IEA report: Dimensions and trends of the global battery market

The International Energy Agency (IEA) traces the development of the global electric vehicle battery market in 2024 and reveals details on geographical market distribution, chemistry and price trends. It was already known from a previous IEA publication that battery demand in 2024 exceeded the one terawatt-hour mark for the first time. The International Energy Agency counts batteries of all types together. However, as the batteries installed in electric vehicles accounted for 85 per cent of the global battery market last year, it sees the rise above the TWh mark primarily as a result of the growing electric vehicle battery market. In 2024, this market alone is expected to account for a good 950 GWh, which is 25 per cent more than in 2023.

“Demand for one average week alone in 2024 exceeded the total demand for an entire year just a decade earlier,” the study authors point out. They estimate that electric cars will remain the main driver of demand for electric vehicle batteries, with a share of over 85 per cent. Electric trucks are catching up: they accounted for almost 3 per cent of global EV battery demand, a growth of 75 per cent compared to 2023. “Electric truck battery demand was driven by growth in China,” the IEA specified. However, demand has also risen in Europe (+25% YoY).

China is the largest and most dynamic market

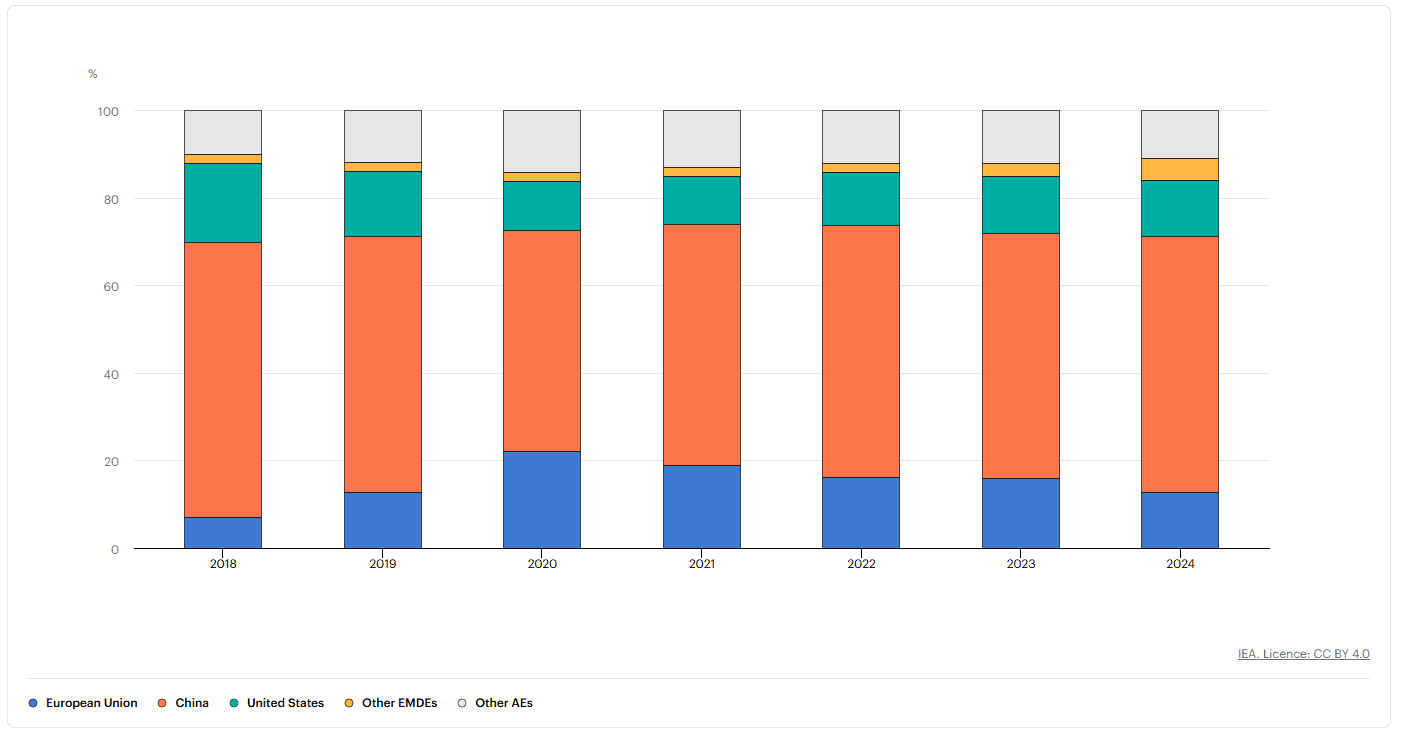

If the cake of all EV batteries from 2024 is broken down by region, China accounts for 59 per cent and the EU and the USA each account for 13 per cent. The IEA explains the fact that the latter two are on a par, even though fewer e-cars are sold in the USA, by the fact that around 25 per cent larger batteries per electric vehicle are installed in the USA. The share of emerging and developing countries in global battery demand was just under 5 per cent in 2024, which corresponds to a doubling compared to 2023 (supported by continued growth in Southeast Asia, India and Brazil).

The market grew fastest in China (+30% YoY), followed by the USA (+20% YoY), whereas demand in the EU stagnated last year. In its forecasts, however, the IEA assumes that this dynamic will change: For emerging and developing countries, the agency assumes a 10 per cent share of demand by 2030. It also predicts an increasing share for the EU, the UK, Canada, Japan and South Korea, while the authors estimate that the USA will fall to 10 per cent and China to 50 per cent by 2030. Of course, the cake is getting bigger: the IEA expects demand for electric vehicle batteries to exceed 3 TWh by the end of the decade.

Battery packs were 20 per cent cheaper in 2024

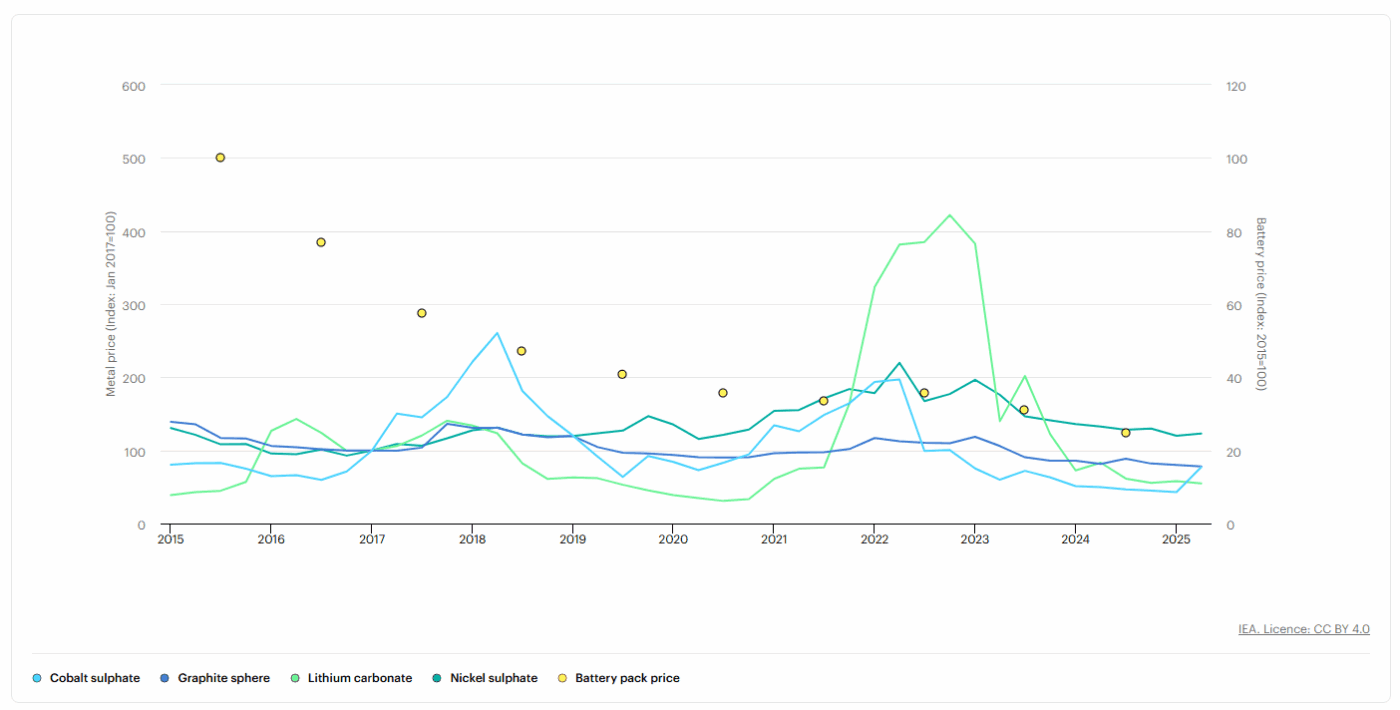

But back to the present – and the price trend for EV batteries: according to the report, prices for lithium-ion battery packs fell by 20 per cent in 2024, marking the sharpest decline since 2017. This was due to “low critical mineral prices and battery margins being squeezed through competition, predominantly in China,” according to the study authors. Lithium prices in particular fell by almost 20 per cent in 2024, reaching prices similar to those at the end of 2015 (“although lithium demand in 2024 is around six times greater than in 2015”). This is primarily due to a supply surplus.

Geographically, prices for battery packs fell in all markets. But the extent of the decline varied significantly, according to the IEA, with the sharpest drop in China (-30% YoY), compared to 10 to 15 per cent in Europe and the United States. “This widened the gap between battery prices in China and the rest of the world, increasing the competitive advantage of Chinese EV and battery producers,” the report states. The faster pace of battery cost reduction and innovation in China has been made possible by fierce competition, which has squeezed profit margins for most manufacturers (“though not all”).

LFP chemistry on the rise

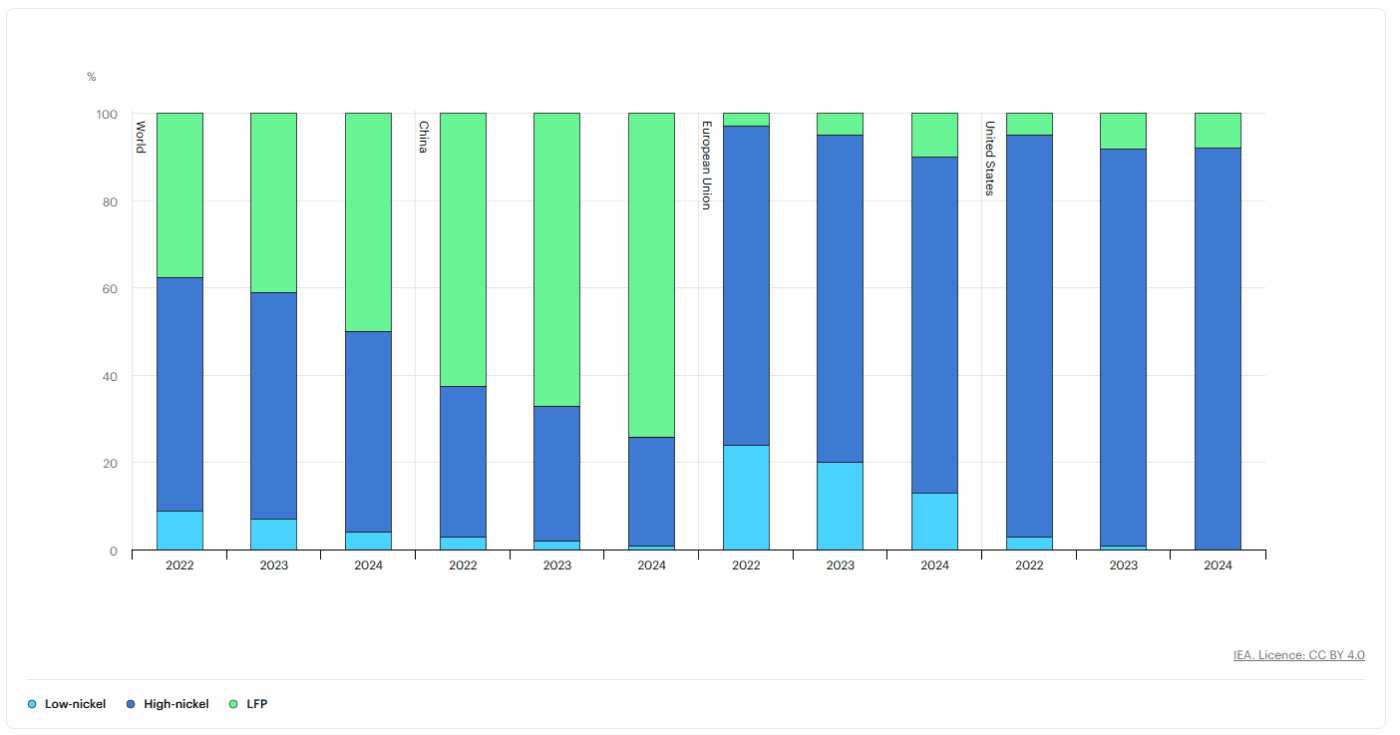

Battery chemistry also plays an important role in the price trend: lithium iron phosphate (LFP) batteries – the most commonly used battery chemistry in China – are almost 30 per cent cheaper per kilowatt-hour than NMC batteries, which are still the most commonly used in the United States and Europe. The higher energy density of NMC batteries remains an advantage for applications that require longer ranges or operation in cold climates, where LFP technology is typically less effective. “However, LFP batteries have now reached a performance level sufficient for most EV applications, making their lower cost a key advantage for automakers aiming to mass markets,” the IEA experts analyse.

In 2024, LFP batteries already accounted for almost half of the global market for electric vehicles. The leader here is China, whose demand for LFP batteries covered almost three-quarters of domestic battery demand in 2024. In the United States, however, the share of LFP batteries used in electric vehicles remains below 10 per cent (“which may be a result of tariffs on Chinese batteries”), while in the EU their share rose by around 90 per cent for the second year in a row, reaching more than 10 per cent of the electric vehicle market. It is worth noting that almost all LFP batteries for electric cars sold in Europe or the United States were manufactured in China. The market penetration of LFP batteries is progressing even faster in other markets: In Southeast Asia, Brazil and India, the share of electric car batteries with LFP will reach more than 50 per cent this year, according to the IEA report. “In Southeast Asia and Brazil, LFP uptake is led by imports from China, mostly by BYD, whereas in India it is driven by cars produced domestically, led by Tata Motors,” it says.

How Europe and the USA fared

Regarding Europe, the IEA describes 2024 as a difficult year for the European battery industry, in which both small and large manufacturers suffered for different reasons. “New players such as Northvolt, which filed for bankruptcy in the United States and Sweden, faced serious difficulties in scaling up production, leading to insufficient manufacturing yield and high production costs.” Falling global battery prices also put a strain on small manufacturers with fewer resources. South Korean companies, such as LG Energy Solution in Poland, are still the largest battery manufacturers in Europe, but their market share is also under pressure, according to the report: “Over the past 2 years, the market share of Korean manufacturers in the European Union has fallen from nearly 80% in 2022 to 60% in 2024, to the benefit of Chinese manufacturers. A key reason for this is the increased success of the LFP chemistry.”

In contrast, according to the IEA, the share of South Korean companies in the United States has risen from around 20% in 2022 to over 35% in 2024, at the expense of Japanese manufacturers. Although Panasonic still accounts for almost half of the electric car market in the US, its share is declining as South Korean manufacturers such as LG Energy Solution, Samsung, and SKI are investing heavily in the US market. Tesla also ramped up its own battery production in 2024, primarily for use in Cybertrucks. Production capacity in the US has doubled since 2022, mainly thanks to incentives from the Biden presidency, reaching more than 200 GWh in 2024, with almost 700 GWh of additional capacity under construction.

Supply chain firmly in Chinese hands

As far as battery precursors are concerned, the supply chain is becoming increasingly geographically concentrated: according to the new IEA analysis, China was responsible for 80 per cent of global battery cell production in 2024, while the rest was produced in the USA, the European Union, Korea and Japan. China has also established a quasi-monopoly in the production of battery components, supplying almost 85 per cent of cathode materials – including NMC and LFP chemicals – and over 90 per cent of anode materials, mainly graphite, it continues. “Outside of China, only Korea and Japan offer sizeable production capacity for cathode components. Korea also produces anodes, and Indonesia is expected to bring some diversification to the market. Nonetheless, China is set to remain the largest producer of batteries and their components by some distance in the medium term, based on announced projects and competitive advantages,” say the study organisers.

The geographical concentration of the mining and refining of battery minerals required for battery cathodes and anodes is also striking: in 2023, Australia, Chile and China mined around 85 per cent of the world’s lithium, with almost 65 per cent being refined in China and a further 25 per cent in Chile. Indonesia was responsible for more than half of nickel mining in 2023, while China and Indonesia together refined more than 60 per cent. In the same year, almost two-thirds of the world’s cobalt was mined in the Democratic Republic of Congo, although three-quarters of all cobalt refining took place in China. Graphite supply, the only critical mineral used for anodes today, is even more concentrated: China is responsible for 80 per cent of mining and over 90 per cent of refining.

Cell production: installed capacity at 3 TWh

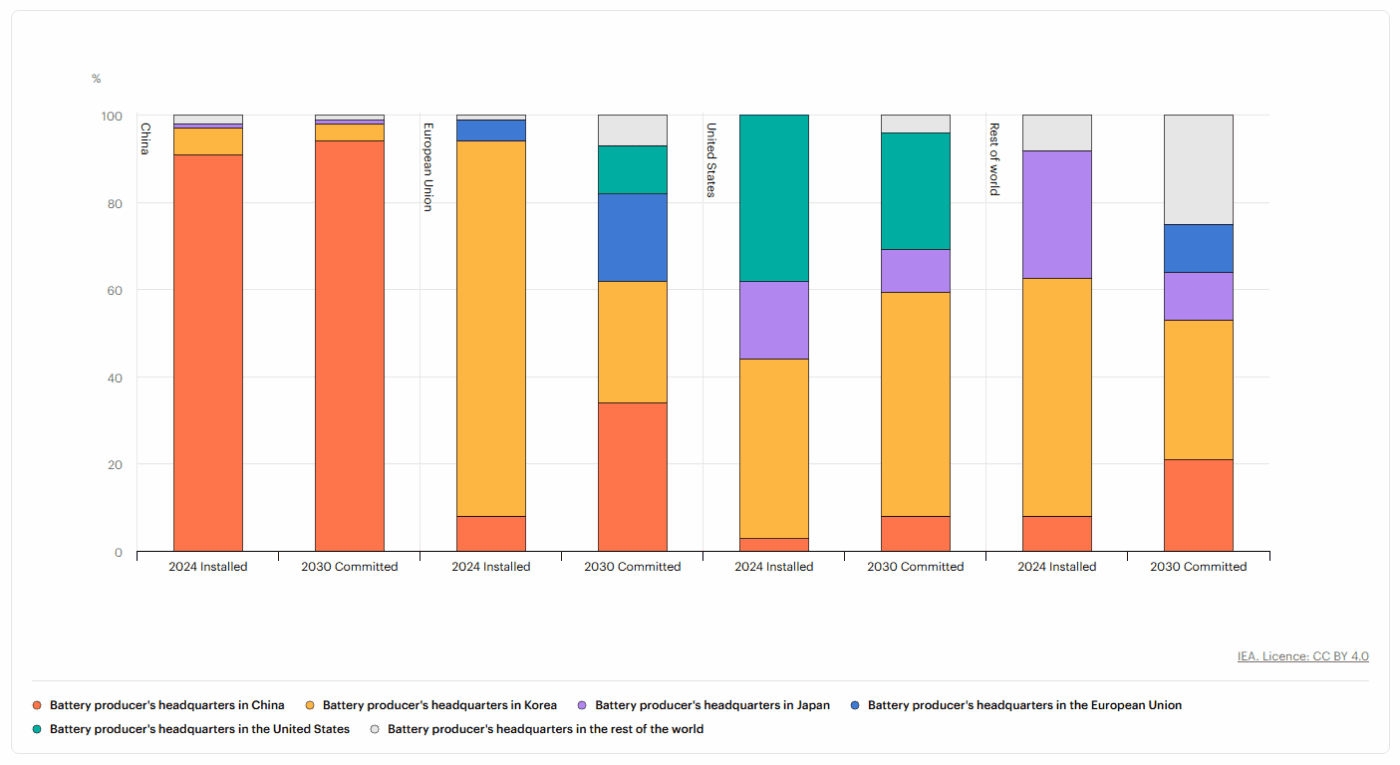

Global production capacity for battery cells increased by almost 30 per cent in 2024, reaching more than 3 TWh – three times the demand for electric vehicles and battery storage in the same year. Around 85 per cent of global production capacity is located in China (‘unchanged compared to 2023’), and over 75 per cent is owned by Chinese manufacturers. In the US, production capacity grew by almost 50 per cent (“led by Korean companies attracted by tax credits”). This means that the USA has overtaken the EU in terms of cell production capacity, with installed capacity in the European Union expected to increase by ten per cent this year despite the closure of the Northvolt plant in Sweden.

According to the IEA, Korean manufacturers continue to be the largest investors in battery production capacity abroad. They have more than 400 GWh worldwide, compared to 60 GWh from Japanese and 30 GWh from Chinese manufacturers. “If all announced projects are completed in full, the manufacturing capacity of Korean manufacturers outside of Korea would reach more than 1.1 TWh by 2030, 85% more than the announced overseas manufacturing capacity of Chinese battery producers,” the report states.

How cell production will develop by 2030

According to the IEA, specific planned projects (“i.e. those that are either under construction or have reached a final investment decision”) are likely to increase global production capacity from the current 3.3 TWh to around 6.5 TWh and reduce China’s share of global production capacity from the current 85 per cent to around two thirds by 2030.

The European Union is the largest target region for foreign investment by Chinese battery manufacturers. According to the IEA, their share of regional production capacity could increase from currently less than 10 per cent to over 30 per cent by 2030. By contrast, the share of Korean manufacturers in battery production capacity in the EU is likely to fall significantly, from around 85 per cent now to 30 per cent in 2030, while the share of EU-based companies could rise from 5 per cent at the end of 2024 to 20 per cent. “However, this includes plants facing significant uncertainty, such as the Northvolt plant in Germany, for which Germany assumed over EUR 600 million in debt, and which is not directly affected Northvolt’s bankruptcy. More generally, concerns are growing about the ability of smaller European producers to scale up production and compete with established global players, which may lead to a much smaller share of the future EU battery market being captured by domestic manufacturers,” the authors conclude.

In the USA, Korean cell manufacturers held or at least participated in 40 per cent of battery production capacity last year. Based on committed projects, the International Energy Agency assumes that their share will climb to over 50 per cent by 2030, while the share of Japanese companies will drop by almost half. For domestic companies such as Tesla, the IEA forecasts a decline from just under 40 per cent to 30 per cent. Companies that are majority or wholly owned by Chinese groups, such as Envision and Gotion, have also announced investment plans for the USA. However, “recent policies might lead to the cancellation of these plans,” the authors point out.

Further committed capacity is to be added in other industrialised countries, including Canada, other European countries, Korea and Japan. More than 150 GWh of committed production capacity will also be built in Southeast Asia, India and Morocco. According to the report, Southeast Asia is attracting significant Chinese investment, which could accelerate the transfer of technology and innovation.

0 Comments