Dataforce: Fleets drive growth amid a record year for German EV market

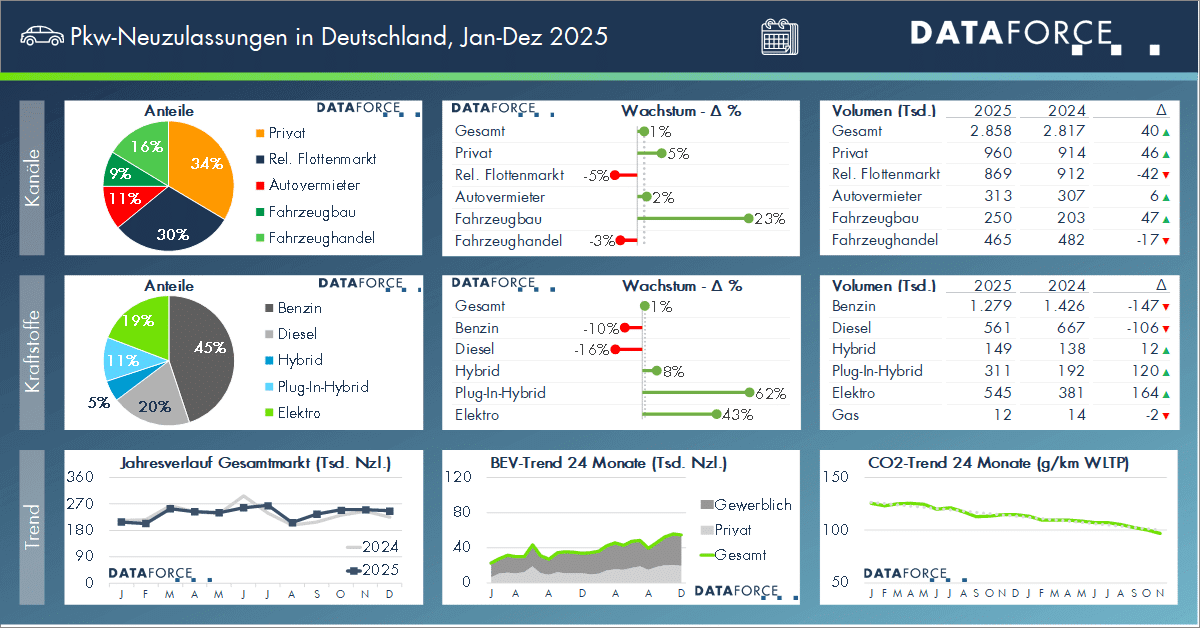

In 2025, the electric car market in Germany grew by a robust 43.2 per cent, according to the recently published annual statistics from the Federal Motor Transport Authority (Kraftfahrt-Bundesamt) – reaching exactly 545,142 new registrations. This marked the highest number of battery-electric vehicles (BEVs) ever to hit German roads, achieving a market share of 19.1 per cent. For comparison: in 2024, the BEV share stood at 13.5 per cent, while in 2023, it had already reached 18.4%. Importantly, the overall passenger car market in Germany remained largely stagnant in 2025, with 2.9 million new cars registered (+1.4 per cent year-on-year).

Dataforce has analysed the German new car market in greater detail and found that the relevant fleet market, with 207,000 BEVs (+38 per cent year-on-year), remains the largest source of demand for electric cars: “Sales reached a new all-time high in the past year.” In November, electric cars even became the most popular drivetrain among fleet customers for the first time. However, over the entire year, the growth of electric cars in fleets remained slightly below the overall BEV market growth of 43.2 per cent.

In contrast, the private market saw a significant recovery in BEV demand, with 195,000 electric car registrations for the year. This represents a 43% increase compared to 2024 – aligning precisely with the overall market growth. However, there is still room for improvement: “In 2022, private individuals purchased 237,000 BEVs with the help of the purchase incentive,” Dataforce notes. Regarding these two channels, the market research institute refers to “genuine demand,” distinguishing it from the often tactical new registrations by manufacturers, car rental companies, and dealers.

Manufacturers record high self-registrations

However, such tactical new registrations also increased in 2025. While Dataforce does not break these down by drivetrain, it notes that for the overall passenger car market, there was a significant rise in self-registrations in vehicle manufacturing (+23%), primarily by manufacturers. Across all drivetrains, tactical registrations (by manufacturers, car rental companies, and dealers) accounted for 36% of all passenger car registrations in Germany (2024: 35%), with the “focus shifting from dealers to manufacturers,” as the market researchers emphasise.

It is evident that the 23% increase in registrations within the manufacturer segment primarily involved electric cars. This is because, particularly in the first quarters of the previous year, BEVs were not as widely accepted in the market as they were produced. However, manufacturers needed these BEVs to meet their CO₂ targets. Calculations show that tactical registrations accounted for 143,000 BEV registrations in 2025.

Looking at the development of other drivetrains, plug-in hybrids showed the greatest dynamism, even ahead of BEVs (+43 per cent year-on-year), with annual growth of 62 per cent. Hybrids increased by 8 per cent, while diesel and petrol vehicles declined by 16 and 10 per cent, respectively. This left only two million internal combustion engine (ICE) vehicles in 2025. “That is half a million fewer than in 2020 and 1.5 million fewer than in 2019,” the Dataforce analysts highlight.

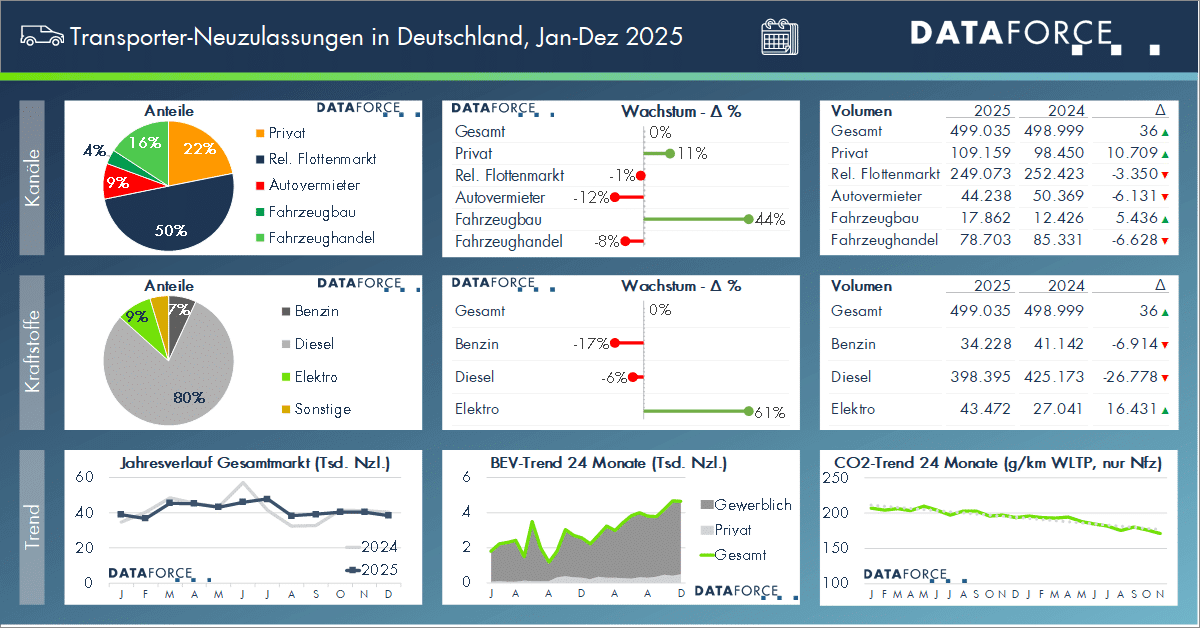

Electric vans surge by 62 per cent

In the van market, 499,035 units were registered in Germany in 2025 – roughly the same as the previous year. However, demand for electric vans climbed by 62 per cent, from 27,041 in 2024 to 43,472 BEVs. “The new registration volume of electric vans increased almost every month. In December, their share stood at 12 per cent, while over the entire year, nine per cent of vans were fully electric,” Dataforce reports. Around two-thirds of electric light commercial vehicles were registered in the fleet market.

The market researchers conclude: “After a weak start to the year, both the passenger car and van markets stabilised by mid-year in Germany and were able to match or even slightly exceed their respective previous year’s results.” Given the ongoing economic stagnation and numerous challenges, this is a positive outcome, according to Dataforce. Furthermore, “Parallel to this, the drivetrain transition continues. The fact that 1.5 million fewer ICE vehicles were sold in Germany within six years, and that this volume continues to decline, is leading to a profound structural change that will keep the industry occupied.”

Looking back at the past year, the passenger car market is now divided as follows: hybrids account for 28.6 per cent of market share, pure petrol vehicles for 27.2 per cent, followed by electric cars (19.1 per cent), diesel vehicles (18.3 per cent), and plug-in hybrids (10.9 per cent). Gas and fuel cell vehicles barely register. The fact that nearly one in five new cars in 2025 featured a purely electric drivetrain is not a given: it speaks volumes for the technology.

First incentive cuts, then stabilisation

Recalling the sudden end to incentives in December 2023, electric car registrations in 2024 initially fell significantly – partly due to pull-forward effects from the previous year-end rally (e.g., 54,654 BEVs in December 2023 compared to 22,464 in January 2024) and the uncertainty caused by the abrupt termination of subsidies at the end of 2023. Demand stabilised in the second half of the year, settling at roughly 35,000 BEV units per month.

The first quarter of 2025 was also notably weaker compared to the rest of the year. Growth only picked up from March onwards, before the holiday month of August caused an expected dip. In September, electric car registrations rose again significantly. In October, the Federal Motor Transport Authority (KBA) reported the highest number of new electric passenger cars in a single month since the end of the environmental bonus in 2023. In November, the figures increased once more. Even December saw strong results with 54,774 BEV registrations, though slightly below November’s figures. This could be partly due to December having significantly fewer working days due to holidays. However, the announced purchase incentive, which may have placed potential electric car buyers in a waiting position, likely also played a role.

Meanwhile, plug-in hybrids are also in high demand again, after their market collapsed by half in 2023. This was because subsidies for plug-in hybrids ended earlier than those for BEVs. In 2024, their sales gradually stabilised, and in 2025, demand surged once again.

Manufacturers with high numbers of own registrations

However, such tactical new registrations also increased in 2025, especially among manufacturers. They registered around 64,000 electric cars themselves in 2025 (+68 per cent YoY) – as did car rental companies (around 20,000 electric cars, +63 per cent YoY), a disproportionately high figure that added a few extra percentage points to the German electric car market. Less so, incidentally, was the vehicle trade, with 59,500 electric car registrations in 2025, which corresponds to ‘only’ a 36 per cent increase compared to 2024. In total, tactical registrants accounted for just under 144,000 BEV registrations in 2025, with ‘the focus shifting from dealers to manufacturers,’ as market researchers emphasise.

From the manufacturers’ point of view, it is logical that vehicle manufacturers in particular are primarily registering electric cars. This is because, especially in the first quarters of last year, these were not yet as widely accepted in the market as they were rolling off the production line. However, manufacturers needed BEVs to meet their CO2 targets. While manufacturers’ own registrations of BEVs rose by the aforementioned 68 per cent, they climbed by 23 per cent across all drive types, which is also a very large increase compared to the other channels.

dataforce.de (in German)

0 Comments