Vulcan Energy mobilises €2.2 billion for lithium extraction in Germany

The German-Australian company has announced the signing of a deal worth €2.193 billion to fully finance the construction and development of the first phase of its lithium extraction project. Investors include private, institutional, and public sector stakeholders. The recently established Raw Materials Fund of the German government alone is investing up to €150 million in the project, marking the first initiative to receive funding from this new fund. Additionally, the Australian government’s export credit agency, Export Finance Australia (EFA), has committed €120 million at an early stage.

Vulcan aims to extract lithium from geothermal brine as part of its Lionheart project, creating a local source of sustainable lithium for Europe. Vulcan’s combined geothermal and lithium resource is the largest in Europe, with its licence areas focused on the Upper Rhine Valley in Germany. In February 2023, Vulcan published the results of a definitive feasibility study for the first phase of its lithium project. This study confirmed plans to produce 24,000 tonnes of lithium hydroxide monohydrate (LHM) annually. This production target remains unchanged and will be achieved with the newly secured financing. The volume is expected to “suffice for the production of approximately 500,000 batteries for electric vehicles per year,” Vulcan recently stated.

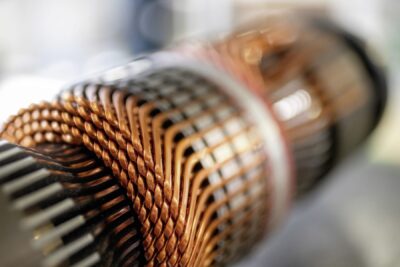

The battery-grade lithium is produced through a multi-stage process from lithium chloride, with extraction taking place in Landau and processing in Frankfurt-Höchst. Vulcan already operates pilot plants at both locations, which will now serve as 1:50 scale models for the construction of the full-scale commercial facilities. The company received building permits for both large-scale facilities in September and November. However, construction could only commence once the financing was secured. Meanwhile, the Ministry of Economic Affairs stated that “construction work is already underway,” and the company aims to start commercial production two and a half years after the start of construction—i.e., in 2028.

Buyers for the lithium from the first project phase have already been confirmed. Supply contracts are in place with Umicore, LG Energy Solution, Stellantis, and Glencore. LG Energy Solution is set to receive 31,000 tonnes of LHM over six years. Umicore has secured 23,000 tonnes over the same period. Stellantis is guaranteed 128,000 tonnes of LHM over ten years. Glencore will receive between 36,000 and 44,000 tonnes over eight years.

Regarding the financing details, Vulcan specified that the project receives financial support not only from Australian and German investors but also from the European Investment Bank (€250 million loan), Export Development Canada, the Danish Export and Investment Fund, Bpifrance Assurance Export, and Servizi Assicurativi del Commercio Estero (SACE). The company provided the following breakdown of the financing components:

- €1.185 billion in senior debt facilities from a consortium of 13 financiers, comprising the European Investment Bank, five export credit agencies, and seven commercial banks. This amount includes the €120 million loan from Export Finance Australia.

- €204 million in federal funds from the German government, including commitments announced in the summer.

- €150 million equity investment from the KfW Raw Materials Fund (“KfW”) in Vulcan Energie Ressourcen GmbH to acquire a 14% stake in this subsidiary.

- €133 million investment from a consortium of strategic investors, including Siemens, Demeter, and Hochtief, to acquire a 15% preferred equity stake in the project company VER GEO LIO GmbH (the project company for Vulcan’s Phase One).

- €528 million in guaranteed proceeds from a Vulcan capital increase at €2.24 per share.

The significance of the project is underscored by Katherina Reiche (CDU), German Federal Minister for Economic Affairs and Energy: “With the first project from the German Raw Materials Fund, Germany and Australia are sending a strong signal for a more resilient and strategic raw materials supply. Australia contributes reliable resources and technological expertise, while Germany provides its industrial innovation capabilities. Projects like Vulcan Energy’s in the Upper Rhine Valley deepen our collaboration and create a more strategic and diversified partnership. This reduces critical dependencies. Both countries are ideal partners for this—this launch demonstrates that we are serious.”

handelsblatt.com, eqs-news.com, bundeswirtschaftsministerium.de (all in German), eib.org

This article was first published by Cora Werwitzke for electrive’s German edition.

1 Comment