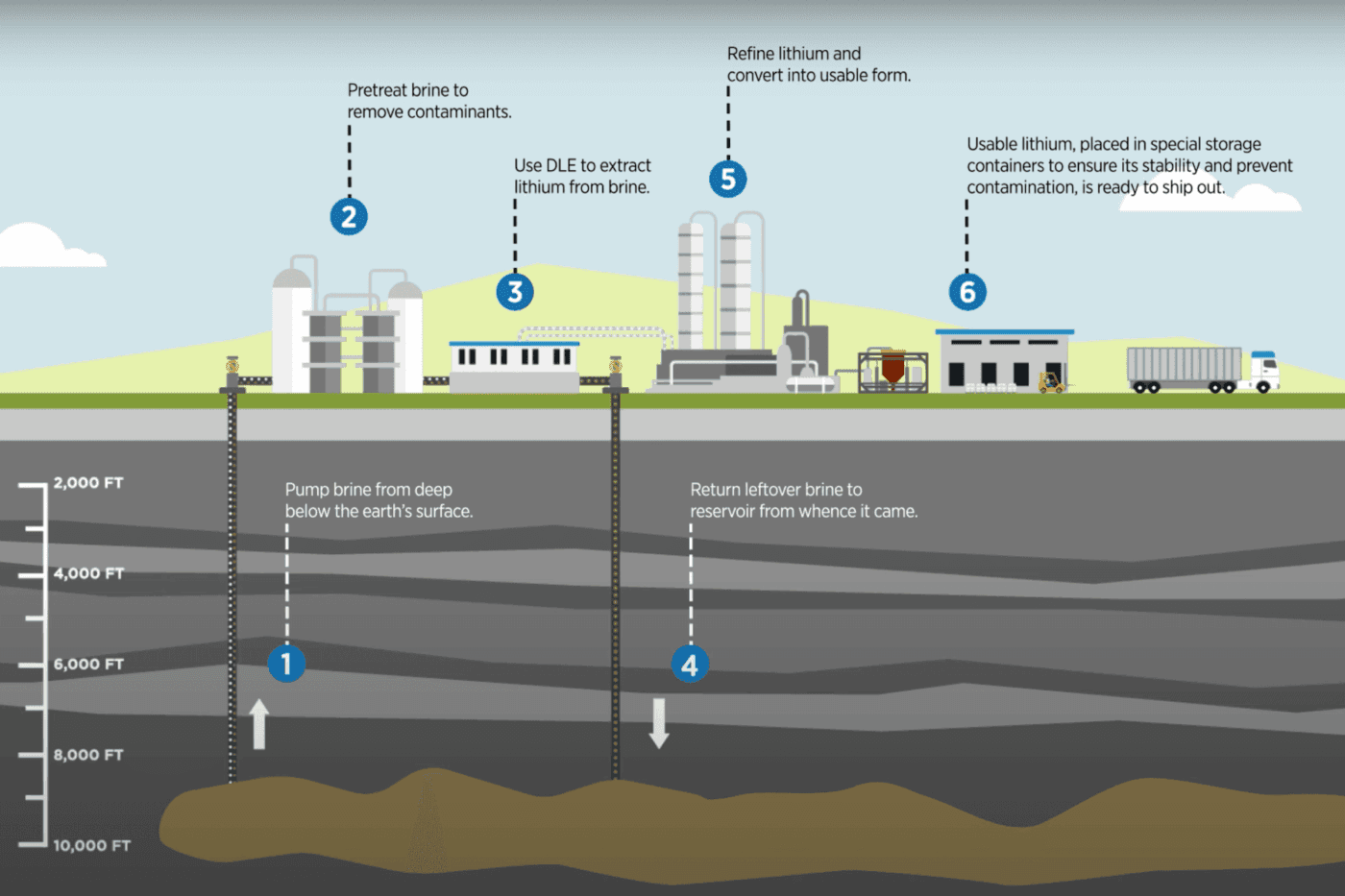

To launch its entry into the lithium business, Chevron acquired the mining rights for two locations, including one from TerraVolta Resources, which is supported by the investment company The Energy & Minerals Group, and another from East Texas Natural Resources (ETNR). The energy company plans to employ a direct lithium extraction process there.

With these two sites, Chevron has effectively secured about 125,000 net acres of land in Northeast Texas and Southwest Arkansas. This corresponds to approximately 50,000 hectares or 70,000 football fields. Both regions include parts of the Smackover Formation, a geological formation known for its high lithium content.

The German chemicals group Lanxess is already planning lithium production in the region together with Standard Lithium from Canada. In 2023, Chevron rival ExxonMobil declared that it wants to mine lithium in Arkansas from 2027 and has started test drilling. Most recently, a study by the U.S. Geological Survey (USGS) revealed that there are between 5 and 19 million tonnes of lithium reserves under southwest Arkansas alone, which would cover a large part of the world’s demand for lithium for electric car batteries.

“This acquisition represents a strategic investment to support energy manufacturing and expand U.S.-based critical mineral supplies,” said Jeff Gustavson, President of Chevron New Energies, emphasising the strategic importance of the move. He added: “Establishing domestic and resilient lithium supply chains is essential not only to maintaining U.S. energy leadership but also to meeting the growing demand from customers. This opportunity builds on many of Chevron’s strengths including subsurface resource development and value chain integration.”

Chevron sees the lithium sector as a natural next step in the expansion of its energy portfolio. The company is contributing its decades of experience in the fields of geology, drilling technology and resource extraction. In the medium term, lithium production is expected to grow into a new business segment that also supports the energy transition.

Chevron is around two years behind its rival ExxonMobil, which acquired its first lithium mining rights in 2023 and has already found two customers for the lithium in Korean battery manufacturers SK On and LG Chem. Despite the head start, ExxonMobil has not yet started commercial lithium production either, however. Instead, the German ExxonMobil subsidiary Esso received authorisation from the state of Lower Saxony in December to search for lithium there.

0 Comments