France: New environmental bonus could push out imported EVs

French President Emmanuel Macron already announced in May that he wanted to make state subsidies for electric cars dependent on CO2 emissions during the production of the vehicles and batteries. Now, his government has outlined the first key points.

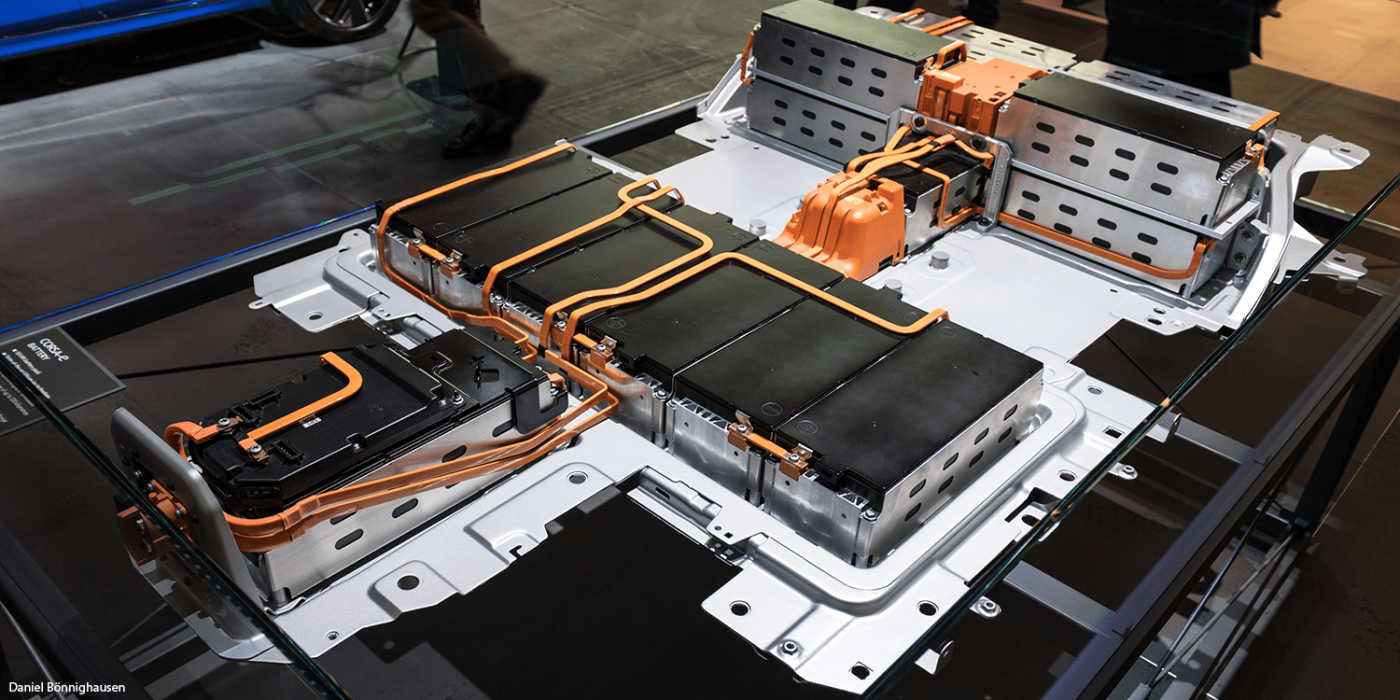

It plans the introduction of a points system based on various environmental criteria, which include the characteristics of the vehicle model itself, e.g. its weight, but also the origin and environmental impact of the materials used (including the battery), as well as the assembly plant’s environmental record and transport routes to the point of sale.

For an electric model to be eligible for the reformed eco-bonus, manufacturers must submit a file with the required information to the Agence de la transition écologique (ADEME) for each vehicle model. These must score at least 60 out of 100 points. A list of eligible vehicles will be published by 15 December 2023, before the reformed eco-bonus comes into effect on 1 January 2024.

The new subsidy regulations for electric cars are indirectly aimed at limiting the import of Chinese vehicles to France, which compete with EVs produced in the country and Europe. “We will stop subsidising electric vehicles with a bad carbon footprint,” commented France’s Economy Minister Bruno Le Maire. “We are giving an advantage to French and European companies that strive to reduce their ecological footprint,” adds Agnès Pannier-Runacher, French Minister for the Energy Transition.

In May, President Macron had already announced that the subsidies would be disbursed in a “more targeted” way to strengthen the production of battery cells and electric cars in Europe. In China, which produces 60 per cent of its electricity from coal, many manufacturers are unlikely to meet the criteria. The push on EV subsidies is part of a draft law also presented by Macron in May to promote “green industry” or accelerate the “reindustrialisation” of his country.

One of the most striking statements made by the French President in his speech was that “we must not make the same mistakes as with the solar industry”, which had been massively promoted in Europe and then migrated to China. And: “That doesn’t mean that we are protectionist; we are not going to close the market, but we don’t want to use the French taxpayers’ money to accelerate non-European industrialisation.”

Already then, Macron announced a system to assess the carbon footprint of a vehicle’s manufacture “from the battery to the construction of the engine”.

In spring, there were still concerns about whether the initiative might be considered an irregular trade barrier by the World Trade Organisation and the EU. That was not the case. The EU Commission even recently announced its own anti-dumping investigation to examine the imposition of punitive tariffs to protect EU carmakers from Chinese EV imports – a much more direct push against Chinese manufacturers than France with its indirect approach.

Since the beginning of this year, the “bonus écologique” for a fully electric car in France is still 5,000 euros – regardless of manufacturer and country of production. So far, the only decisive factor is that the purchase price does not exceed 47,000 euros.

However, the subsidy was increasingly used to promote Chinese electric cars. The German Handelsblatt wrote in May that 40 per cent of the state subsidies for the purchase of an electric car in France in the first quarter of the year were for vehicles imported from China.

Suppose the regulation comes into effect as announced. In that case, other manufacturers will be affected in addition to the Chinese – for example, US manufacturer Tesla, which builds its Model 3s for Europe in Shanghai. German manufacturers would also lose out on some models. For example, the Cupra Tavascan or the BMW iX3, which are built in China for export.

0 Comments