Mercedes increases Aston Martin shares

Mercedes-Benz has announced that it will significantly increase its stake in the struggling British manufacturer Aston Martin Lagonda from what is currently 2.6 per cent to a maximum of 20 per cent. In return, the British company is to receive hybrid and electric drive trains from Mercedes.

The increase in shares is to take place gradually, which is why the two companies have chosen the wording “up to 20 per cent,” saying: Over the next three years, Mercedes-Benz will receive newly issued shares in Aston Martin up to a total value of 286 million pounds, or 315 million euros at the current exchange rate. If the British sports car manufacturer were to issue further shares in the meantime that go beyond the Mercedes deal, the Stuttgart company’s share could end up at less than 20 per cent.

Mercedes states in its announcement that it does not want to increase its shareholding beyond that. Mercedes-Benz AG will also not transfer money for the shares to Gaydon. The only consideration is the supply of various technologies.

Under the new agreement, Mercedes-Benz will also grant Aston Martin access to a number of its technologies, including “next-generation hybrid and electric powertrains”. Exactly which powertrains are to be involved – i.e. only full hybrids or also plug-in hybrids or even the electric powertrains from the upcoming Mercedes EQS – will not be mentioned in the notifications. In addition, every new Aston Martin is to be based on a Mercedes electronics architecture by 2027.

Although the cooperation between Aston Martin and Mercedes has been in place since 2013, the Stuttgart-based company supplies the British company with V8 engines from the performance subsidiary AMG and infotainment components, among other things. Nevertheless, the new agreement also raises some questions.

It was only in the spring that the struggling carmaker was taken over by a consortium led by Canadian billionaire Lawrence Stroll, in which Mercedes motorsport boss Toto Wolff had also joined Aston Martin as a private investor. In the summer, the then head of AMG, Tobias Moers, was also appointed CEO of Aston Martin.

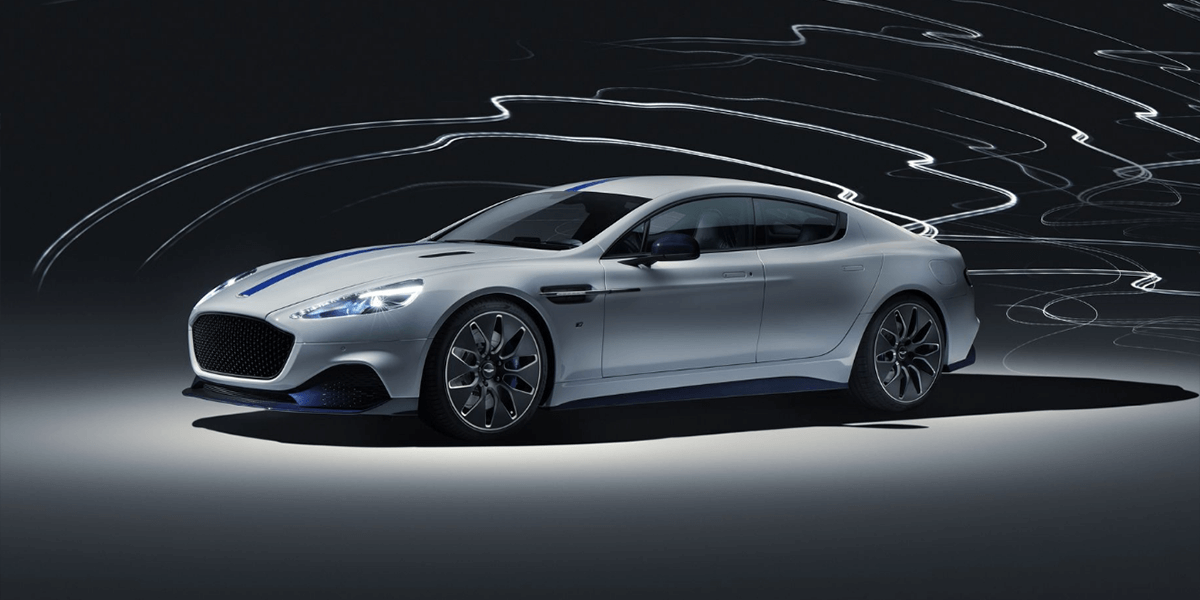

In the same press release announcing Stroll’s entry, Aston Martin confirmed that the completed Rapide-E would not be launched and that the launch of the Lagonda electric car brand announced in 2018 would be postponed from 2022 to 2025 at the earliest. Instead of the sports coupes with V8 engines from AMG, the new strategy focused on sports cars with mid-engines. For this purpose, a separate V6 gasoline engine “with hybrid capabilities” was to be developed. In March, the company then provided initial details of the V6 hybrid engines.

In a telephone conference following the announcement of the Mercedes deal, Aston Martin CEO Moers said that Aston Martin did not want to use entire Mercedes platforms, “but rather to combine components such as engines or batteries to create its own platforms, so to speak”. The company wants to keep its own V12 gasoline engine and can, within the framework of agreements with the AMG-V8, “develop tailor-made solutions for its own needs”. Regarding the V6 hybrid motor systems, Moers said that “work will continue on it, but now there are alternatives”. In view of the last half-sentence, the future of this engine seems questionable.

Aston Martin went public in 2018, at a price of 1900 pence per share at the time. In the meantime, the price has fallen to just 55 pence, and sales have fallen over the years to just 5,809 vehicles in 2019. Aston Martin is now hoping for better sales of the brand’s first SUV, the DBX. But the development of the model was expensive.

Nevertheless, the management team around Stroll as Executive Chairman and Moers as CEO have ambitious plans: By 2025, revenue is expected to increase to £2 billion and adjusted EBITDA to £500 million. The Mercedes deal should also help in this respect, as Aston Martin will be able to save development costs, for example in the area of electronic architecture with the Mercedes components.

During the telephone conference, Moers is said to have explained that the product plan has been completely revised. From 2023, numerous new models based on the Mercedes deal are to be launched, including the brand’s first plug-in hybrid. “In all probability” this drive system is to be used in an SUV – possibly in the DBX. By 2024, the brand plans to sell 10,000 cars per year, with a PHEV share of “20 to 30 per cent”. If PHEVs are only used in SUV models, their share of total sales will be at least as high. The “AMS” does not make any statements in the article about the launch of a possible all-electric model.

With reporting by Sebastian Schaal, Germany.

autocar.co.uk, carscoops.com, daimler.com, astonmartin.com, auto-motor-und-sport.de (in German)

0 Comments