SK Innovation considers going public with battery business

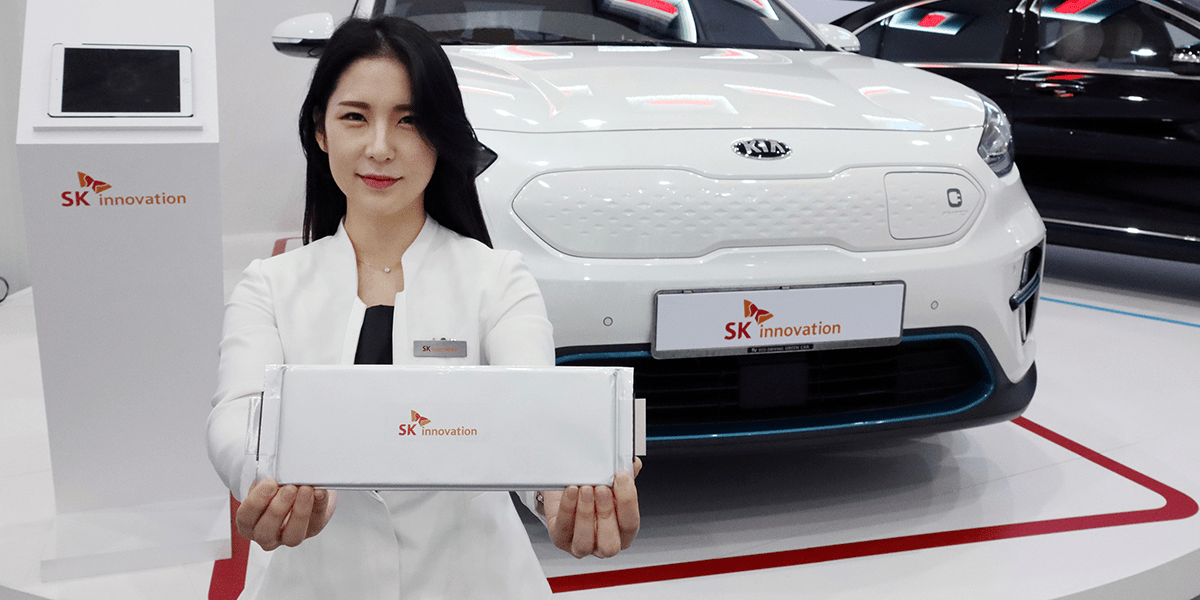

SK Innovation has announced its intention to expand its production capacity to over 500 GWh by 2030. As part of its new strategy ‘From Carbon to Green’, the company, which was founded as an oil refinery, wants to invest heavily in the battery business, possibly also with external investors.

SK Innovation has announced that it will invest a total of 30 million won (equivalent to over 22 billion euros) in green business fields over the next five years, increasing the share of green assets from the current 30 to 70 per cent.

This is to be achieved, among other things, through the expansion of the existing battery business and the production of battery separators. SK also wants to enter the battery recycling business. The expansion of the battery division is also driven by the high order backlog: as SKI reports, it has orders for more than one TWh – i.e. 1,000 GWh. At the same time, the company currently has a production capacity of only 40 GWh per year.

According to SKI, the orders are worth 130 million won, which is equivalent to about 97 billion euros. These batteries should be able to power about 14 million electric cars.

Some projects are already in the planning or construction stage. As SKI stated in February during the presentation of its business figures for 2020, it is expected to have a capacity of 85 GWh by 2023 and 125 GWh by 2025. In May, the establishment of a joint venture with Ford was announced – adding the planned 60 GWh from BlueOvalSK by the middle of the decade results in 185 GWh. In the updated plan, SKI itself states 200 GWh for 2025. By 2030, SKI should then be able to produce over 500 GWh of battery cells.

While the battery division was still making losses in 2020, it should soon be profitable. For 2023, SKI expects an EBITDA of one trillion won (about 750 million euros), for 2025 2.5 trillion won (1.87 billion euros).

External investors could also be brought on board in the form of a partial IPO in order to stem the investments in the expansion. “While the battery business and E&P business at SK Innovation is currently being operated as business divisions, the company is reviewing the possibility of a spin-off of each division to maximize the value of its overall business portfolio, considering the expectations of the relevant stakeholders in a comprehensive manner,” the company wrote.

IPO decision has not fallen yet

Reuters reports that CEO Kim Jun is even considering a dual listing in South Korea and the USA – a pure US IPO is also possible. But apparently nothing has been decided yet. “We haven’t decided how to split the battery business … it takes quite a lot of resources to further grow our growing battery business, so we are considering the spin off as one of the ways to secure resources,” Kim said.

Incidentally, SK Innovation’s shares fell to a three-week low after the announcement. Analysts said SKI would not be as attractive to investors without its battery division with its conventional petrochemicals business.

According to Jee Dong-seob, head of SK Innovation’s battery business, there is no timetable for the possible IPO yet. Instead, Jee gave an outlook on the prospects of the Ford joint venture BlueOvalSK, for which, as mentioned, 60 GWH have been targeted so far by 2025: Bos 2030, the joint venture could produce up to 180 GWh, the manager said.

With reporting by Sebastian Schaal, Germany.

0 Comments