CATL to sharpen focus on sodium-ion batteries

One of the key reasons for the increased focus on sodium-ion batteries is the sharp rise in lithium prices, which is driving up the cost of current lithium-ion batteries. Chinese outlets report that, at a conference in Ningde with its suppliers, CATL has now made it clear that sodium-ion and lithium-ion batteries will form a new ‘Dual-Star’ trend in the future.

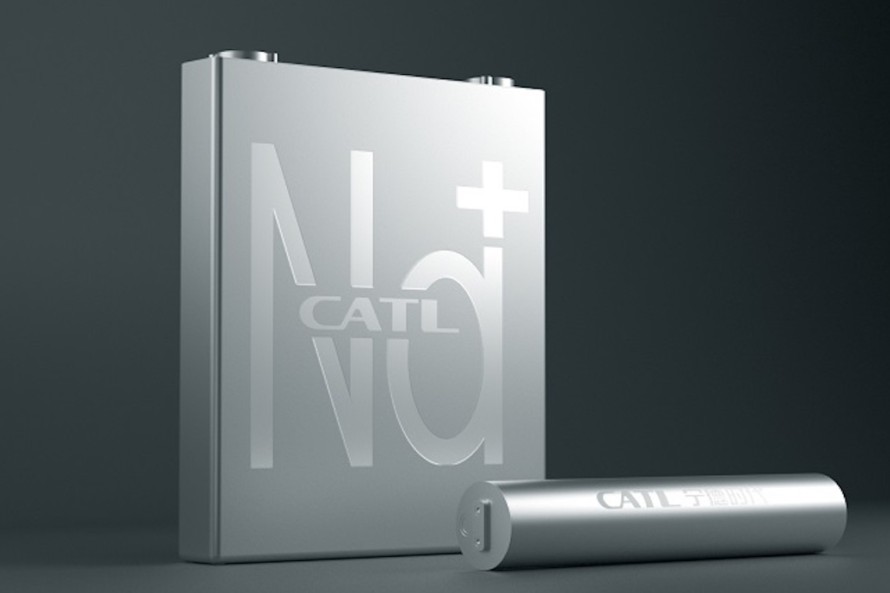

CATL was one of the first battery manufacturers to introduce its own sodium-ion battery in mid-2021. The first generation reportedly achieved an energy density of 160 Wh/kg. In 2024, a further generation with 200 Wh/kg was announced. For comparison: lithium-ion batteries with liquid electrolyte are limited to around 350 Wh/kg. In April 2025, CATL introduced its new sodium-ion battery brand Naxtra at its Tech Day and has since been marketing the so-called Naxtra battery for passenger cars with an energy density of up to 175 Wh/kg.

Sodium-ion batteries are increasingly being highlighted as an alternative as lithium prices rise. As the price curve had remained relatively low recently, manufacturers had held back. However, in China, the prices for battery-grade lithium carbonate have surged by over 50 percent in the past three months—reaching more than 110,000 yuan (€14,000 euros) per tonne. This has already led some domestic lithium iron phosphate (LFP) manufacturers to halt production, as customers are apparently unwilling to absorb the cost increases.

2 Comments