Ultium Cells converts Spring Hill factory for LFP production

According to the battery manufacturer, the conversion of battery cell production in Spring Hill to the production of LFP cells will begin this year, with commercial production scheduled to start at the end of 2027. The plan is to scale production of low-cost lithium iron phosphate battery cells, an initiative which builds on a $2.3 billion investment announced all the way back in 2021. The reasoning behind the move is to offer lower-cost batteries to enable the manufacturer to offer entry-level electric vehicles at lower prices.

According to a South Korean media article published in June, Samsung SDI will therefore also convert part of its joint venture with GM in Indiana, which was originally intended purely for the production of nickel-rich batteries, so that LFP production lines can also be accommodated.

LGES and GM currently only produce pouch cells with NMC chemistry in both US factories. It had been known for some time that the joint venture was aiming to switch to prismatic cells, whose structure is also better suited to LFP chemistry. With the official announcement of the conversion of the Spring Hill plant, GM has put an end to the speculation that was fueled by such statements and insider reports. At the same time, LGES and GM are also focusing on the development of lithium-manganese-rich batteries (LMR) – a new format that should retain the cost advantages of LFP while offering superior performance.

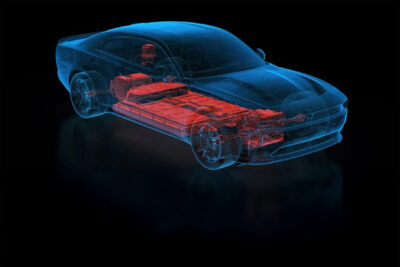

Ultium Cells currently operates two cell factories in the USA, one in Warren, Ohio, since 2022 and another in Spring Hill, Tennessee, since 2024. While the former continues to produce cells with NMCA (nickel-cobalt-manganese-aluminium) chemistry, Spring Hill is to switch from this to the cheaper lithium iron phosphate chemistry. The joint venture has given itself two years to complete the reorganisation. Shareholder General Motors comments: “GM’s flexible EV platform is designed to enable the rapid integration of different cell chemistries and form factors. With LFP battery technology, GM is targeting significant cost savings in battery packs compared to today’s high nickel battery packs, while increasing electric car choices for consumers.”

As GM announced in its current press release, the Spring Hill plant currently employs around 1,300 people. The company does not mention how the workforce will continue to be employed during the conversion. Kurt Kelty, Vice President of Batteries, Propulsion and Sustainability at GM, refers much more to the upcoming benefits for customers.

“At GM, we’re innovating battery technology to deliver the best mix of range, performance, and affordability to our EV customers,” said Kurt Kelty, VP of batteries, propulsion, and sustainability at GM. “This upgrade at Spring Hill will enable us to scale production of lower-cost LFP cell technologies in the U.S., complementing our high-nickel and future lithium manganese rich solutions and further diversifying our growing EV portfolio.”

Spring Hill has only been in series production mode since April 2024

The conversion, which involved a major effort, is remarkable in that it has only been a year and three months since Spring Hill produced its first series-produced NMC cells. In other words, the systems are all new and have only just been harmonised. The ground-breaking ceremony dates from 2021, and the change in strategy is testament to the high pressure that GM and its battery subsidiary in the USA are under. Against this backdrop, the car manufacturer recently sold a third Ultium Cells plant to joint venture partner LGES just before its completion, specifically the one in Lansing, Michigan. The plans for a fourth plant, which was to be built in New Carlisle in the US state of Indiana, were put on hold by GM and LGES at the beginning of 2023.

GM strategy is a reflection of the political situation

The new strategy naturally also has a political dimension. As Reuters recently reported, GM CEO Mary Barra met with US President Donald Trump in March to discuss US investment plans. She is also said to have told the President that GM needed a concession on the Californian emissions requirements in order to expand production in the USA. California and ten other US states are known to have adopted stricter environmental regulations than the national rules. In June, Trump signed a law that cancels Califonia’s regulations for zero-emission vehicles by 2035.

Meanwhile, GM is recording growing sales figures in the USA for both petrol and electric vehicles. The company emphasises that it will have become the second-largest seller of electric vehicles in the USA in the second half of 2024 (January to May: 62,000 EVs sold), thanks to the 13 electric car models now available from its brands. And: Chevrolet was the fastest-growing electric vehicle brand in the country in the first quarter and is now number 2 among all electric vehicle brands. Between January and May, Chevrolet sold over 37,000 electric cars in the USA, Ford only 34,000, with Tesla leading the way.

Meanwhile, GM’s capital expenditure forecast for 2025 remains unchanged at $10bn to $11bn. Looking ahead, GM expects annual capital spending to be between $10 billion and $12 billion by 2027, “driven by increased investment in the US, prioritisation of key programmes and efficiency offsets.”

0 Comments