ACEA statistics: Electric trucks slow to start while buses surge ahead

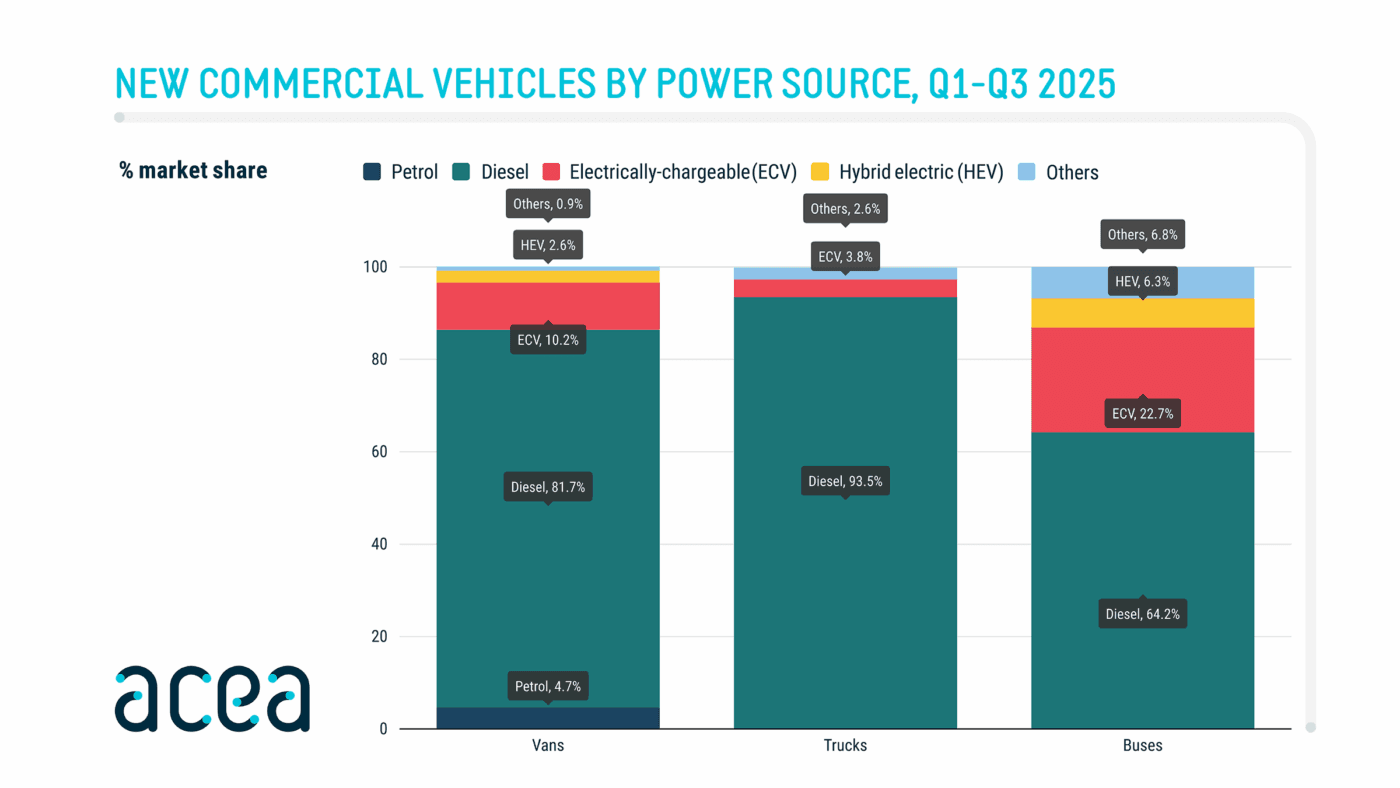

Quarter by quarter, the European Automobile Manufacturers’ Association (ACEA) tracks developments across the EU and wider European commercial vehicle markets. For the first nine months of 2025 (Q1–Q3), the association reports a 9.8% year-on-year decline in overall truck registrations, while bus registrations increased by 3.6%. Fossil-fuelled vehicles continue to lose ground, as electric trucks and buses gain traction—although in the truck sector, the rise in battery-electric models has yet to offset the losses among combustion vehicles.

Progress is evident, however: battery-electric trucks achieved a market share of 3.8% after three quarters, compared with 2.1% a year earlier. Including EFTA countries (Iceland, Liechtenstein, Norway and Switzerland) and the United Kingdom, the share rises to 4.4%. The bus market is much further advanced, with electric buses now accounting for 22.7% of all EU registrations. When including the EFTA region and the UK, the share climbs to 24.8%—meaning one in every four new buses in Europe is electric.

Before examining the country rankings, ACEA’s definitions are worth noting: in the truck category, the association distinguishes between medium-duty vehicles (3.5–16 tonnes) and heavy-duty trucks (16 tonnes and above). Anything below 3.5 tonnes falls under the van segment, which is not included here. For buses, ACEA counts all passenger transport vehicles over 3.5 tonnes and groups battery-electric and plug-in hybrid models together as “electrically chargeable vehicles.”

Between January and September, ACEA recorded 225,483 new trucks over 3.5 tonnes in the EU—a drop of 9.8% compared with the same period last year. Heavy-duty truck registrations fell by 9%, while medium-duty models saw a sharper decline of 13.5%. All major markets weakened, with Germany (-17.9%) and France (-13.4%) seeing double-digit decreases. Diesel vehicles still dominate, accounting for 93.5% of EU truck registrations, while electric trucks between 3.5 and 44 tonnes reached a 3.8% share.

In the medium-duty segment (3.5–16 tonnes), the electric share already stands at 14.1%. A total of 5,384 electrically chargeable trucks were registered in the EU from January to September (+90% year-on-year), with Germany accounting for nearly half of them (2,260 units). However, growth in Germany (40%) lagged behind the EU average. The Netherlands (853 units, +736%), Sweden (422 units, +817%) and Italy (456 units, +210%) recorded the strongest growth. France added 522 units (+15%), while Denmark reached 301 (+117%). Outside the EU, the UK followed closely behind Germany with 1,909 electric trucks up to 16 tonnes (+54%).

The heavy-duty category (16 tonnes and above) represents the bulk of EU truck registrations. Out of roughly 187,300 total registrations, around 3,200 were electric, giving the segment a 1.7% market share. Germany again led with 900 units (+19%), meaning roughly one in three heavy-duty electric trucks in the EU was registered there. France (568 units, +41%) and the Netherlands (556 units, +46%) also outperformed the EU’s average growth rate of +35%. The UK was less dynamic in this segment, with 295 units (+26%).

Notably, ACEA reports that Cyprus is now the only EU country without any heavy-duty electric truck registrations. All other EU and EFTA nations have introduced at least a few, showing that hesitation around electric heavy trucks is waning.

Switzerland stands out in particular. Between January and September, the country registered 614 electric trucks above 3.5 tonnes (+72%), reaching an electric share of 18.9%. That means nearly one in five new trucks sold in Switzerland was battery-electric—the highest proportion in Europe. Most of these were heavy-duty trucks (373 units, +76%).

The Netherlands followed with an electric truck share of 16.8% (1,409 units, +192%), while Belgium (+138%), Italy (+192%) and Sweden (+139%) also posted significant growth. Together with leading markets such as Germany, France, the Netherlands and the UK, these countries are driving the shift to zero-emission freight.

Turning to the European bus market, electric vehicles are already well established. Of the 28,417 new buses registered in the EU (+3.6%), 6,444 were rechargeable, representing a 22.7% market share—up from 15.9% in the same period last year. The EU’s electric bus market grew by an average of 49%, led by Germany (1,202 units, +108%), followed by Sweden (+684%) and Belgium (+389%). Other strong performers include Romania (455 units, +62%) and Lithuania (143 units, +170%).

Electric buses are also replacing hybrid models, with hybrid bus registrations in the EU falling by 32.7%, reducing their market share to 6.3%. Diesel buses, meanwhile, have remained stable and now account for 64.2% of total EU bus registrations.

Compared with the electric truck market, the electric bus sector shows a more uniform distribution across Europe. Fifteen of the 27 EU member states recorded three- or four-digit registration figures for electric buses after the first three quarters of the year, led by Germany (1,202 units, +108%), Italy (912, +83%) and Sweden (698, +684%). On a pan-European scale, the UK remains the clear leader, with 2,117 new electric buses registered since the start of the year (+50%). The UK’s strong performance has been instrumental in pushing the overall share of electric buses across the EU, EFTA and UK markets to a record 24.8%.

This article was first published by Cora Werwitzke for electrive’s German edition.

0 Comments