US parties agree on slimmed down infrastructure package

In the USA, Democrats and Republicans have now agreed on details of the infrastructure package presented by US President Joe Biden after long negotiations. Biden had to make some concessions to his original plan, also in the area of e-mobility.

++ This article has been updated. Kindly continue reading below. ++

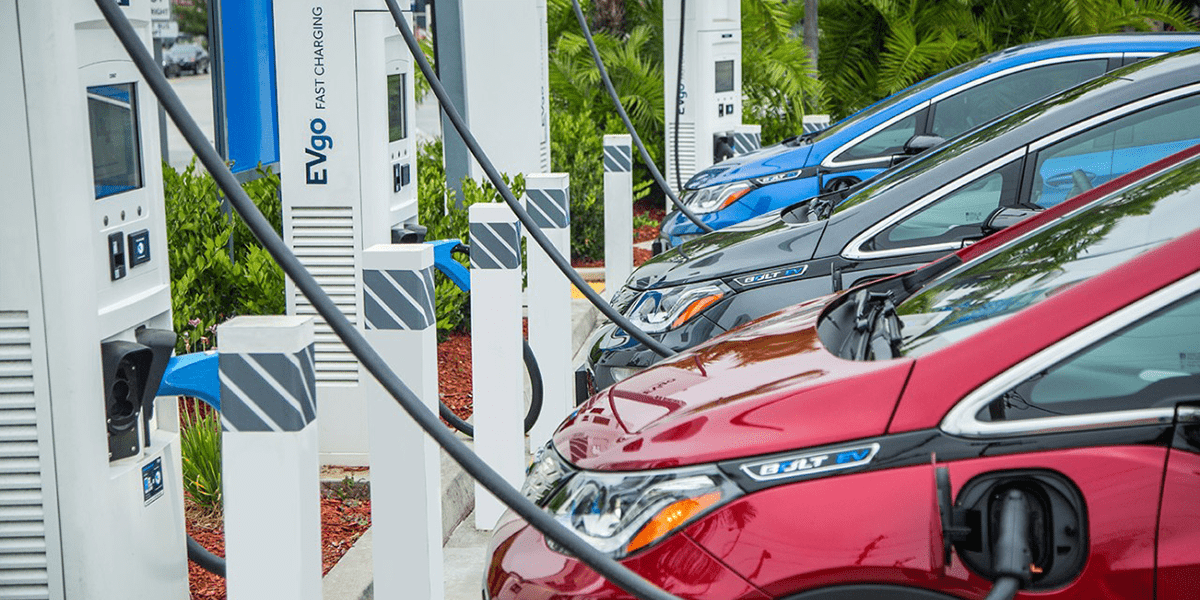

For the construction of a national network with 500,000 charging stations for electric vehicles, the compromise that has been reached leaves 7.5 billion dollars of the 15 billion dollars that Biden had announced. For the purchase of electric school and public transport buses, the bipartisan draft now also provides 7.5 billion – instead of the previously mentioned 45 billion dollars. The reform of tax incentives for electric vehicles is still sought by the Democrats, but is not part of the infrastructure package, but of the tax legislation.

The US president had presented a two-trillion-dollar investment plan at the beginning of April, which included funds amounting to 174 billion dollars to push electric mobility. Specifically, the bill proposed $100 billion for purchase incentives including tax credits for electric cars, said $15 billion for charging infrastructure, $20 billion for electric school buses, $25 billion for electric public transport buses and $14 billion for other tax breaks. However, it was clear from the start that these sums would not be so lavish after the plan went through the legislative process under Republican influence. In its current form, the chances are now good that the bill will be passed in the Senate.

The question of the future design of tax incentives for electric vehicles remains exciting. The US Senate Finance Committee recently approved a bill to increase the tax credit for electric vehicles assembled by union workers in the US up to $12,500. This would apply to e-vehicles up to a price of $80,000.

However, the Senate Finance Committee vote is only one stage in the legislative process. The “Clean Energy for America” bill still has to be submitted to the full Senate and the US House of Representatives for a vote.

Currently, the maximum tax credit for electric vehicles in the United States is US$7,500. This amount is not tied to any model price cap, but expires once automakers reach the 200,000 electric vehicle sales limit – which has long been the case for General Motors and Tesla. The new law would remove this existing cap, but a different, future limit is included in the proposal: The tax credit is to be phased out over a period of three years as soon as 50 per cent of car sales in the USA are electric cars.

Update 11 August 2021

US President Joe Biden’s infrastructure plan has now been passed in the Senate. Now the House of Representatives must approve it, but the timetable for this is still unclear.

In the Senate, the Democratic representatives and even some Republicans had voted unanimously in favour of the infrastructure package. The 2,700-page legislative package provides for additional investments of about 550 billion dollars (about 470 billion euros) for the coming years. Including previously budgeted funds, the package comes to around one trillion dollars or 850 billion euros.

Specifically, the bill currently features $7.5 billion in funding to build a network of charging stations across the USA, which the organizers hope will spur EV adoption in the country. Additionally, the bill includes another $7.5 billion to transition buses and other public transportation away from fossil fuels and to emissions-free mobility. Finally, $66 billion are to go to railroad operator Amtrak to fund a backlog of repairs and expand routes across the US.

electrek.co, whitehouse.gov, cnet.com, cnbc.com (both update)

0 Comments