BEV growth slows in July as UK market awaits clarity on Electric Car Grant

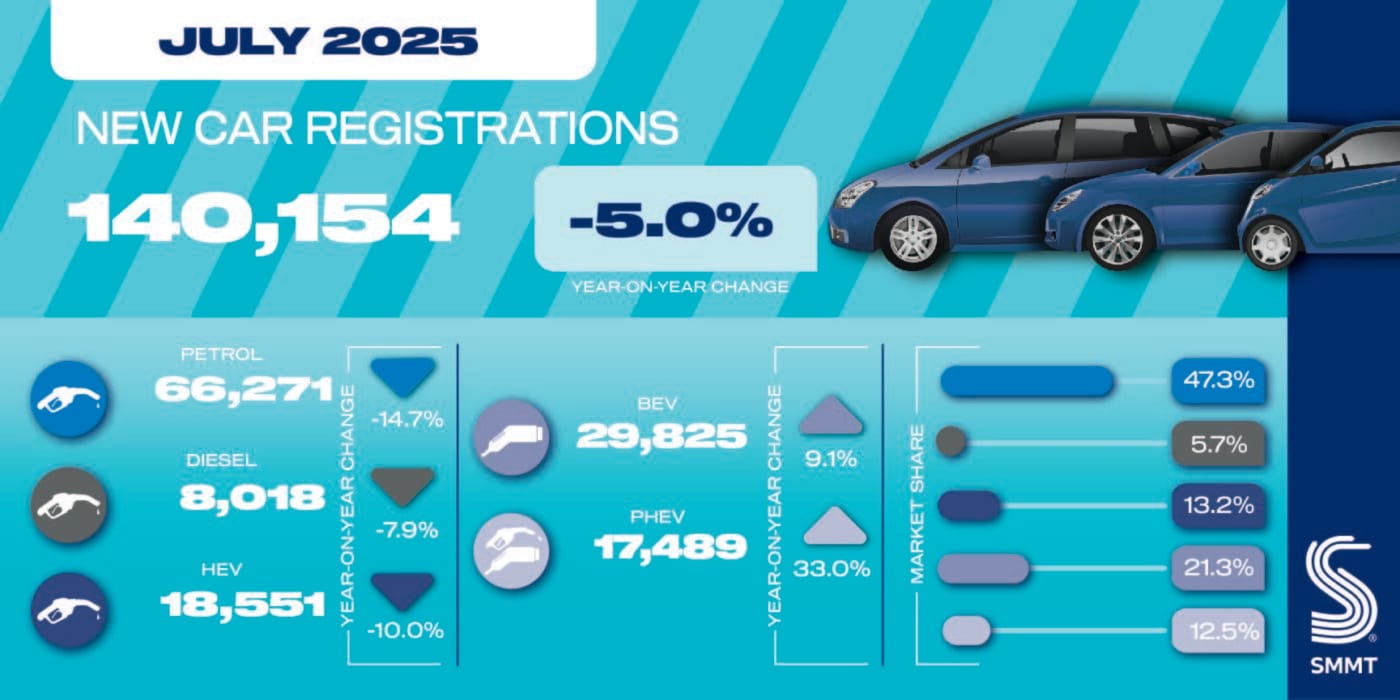

BEV rose to 29,825 units last month, according to the latest data from the Society of Motor Manufacturers and Traders (SMMT). Although battery-electric vehicles gained market share, rising to 21.3% from 18.5% in July 2024, the growth rate marks a significant slowdown compared to the 34.6% uplift recorded across the first half of the year.

July was the second weakest month for BEV growth in 2025 so far, following April’s distorted results due to the introduction of the Vehicle Excise Duty Expensive Car Supplement (VED ECS). The slower growth comes amid uncertainty surrounding the recently announced Electric Car Grant (ECG), which offers up to £3,750 off eligible electric vehicles. With no official list of qualifying models released, potential buyers have delayed purchases pending confirmation.

To bridge the gap, or to ensure they remain competitive if they do not qualify for subsidies under the ECG, some carmakers have introduced their own grants. We have compiled a list of what manufacturers offer UK customers, and will keep the list updated.

The SMMT emphasises that ECG is viewed by industry stakeholders as essential to sustaining BEV demand, particularly in the private buyer segment, where uptake continues to lag. Without full clarity on the scheme, BEV registrations risk falling short of the 28% market share required by the Zero Emission Vehicle (ZEV) Mandate for 2025. July’s share of 21.3% highlights the current shortfall and underscores the urgency of policy alignment.

“July’s dip shows yet again the new car market’s sensitivity to external factors, and the pressing need for consumer certainty,” said Mike Hawes, Chief Executive of the SMMT. “Confirming which models qualify for the new EV grant, alongside compelling manufacturer discounts on a huge choice of exciting new vehicles, should send a strong signal to buyers that now is the time to switch.”

In addition to grant uncertainty, the sector faces fiscal headwinds. The ECS, which applies an additional tax burden on new BEVs with a list price above £40,000, is projected to cost consumers over £360 million in 2025 alone. Industry voices have repeatedly warned that such measures run counter to the government’s stated ambition to make the UK a global leader in zero-emission mobility.

Despite the challenges, BEV uptake remains robust in absolute terms. Year-to-date registrations have surpassed 250,000 units, contributing to a 2.4% overall market increase to 1.18 million vehicles. The SMMT has revised its full-year forecast upward to 1.9 million units, with BEVs expected to take a 23.8% share by December, still below the mandated target.

0 Comments