Over 380,000 electric cars registered in the UK in 2024

This marks the UK’s second successive year of growth in the EV market, marking a 2.6% overall increase in vehicle purchases, but also marked improvement for the electric and hybrid segments, while classic combustion engines took a hit.

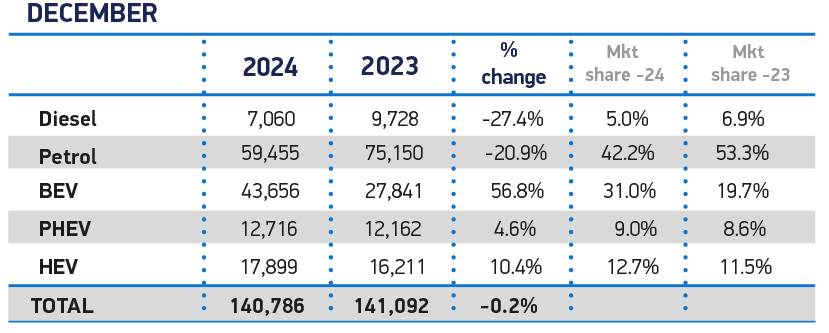

Battery-electric vehicles saw a major boost in popularity, with the segment growing by 21.4 per cent since 2023 when the BEV segment reached a market share of only 16.5 per cent with a total of 314,687 vehicles purchased. This grew to a margin of 19.6% to reach a total number of 381,980 BEVs registered in 2024. December proved to be the most exciting month for battery-electric cars, showing a 56.8% growth from the previous year, and a total of 43,656 battery-electric cars sold.

Interestingly enough, December also saw all other vehicle types sell significantly under the number seen in other months, with diesel cars falling by a whopping 27.4% compared to the previous year, and petrol-powered cars dropping by 20.9% compared to December 2023. A minor exception to this statistic is the HEV, which sold 1 per cent more than the average for the year. Plug-in hybrids, on the other hand, underperformed by nearly 15 per cent compared to the rest of 2024.

Generally speaking, the trend continues away from traditional combustion engines, with the only combustion engine segment showing growth belonging to the HEV. Mild Hybrid Electric Vehicles (MHEV) were included in the diesel and petrol figures. The BEV and PHEV gains clearly outweighed those of their gasoline and diesel counterparts, growing by a collective 39.7 % (49.3 if HEVs are included), compared to the 18 per cent market share collectively lost by diesel and petrol cars.

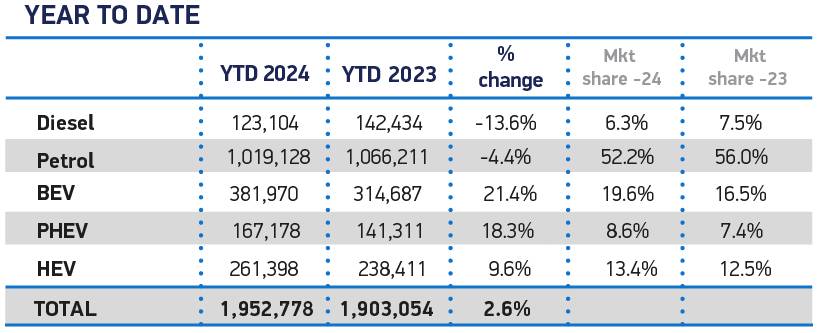

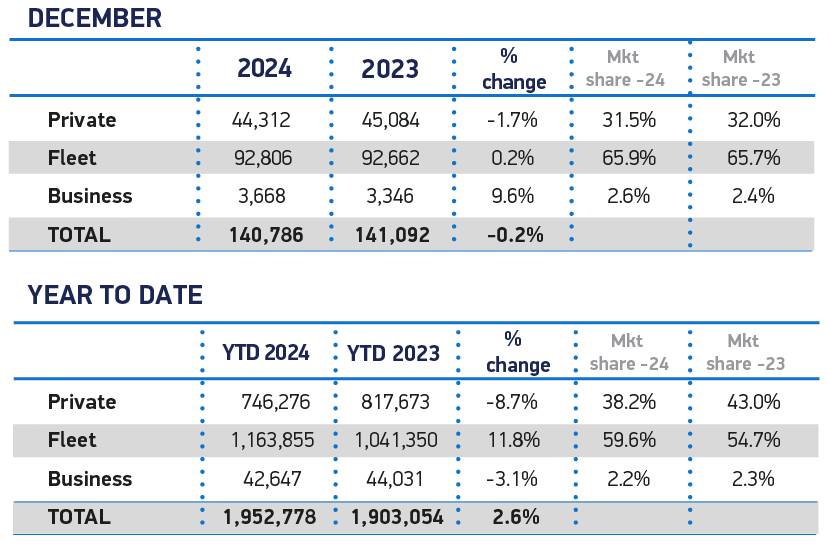

According to SMMT, this “growth was delivered entirely by fleets, up 11.8% to reach 1,163,855 units, accounting for a record six in 10 (59.6%) new car registrations.” At the same time, private buyer purchases went down by 8.7% to 746,276 units, which SMMT notes is “less than in 2020 when social distancing restrictions during the pandemic shut down the market for three months.”

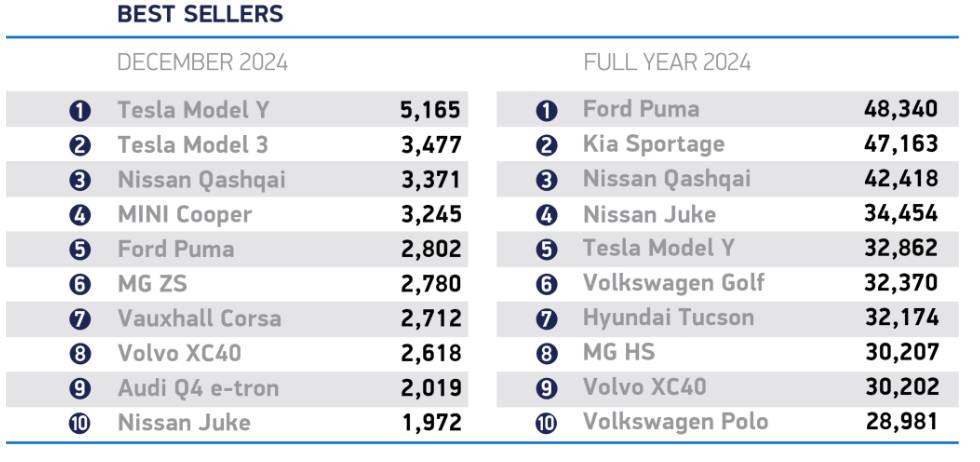

In terms of model popularity, there is another major discrepancy between the yearly average, and the winner in December: The Ford Puma proved to be the most popular vehicle in 2024, with a total of 48,340 Pumas added to the UK’s roads, while December’s most popular purchase by far was the Tesla Model Y, standing at 5,165 models registered. The Ford Puma only made it to fifth place in December with 2,802 cars registered. Conversely, the Model Y only made it to fifth place for the entire year 2024, seeing a total of 32,862 registered in the UK. It should also be noted that the Model Y is also the UK’s highest-selling battery-electric car, as the other models are hybrid vehicles.

Despite the impressive growth, the Society of Motor Manufacturers and Traders (SMMT) is not happy with the results. While fleet operators lifted the market to impressive heights with their orders, SMMT describes this as “record but unstainable levels.” In order to help bring the private market back, the “government must do more to stimulate private demand and challenge chargepoint operators to accelerate rollout, ensuring the UK has a reliable, affordable and comprehensive nationwide network of infrastructure.”

“A record year for EV registrations underscores vehicle manufacturers’ unswerving commitment to a decarbonised new car market, with more choice, better range and increased affordability than ever before. This has come at huge cost, however, with the billions invested in new models being supplemented by generous incentives which are unsustainable,” concluded Mike Hawes, SMMT Chief Executive, adding a dire warning: “We need rapid results from the regulatory review and urgent substantive support for consumers – else automotive investments will be at risk and the jobs, economic growth and net zero ambitions we all share in jeopardy.”

1 Comment