Tesla earnings Q3 2020: Another profit + record revenue

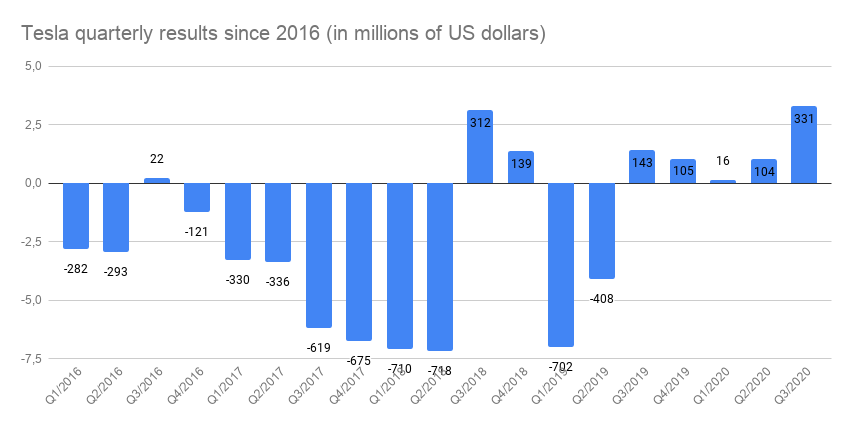

Tesla just reported third-quarter results including net income of 331 million dollars (GAAP) on revenue of $8.77 billion, meaning Tesla again broke its own records or simply continues to grow.

Strong delivery and production figures issued earlier in September had indicated as much, and Tesla confirms that they achieved the results “mainly through substantial growth in vehicle deliveries”. They also claim to be on track to make their target of delivering half a million vehicles this year.

But down to the numbers first. This Q3, the total revenue grew 39% YoY. With GAAP at 331 million dollars, Tesla also reports its fifth consecutive quarter of net profit. This was at $327 million in Q2. Like last quarter, Tesla also claims to have raised the cash and cash equivalents. This time by $5.9B in Q3 to $14.5B, driven by a recent capital raise of $5.0B.

During the earnings call, the company said both profit, as well as revenue, was down to the vehicle deliveries as mentioned above. Automotive revenue comprised $7.6 billion, about 91% of the total for the quarter. Tesla also made $397 million in carbon trading during the quarter nearly doubling the amount it made from these credits year-over-year, and we leave it to you to cue into the profit here.

At the same time, the delivery figures for Q3 were at a record-high for the company that delivered 139,300 electric vehicles in the period July throughout September this year. Aggregating the quarterly figures, they produced 329,980 electric vehicles and delivered a total of 318,350 Teslas in 2020 so far.

Investors were still eager to hear whether Tesla was on track to hit the target of half a million cars delivered at year’s end. Announced pre-Covid, Tesla has not taken the target off its back but will need another record quarter to close 2020 with 181,650 more vehicles. Today they said:

“We have the capacity installed to produce and deliver 500,000 vehicles this year. While achieving this goal has become more difficult, delivering half a million vehicles in 2020 remains our target. Achieving this target depends primarily on quarter-over-quarter increases in Model Y and Shanghai production, as well as further improvements in logistics and delivery efficiency at higher volume levels.”

When looking at the Model 3 and Y, these make for 128,044 units (up 60%) out of the total production of 145,036 (up 50% YoY, +76% QoQ). This is also down to Tesla having recently increased capacity of Model 3 / Model Y to 500,000 units a year in Fremont as they said.

For the Model S and X, the operational summary also showed a 169% increase in premium production QoQ, another indication of much more efficient manufacturing. Year-on-Year, the output has risen by 4 per cent to 16,992 units.

The concentration on making more volume models showed in the vehicle average selling price (ASP) too, which had “declined slightly compared to the same period last year as our product mix continues to shift from Model S and Model X to the more affordable Model 3 and Model Y,” the company states. More so, Tesla has lowered the price of its cars repeatedly in the last few months.

Tesla also brought down the inventory, that is how long it takes for a delivery to 14 days, that is a reduction of 22% YoY.

At the same time, the operating income, that measures the amount of profit realized from business operations after deducting operation expenses such as wages, depreciation and cost of goods sold (COGS), was looking up at Tesla. The company claims they reached “a record level” of operating income in Q3, that is $809M, resulting in a 9.2% operating margin (the profit a company makes on a dollar of sales before taxes). Again this was due to the high output and also advances in the efficiency.

It had already become clear in the delivery and production figures, that the Californian carmaker had reversed the Corona-related decline and instead achieved strong growth once again, esp. as Giga Shanghai is gearing up.

Manufacturing is also were Elon Musk feels his company is most underrated. During the call, he compared the conventional automotive industry to the business of a carpenter that relies on suppliers to assemble the products. Tesla is working to keep everything in their hand, not the least with battery production but also by innovating in the Valley’s disruptive manner but recently around the world.

Model 3 production capacity has increased to 250,000 units a year at Giga Shanghai, says Tesla (up from 200,000). Plus, they mention the recently lowered prices in China facilitated by “lower-cost batteries and an increased level of local procurement. As a result of this shift in cost and starting price, we recently added a third production shift to our Model 3 factory,” Tesla said. These cheaper batteries are the cheaper LFP cells CATL has been making locally for the electric carmaker (Ed.).

For Giga Berlin, construction progresses with Tesla expecting “move-in” of equipment “to start over the coming weeks”. The company previously announced that the site near Berlin would become a testbed for the new 4680 cells as well as the mentioned advanced manufacturing methods. The most prominent example is massive die casting machines which will eventually cast Model Y frames in two if not one piece.

Overall, Tesla considers the company “on track to start deliveries from each location in 2021”. This also includes the Gigafactory Texas. Tesla Semi deliveries will also begin in 2021, according to the EV maker. Production of these trucks will then happen at the site near Austin, where Tesla will also build the Cybertruck. CEO Elon Musk managed expectations regarding the pick-up truck when he told investors to expect first deliveries at the end of 2021 while series production in larger quantities would not begin before 2022.

For the 25k electric car Tesla promised at Battery Day in September, the company still considers it “a critical component to exceed cost parity with internal combustion engine vehicles.” In their statement, they repeated the claims of “reducing battery pack cost per kWh by 56% and enabling the production of a profitable $25,000 vehicle.”

Besides, the Supercharger network continues to grow, this quarter by 33 per cent YoY. Tesla now has 2,181 sites worldwide that add up to 19,437 connections.

On the note of Tesla considering itself an energy company foremost and in future, Tesla reported an installed solar capacity of 57 MW in the third quarter, 111 per cent more than the 27 MW in Q2. Like with the other data delivered today, this too is the best figure in the past twelve months (the increase in solar is 33% YoY). The company’s solar modules cost no more than 1.49 dollars per Watt, with installations taking around 1.5 days. That is given the old roof has already been removed, and the carpet pad of the new roof laid and ready to carry the solar tiles.

In the case of the energy storage in the form of Tesla Powerbanks, which fluctuate less seasonally, the company installed 759 MWh, up 81 per cent from Q2 and 59 per cent more than in Q3 2019.

We updated this article continuously.

3 Comments