BorgWarner concludes Delphi takeover

BorgWarner has completed the acquisition of Delphi Technologies. The US-American automotive supplier wants to use the acquired know-how in electronics and power electronics to become one of the leading companies for electric drive systems.

When the takeover was announced in January 2020, BorgWarner was quite clear about the primary goal of acquiring its competitor’s know-how. Although BorgWarner clearly wants to be better equipped for the change to electric drives, the automotive supplier is still very much anchored in the world of combustion engines. BorgWarner’s intent to increase capacities and expand their electronics and power electronics divisions is clear in their public announcement that the takeover of Delphi has been completed.

Delphi shareholders had already agreed to the deal in advance, and official approval procedures were also granted under specific conditions. These include, among other things, specifications for Delphi Technologies’ debt burden. With the closing of the takeover, Delphi will no longer be traded on the New York Stock Exchange (NYSE).

“Through this combination, BorgWarner is even better positioned with a more comprehensive portfolio of industry-leading propulsion products and systems across combustion, hybrid and electric vehicles,” said Frédéric Lissalde, President and CEO of BorgWarner upon announcing the conclusion of the takeover. “We expect that the combination will also strengthen our commercial vehicle and aftermarket businesses.”

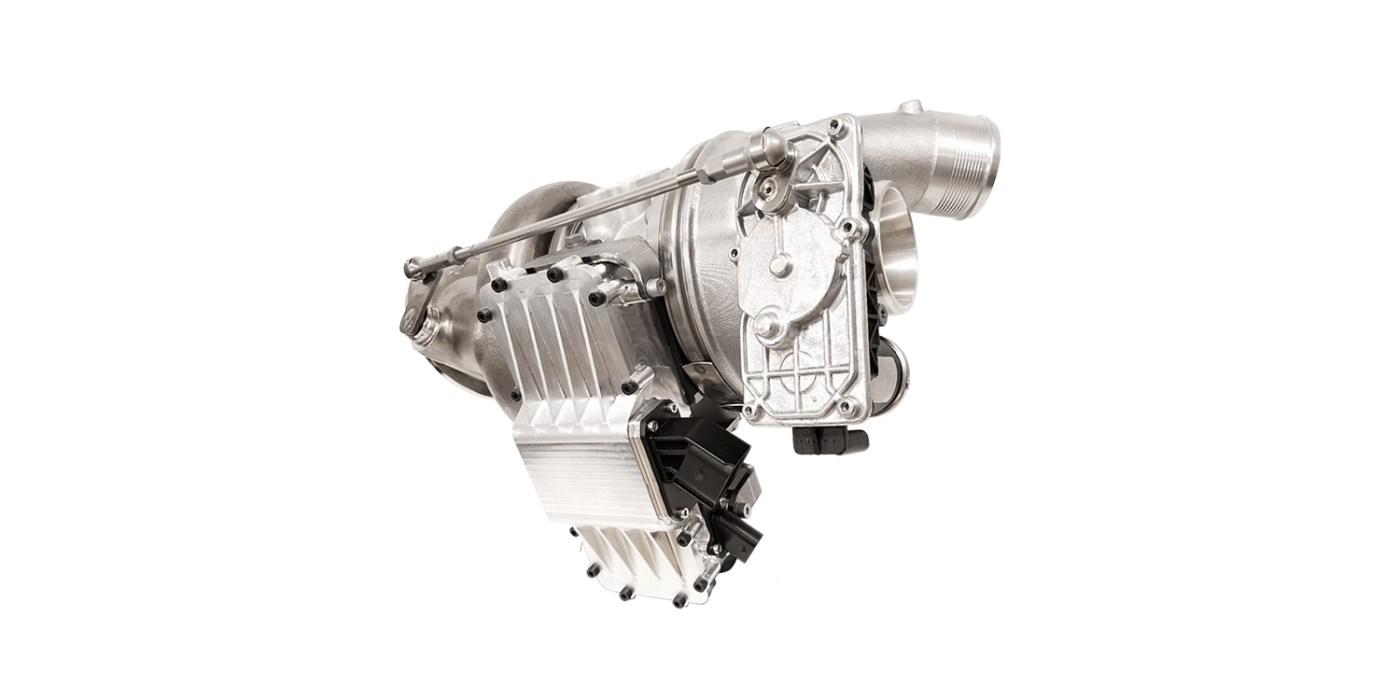

Delphi Technologies brings significant expertise including “industry-leading power electronics technology and talent, with an established production, supply and customer base,” announces BorgWarner. The combined company will be able to offer standalone and integrated solutions to its power electronics customers. This includes high-voltage inverters, converters, on-board chargers, battery management systems and software as well as other solutions in the areas of system integration and thermal management.

Together with the announced, but not precisely quantified, additional capacities, BorgWarner says it is aiming to become one of the leading companies for electric drive systems.

Delphi itself emerged from the supplier business of General Motors in 1999. In 2017, the company will be split up; the Delphi Technologies division will concentrate on drive technologies, while the spin-off company Aptiv will focus on vehicle electronics, networking and autonomous driving. Aptiv is not affected by the takeover.

When the takeover was initially announced in January, Delphi was valued at 3.3 billion dollars in the deal. Now that the deal is closed, current BorgWarner shareholders will hold 84 per cent of the shares, while Delphi shareholders will hold 16 per cent.

0 Comments