Nidec aims for EV joint venture with Foxconn

Foxconn and Nidec have launched talks to set up a joint venture in Taiwan next year to accelerate electric vehicle motor production as the two Apple suppliers push further into the market. Nidec wants Foxconn to help make automotive its largest business driver – only there’s some way to go.

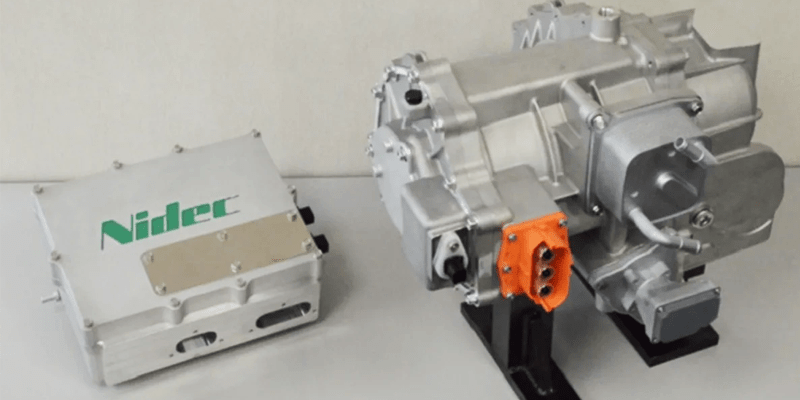

Marketshare, nothing less. Nidec had said as much during a press call last year and, when disclosing its financial results last night, again put the automotive sector centre-stage. For the facts, Nidec’s existing automotive business kept a double-digit operating profit ratio for four consecutive quarters after bottoming out in Q1 2020, the corporation reports. The EV part essentially comprises the E-Axle, Nidec’s traction motor system, and the company says 161,000 vehicles utilise it to date. So clearly, there is room for growth.

Cue in Foxconn and owner Hon Hai. Known for supplying Apple, Foxconn has been pushing into e-mobility for some time. The company unveiled an electric car platform in 2020 before announcing a series of collaborations, including Geely, Fisker, and Thailand’s state-owned energy company PTT.

And, there is Nidec as a motor partner. When asked what a joint venture would add to the existing relation, Nidec let us know that the JV would further develop the E-Axle and production to supply Foxconn and the latter’s customers. Yet, in the press call, Nidec’s chief executive Jun Seki also said he was yet to see “the actual volumes with proof” before any contracting.

However, volume is key to Nidec’s strategy ‘Vision 2025’ and beyond. The corporation targets selling ten million traction motors in 2030 and 2.8 million in 2025, which is ambitious. “The E-Axle product is still loss-making,” Hidetoshi Yokota, Chief Financial Officer at Nidec Corporation, informed electrive after the call. “We will make it positive in FY23, and cumulative loss must disappear by FY25,” the CFO added. He would not disclose any plans for Nidec’s small mobility business. However, the portfolio traditionally includes e-scooters, e-motorbikes and pedelec applications, and Yokota said that “it should surely contribute to our corporate level OP target of 15% at FY25.”

Micro mobility applications aside, the automotive business accounts for 21.8 % of sales by product group, with another 17.5 % from smaller motors. Nidec also supplies small precision motors alongside appliance and industrial products, which take the biggest share in the portfolio to date.

This is to change, as Nidec said that it planned to double its revenue to 4Tn yen ($36Bn) by March 2026, of which one-third is expected to come from sales of automotive products. By 2030, the group has ambitions to increase its revenue to 10Tn yen by serving new market segments.

“Currently, the majority of our [automotive] clients are carmakers. But in addition to those who have traditionally been selling cars, we are now seeing loads of new entrants from other sectors,” Jun Seki, a former Nissan executive who was appointed Nidec’s CEO earlier this year, told the online news conference.

Electric vehicle demand to become “natural”

Accordingly, Nidec is banking on a changing market, first through regulation and price adjustments in a second step. “Current demand is forced demand,” said Seki, pointing to subsidies, comparably high prices and infrastructure challenges. At the same time, he is convinced that falling battery prices and low cost, mass compatible vehicles such as the China Mini EV will lead to “natural demand” in a decade and wet the “price-conscious consumer’s appetite”.

To get ready, Nidec is planning to spend 9Bn dollars in acquisitions over the next five years to increase sales of electric vehicle motors. Not last through Foxconn’s EV platform for which Nidec delivers the motors and the MIH alliance. Nidec expects the EV platform to bring in “billions of yen” when it debuts this autumn.

The companies did not disclose how much they will invest in the joint venture, saying they will conduct feasibility studies and negotiate details of their contract by the end of the year. Nidec would also not comment on any specific joint projects.

CEO Seki added, however, that he would focus on filling technology and geographical gaps in areas where the company sees growth in wider strategies. One such area is Serbia, where Nidec is currently building up its manufacturing capacity.

In terms of automotive, Nidec’s most significant client is Stellantis. The company would not comment on the true nature of the cooperation. Seki only told electrive that the merged business of FCA and PSA was one “very smart” example for (almost) outsourcing motor development other OEMs would eventually follow. “By 2030, no one will build by themselves unless it is very high-performance motors,” said the Nidec executive.

Info via online press conference

mynewsdesk.com (Foxconn JV), mynewsdesk.com (Nidec financial results)

0 Comments