CAM study: Sales of electric cars rise in Europe by 26.2 per cent

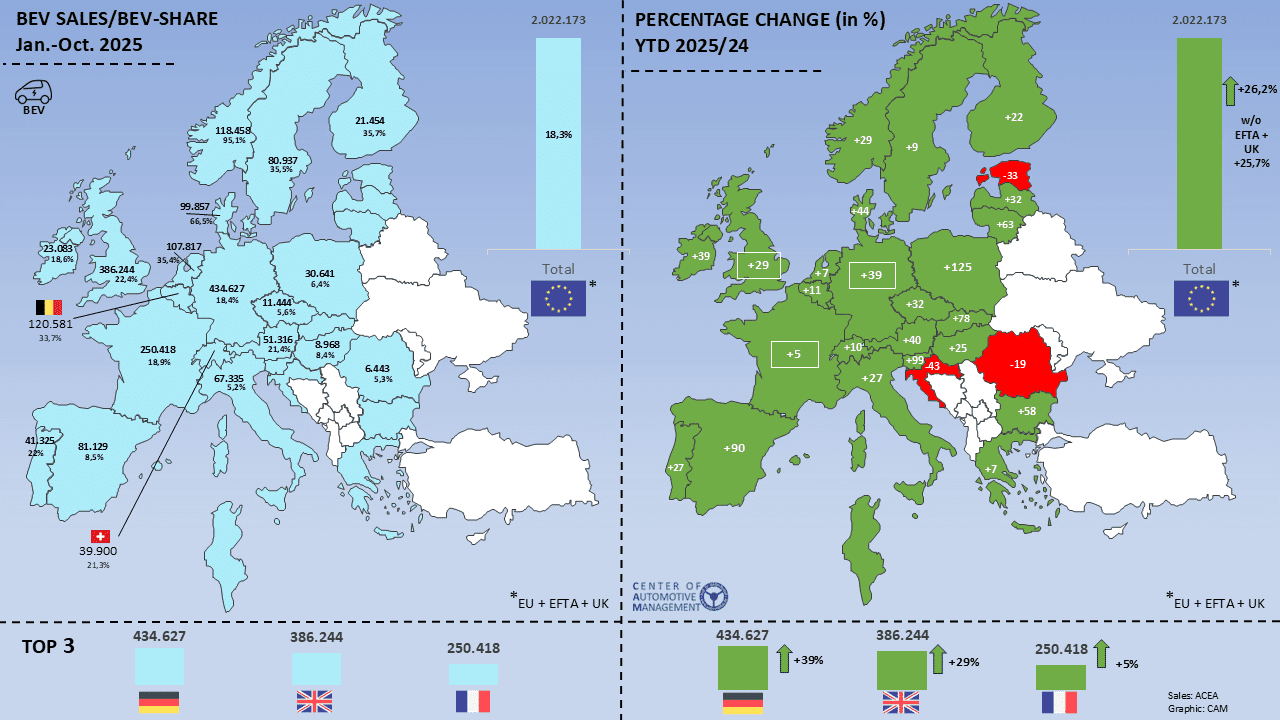

Across all drive types, the European passenger car market grew by just 1.9 per cent year-on-year to around 11 million new registrations from January to October 2025. In contrast, the battery-electric vehicle (BEV) segment is developing far more dynamically: Europe (EU + EFTA + UK) recorded 2.02 million new registrations of battery-electric cars (BEVs) and a growth rate of 26.2 per cent compared to the same period in 2024.

As a result, BEVs significantly expanded their market share in Europe this year to 18.3 per cent, up from 15.4 per cent for the whole of 2024. This demonstrates that, despite strong headwinds—such as debates around openness to technology and a potential weakening of the EU’s internal combustion engine (ICE) phase-out—the transition to electric mobility is progressing. However, it is advancing steadily rather than at full throttle. One thing is clear: electric cars are becoming increasingly common in corporate fleets, and more private customers are adopting them.

Nevertheless, the transition to electric mobility is progressing at different speeds across Europe. Norway leads with a 95.1 per cent share of BEV new registrations, while Denmark (66.5 per cent), Sweden (35.5 per cent), the Netherlands (35.4 per cent), and Belgium (33.7 per cent) are also making rapid progress. The major car markets—Germany (18.4 per cent), France (18.9 per cent), and the United Kingdom (22.4 per cent)—are close to the European average of 18.3 per cent. In contrast, the outlook is less promising in Italy (5.2 per cent), Poland (6.4 per cent), and Spain (8.5 per cent).

Stefan Bratzel, Director of CAM and lead author of the study, stated: “In Europe, the ramp-up of electric mobility is in a critical transition phase in 2025, despite strong growth. The development remains uneven. There continues to be significant consumer uncertainty and scepticism about the future of drive technologies, further fuelled by ongoing ideological debates around technological openness and a potential relaxation of the 2035 ICE phase-out. Uncertainty typically leads to hesitation in purchasing and clinging to the familiar, so clarity must be established quickly.”

Bratzel also warns that a potential weakening or relaxation of the de facto 2035 ICE phase-out could provide short-term relief and financial benefits for car manufacturers, such as avoiding penalty payments. “However, this would not improve the innovation and competitiveness of the automotive industry in the medium to long term. If efforts in future technologies like electromobility are slowed, it could even prove to be a Pyrrhic victory for the German automotive industry.”

Beyond the growth dynamics and market shares of BEVs compared to other drive types, it is also interesting to see which countries represent the largest markets for electric cars in absolute terms. After the UK overtook Germany as Europe’s largest electric car market in 2024, the two countries appear to have swapped places at the top once again. From January to October 2025, Germany led with a 39 per cent increase, registering 434,627 new BEVs, while the former leader, the UK, saw a 29 per cent rise to 386,244 units. France, which plans to continue its electric car purchase incentive in 2026, ranked third with 250,418 new BEV registrations.

The CAM study also examines the German BEV market in detail, incorporating the latest new registration figures from the Federal Motor Transport Authority, including data for November. From January to November 2025, 490,368 electric cars were newly registered in Germany—a 41.3 per cent increase compared to the same period last year. The BEV share of new passenger car registrations has risen almost continuously over the past 12 months, from 14.4 per cent to 22.2 per cent, and stands at 18.8 per cent after 11 months of the current year. Including December, CAM expects a total of 530,000 new BEV registrations for 2025. This would slightly exceed the previous record year of 2023, which saw 524,219 units, though that year was still influenced by the environmental bonus that expired at the end of 2023.

Next year, the new electric car incentive scheme in Germany is set to come into force, offering state purchase grants of between €3,000 and €5,000 for BEVs, depending on the configuration. However, CAM Director Bratzel is critical of this approach: “While targeted support for electromobility in Germany would generally make sense, the planned purchase incentive risks creating only a short-lived surge, with windfall effects and further distortions in the residual values of used vehicles. Instead of offering expensive purchase grants, a programme to promote charging infrastructure—such as a year of free charging for private buyers of new or young used vehicles up to a certain price limit—would be far more effective and sustainable.”

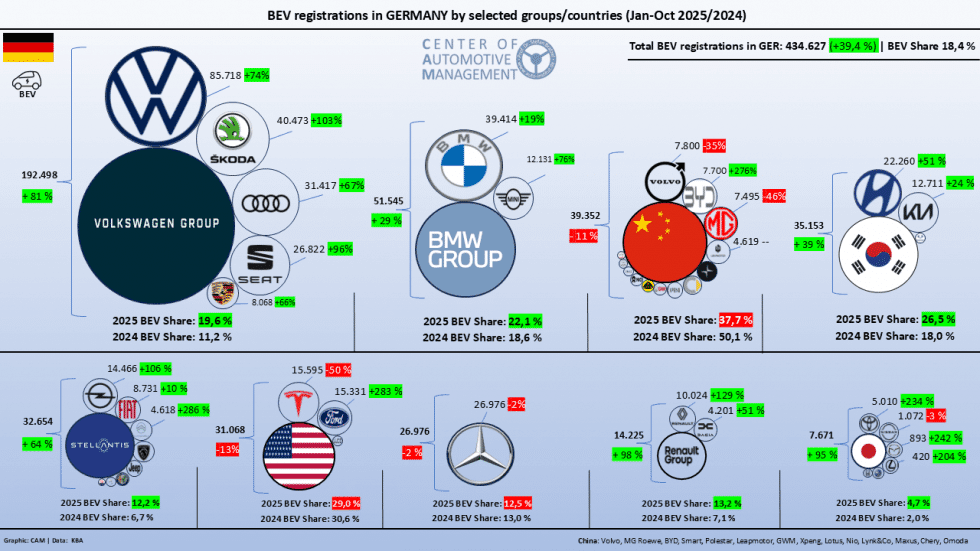

Finally, the CAM study compares the performance of various manufacturers in the German BEV market, though only data from January to October is analysed, as manufacturer-specific figures for November were not yet available. The Volkswagen Group emerged as the clear leader in BEV registrations, with 192,498 new units—a 81 per cent increase. The driving force behind this growth was the Škoda brand, which saw a 103 per cent rise, thanks in part to the compact SUV Elroq, produced since January and already rolled off the production line 100,000 times. The group’s BEV share increased from 11.2 per cent to 19.6 per cent. The BMW Group also saw significant growth in the BEV segment, with 51,545 new registrations in Germany (+29 per cent), while Mercedes-Benz experienced a 2 per cent decline to 26,976 BEVs. However, new electric models such as the all-electric CLA and GLC are expected to reverse this trend soon. The Korean sister brands Hyundai and Kia also demonstrated strong growth in the German BEV market.

auto-institut.de (in German)

This article was first published by Sebastian Schaal for electrive’s German edition.

2 Comments