EU new registrations show Tesla no longer losing ground as quickly

In May, exactly a quarter more electric cars were registered in the EU than in the previous year. According to the industry association ACEA, 142,776 battery electric cars (BEV) were newly registered on the roads. Plug-in hybrid new registrations (PHEV) developed even more dynamically: the 59,423 units in May represent an increase of 47 per cent compared to May 2024. Hybrids were once again the most dominant drive type with 315,597 vehicles (+16% YoY), while petrol and diesel each lost double digits.

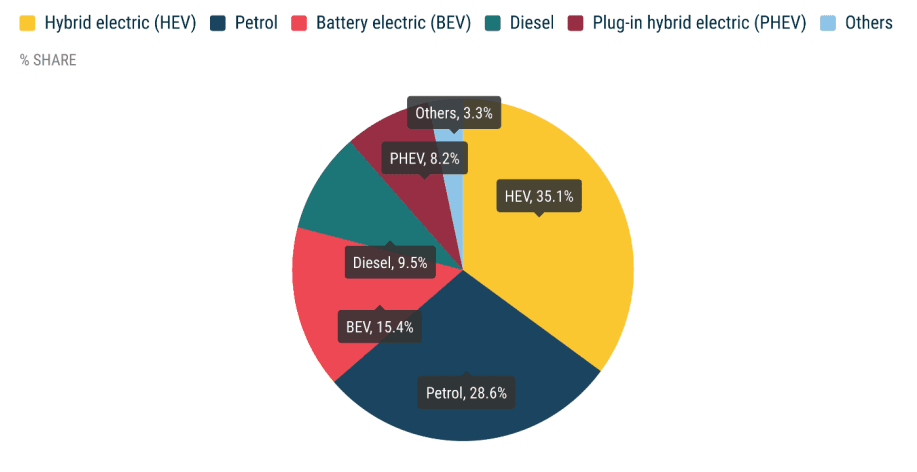

At the same time, the overall passenger car market recorded a mini increase of 1.6 per cent to 926,582 units in May, giving BEVs a market share of 15.4 per cent. If plug-in hybrids are added, the market share rises to 21.8 per cent. In other words, more than one in five new registrations in the EU were plug-in vehicles in May. Germany is the driving force here, accounting for around 43,000 new BEVs and 25,200 new PHEVs in the previous month alone.

Zoom on the first five months of the year

In the current year, May has shown stable growth in electrified drives. New BEV registrations in the EU in the first five months of the year totalled 701,089 BEVs, which corresponds to an electric share of 15.4 per cent, as was the case atthe monthly level in May. While the overall market has stagnated so far (+0.6%), all alternative drive systems are growing at an above-average rate: BEVs have increased by 26.1% since the beginning of the year compared to the same period in 2024, PHEVs by 15% and hybrids without external charging options by 19.8%. In absolute figures, exactly 375,182 PHEVs and 1,601,090 hybrids were added in the EU in the first five months of the year, in addition to around 700,000 BEVs.

Market shares are also shifting in favour of alternative drive systems. As mentioned, battery-electric cars claim 15.4 per cent of the market (a year ago it was 12.1% YTD). Plug-in hybrids now have a market share of 8.2 per cent in the period from January to May (from 7.1 per cent YTD 2024), while hybrids are clearly in the lead with 35.1 per cent. Petrol cars still account for 28.6 per cent of the market after the first five months of the year. Diesels are losing ground (9.5 per cent) and could soon be overtaken by plug-in hybrids in view of their momentum in May. The combined market share of petrol and diesel vehicles thus fell to 38.1 per cent – compared to 48.5 per cent in the same period in 2024. For the sake of completeness: 3.3 per cent of the market is accounted for by ‘other drives’ according to ACEA figures.

Which countries are fuelling growth

The growing demand for alternative drive systems is primarily guaranteed by the momentum in three of the four largest EU markets – Germany, Belgium, the Netherlands and France (‘which account for 62 per cent of all BEV registrations in the EU’). Germany, for example, has recorded an increase of 43.2 per cent in the year to date, although this is also due to the weak start to 2024. As is well known, the purchase premium was discontinued ad hoc at that time, which hit the market hard for several months. Belgium (+26.7%) and the Netherlands (+6.7%) also recorded growth, while France (-7.1%) saw a downward trend, which, like Germany last year, could be due to fewer subsidies. At the beginning of 2024, for example, France granted a short-term ‘social leasing’ scheme for e-cars, and the government is also slowly reducing other subsidies.

It is also interesting to look at the UK. There, 177,487 new BEVs have been registered since the beginning of the year, an increase of 33 per cent. But Germany remains ahead in terms of absolute figures with 201,563 newly registered BEVs to date. This is exciting because the UK overtook Germany in terms of BEV registrations for the first time in 2024. After the first five months of the current year, Germany is now back in the lead. Incidentally, France is the only other European country to also have a six-digit BEV registration figure so far this year (119,475 units).

Tesla’s downward momentum slows

In terms of new registrations by manufacturer, the ACEA does not differentiate between drive types, so only statements on pure BEV manufacturers are possible here. Between January and May, 50,413 new registrations were registered for Tesla in the EU, which corresponds to a decrease of 45 per cent compared to the same period last year. In May, the decline was 40.5 per cent to 8,729 new registrations. Deliveries of the revised Model Y Juniper, which have now begun, have still not reversed the trend. However, if the EU figures are supplemented by registrations in the UK and EFTA countries (Iceland, Norway, Switzerland and Liechtenstein), Tesla has seen a slightly muted decline of 37 per cent since the beginning of the year. And if you look at May in isolation, with this country cut, it is ‘only’ 28 per cent down. The next ACEA report will show whether these are signs of a slight recovery at Tesla.

Another EV manufacturer worth mentioning is Smart. Here, the decline after the first four months of the year is also striking at 69 per cent. In May, 68 per cent fewer new Smarts were registered in the EU, with only 718 vehicles, compared to 2,291 new Smarts in May 2024.

acea.auto (PDF)

0 Comments