Nikola becomes Nikola Corporation via VectoIQ merger

Nikola, the US maker of heavy-duty trucks with batteries and hydrogen fuel cells has become a Nasdaq listed company. The quick entry to the stock market was made possible via a merger with the already listed company VectoIQ Acquisition Corporation.

After completion of the merger in the second quarter of 2020, the new company will be called Nikola Corporation and will trade on the Nasdaq under the ticker symbol NKLA, Nikola Motor said in a press release. The merged company will thus be worth 3.3 billion dollars.

The deal includes a private placement of ordinary shares in the amount of 525 million dollars. The shares will be placed primarily with institutional investors but Nikola’s existing shareholders will remain the majority shareholders of the merged company.

Trevor Milton, Nikola’s founder and CEO told Forbes that the listing and additional fundraising should end up raising about $1 billion for Nikola. Milton indicated that the motivation for merging and getting shares on Nasdaq through VectoIQ was about speed. He estimates that Nikola saved at least six months compared to a conventional public listing.

“The additional capital from blue-chip investors is a sign investors believe in the future of our business,” Forbes quotes Milton from a conference call. “I founded the company to completely disrupt the energy and transportation market.” It seems the move is also advantageous for Nikola, because, says Milton, “…the market has never been stronger and they’ve never rewarded companies like ours more than now.” He confirmed, “It was really important that we hit the market fast.”

CEO of VectoIQ Stephen Girsky, himself a formerly Vice President General Motors, said: “In our two-year search for a partner who proved to be a technology leader and focused on making a global difference, Nikola was the clear winner.” Nikola will add Girsky to its Board of Directors.

According to Nikola, the proceeds from the IPO will be used to advance the construction of the plant in Coolidge in the US state of Arizona and thus accelerate its production project. Nikola expects to generate revenue by 2021 with the rollout of its BEV truck, with FCEV truck sales starting shortly after in 2023. Nikola says that it intends an initial build-out of hydrogen fueling stations to serve their customers’ fleets, citing Anheuser-Busch as such an example.

Nikola says that it has more than 14,000 pre-orders representing more than $10 billion in potential revenue and two-and-a-half years of production. In addition to the planned factory in Arizona, Nikola will also manufacture in Germany.

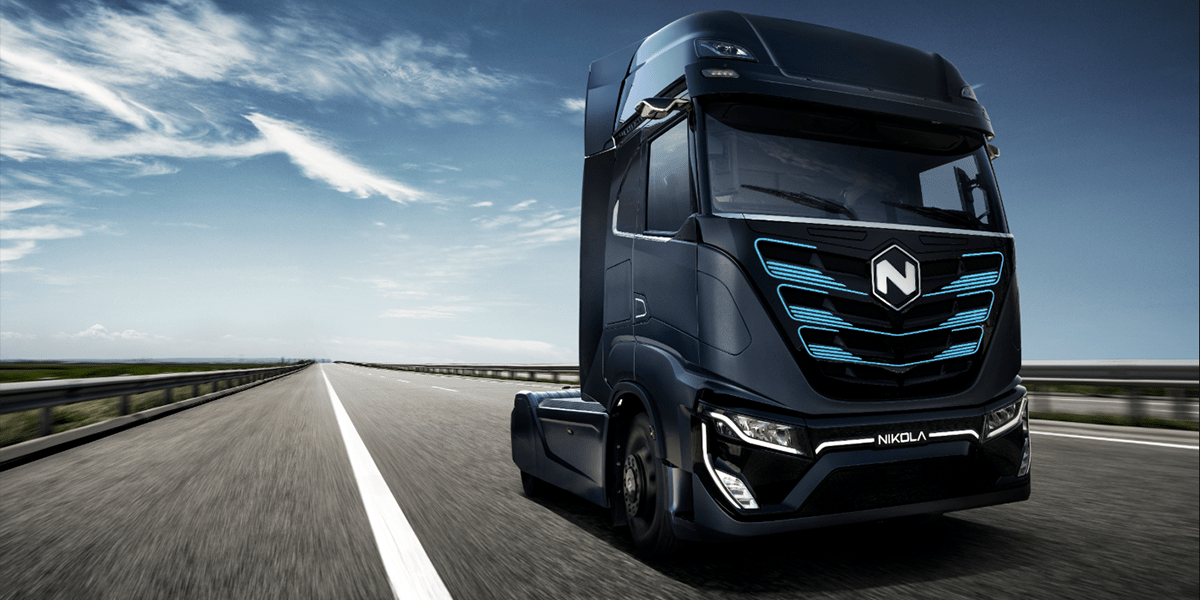

In Europe with Iveco, a subsidiary of Nikola shareholders CNH Industrial, the Nikola Tre battery-electric heavy-duty truck will be built in Ulm, Germany from 2021 onwards. Following the models with a battery-electric drive, the Tre will also be released with fuel cell from 2023 onwards. Just last month, Bosch gave an update on the series production of fuel cell systems for trucks, confirming that Nikola will use Bosch fuel cell systems.

3 Comments