Batteries: What will the EU’s Critical Raw Materials Act really achieve?

The initial situation is clear: batteries, produced as sustainably as possible, will be needed in all areas of life in the future. With the automotive industry traditionally strong in Europe, there are a large number of customers in the mobility sector, and electrification is also progressing in buses and lorries. However, many of the battery cells in today’s EVs – including those used by German car manufacturers – come from Chinese manufacturers. Although the raw materials for this are mined globally, Chinese companies have once again built up great market power in processing these materials into battery-compatible precursor products. The US is already counteracting this with a significant subsidy programme under the banner of the Inflation Reduction Act and is strengthening the domestic battery industry.

In Europe, two pieces of legislation are supposed to provide the answer. The EU is pushing ahead with the Net Zero Industry Act (NZIA) and the Critical Raw Materials Act (CRMA) to promote industrialisation and secure raw materials for the emerging battery industry. Both acts set targets for local production capacity by 2030.

But how realistic are these targets? And what does the path to achieving them look like?

The experts from management consultancy P3 have investigated these questions in the white paper “Localised battery value chains in Europe – How strong is the announced political support?”, available exclusively to electrive. The analysis is based on the draft CRMA ratified by the EU Parliament in December 2023 and the current draft version of the NZIA, which will likely be adopted this spring.

560 GWh battery cell production in 2030

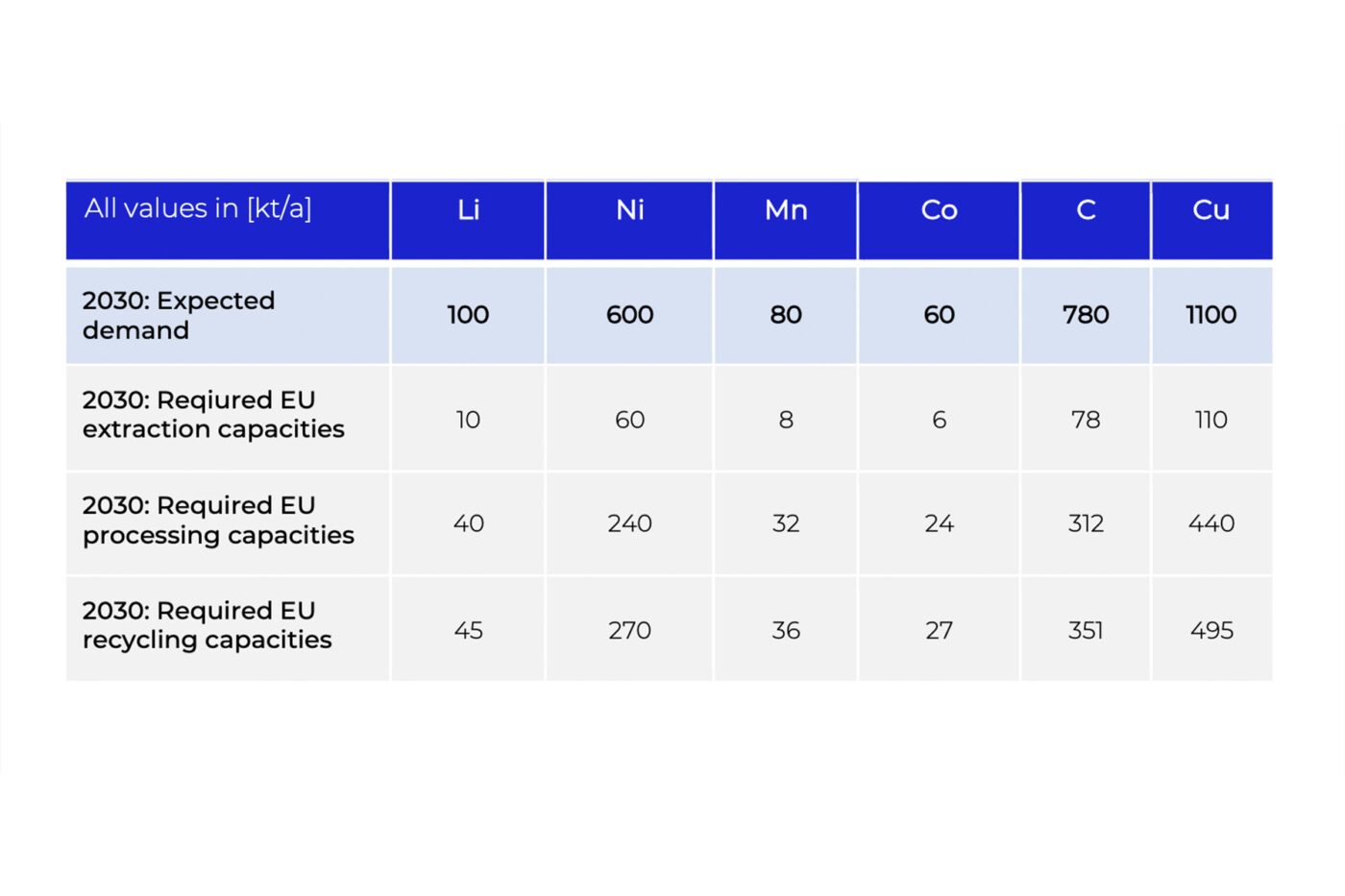

In a nutshell: The Net Zero Industry Act aims to cover at least 40 per cent of the EU’s annual energy requirements by 2030. The CRMA also specifies specific quotas (10 per cent local extraction, 40 per cent local processing and 45 per cent local recycling, with the 2030 demand as the base value).

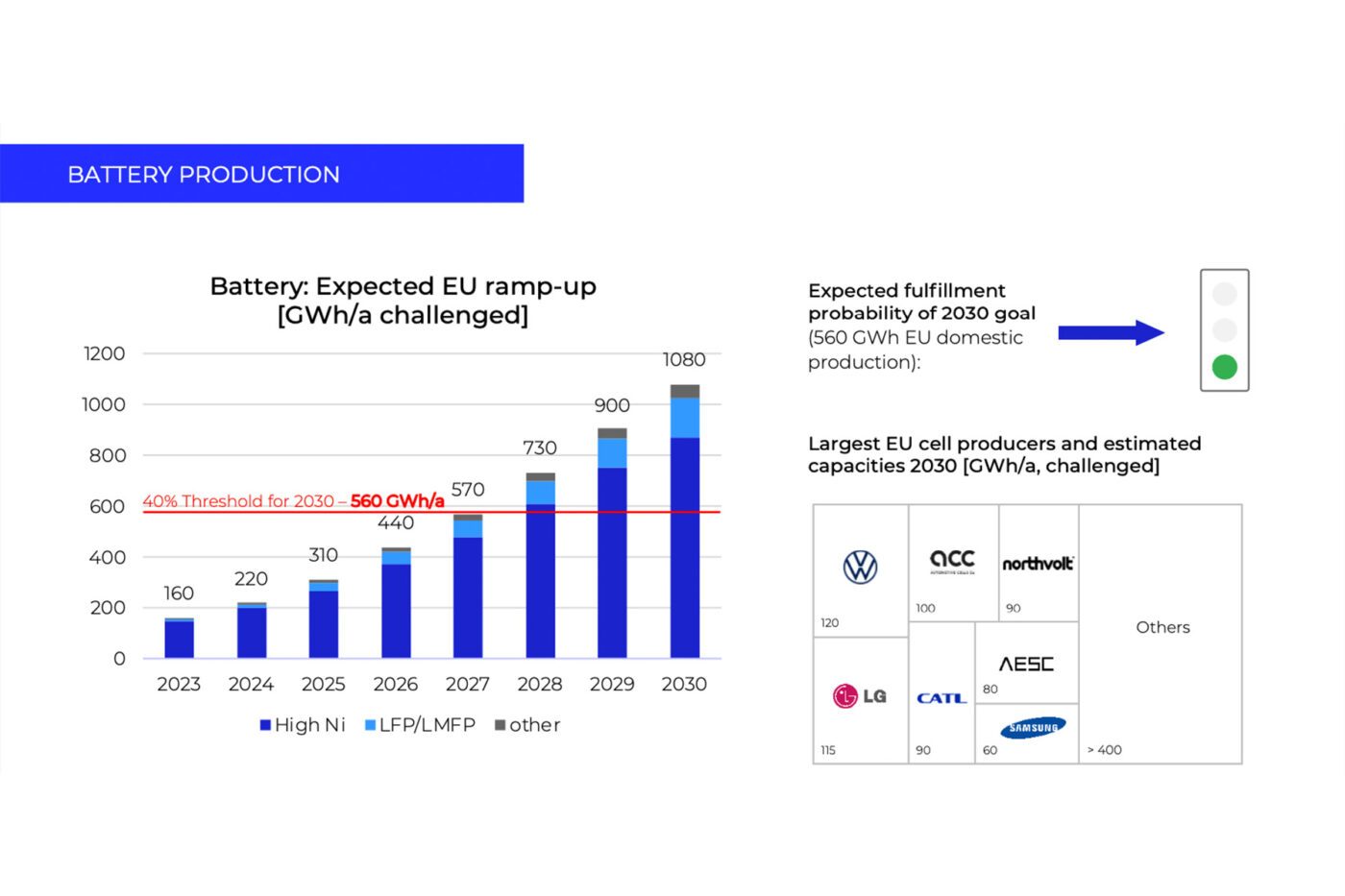

Specifically, the 40 per cent of demand from the NZIA means a production of 560 GWh/year of battery cells, 820 kilotonnes/year of cathode active material and 340 kilotonnes/year of anode active material for 2030. According to the manufacturers’ announcements, cell production will be achieved without significant problems – the plans of VW/PowerCo, LGES and ACC alone would exceed 560 GWh. However, P3 points out that of the six PowerCo cell factories announced in Europe by 2030, VW has so far only confirmed two projects – Salzgitter and Valencia. As the focus could shift to North America with the battery factory in Canada, there is at least a question mark over the 240 GWh/a announced by PowerCo. However, with the plans of the other cell manufacturers via CATL, Northvolt and AESC, the 560 GWh target could be achieved. But here, too, the announcements must first become reality.

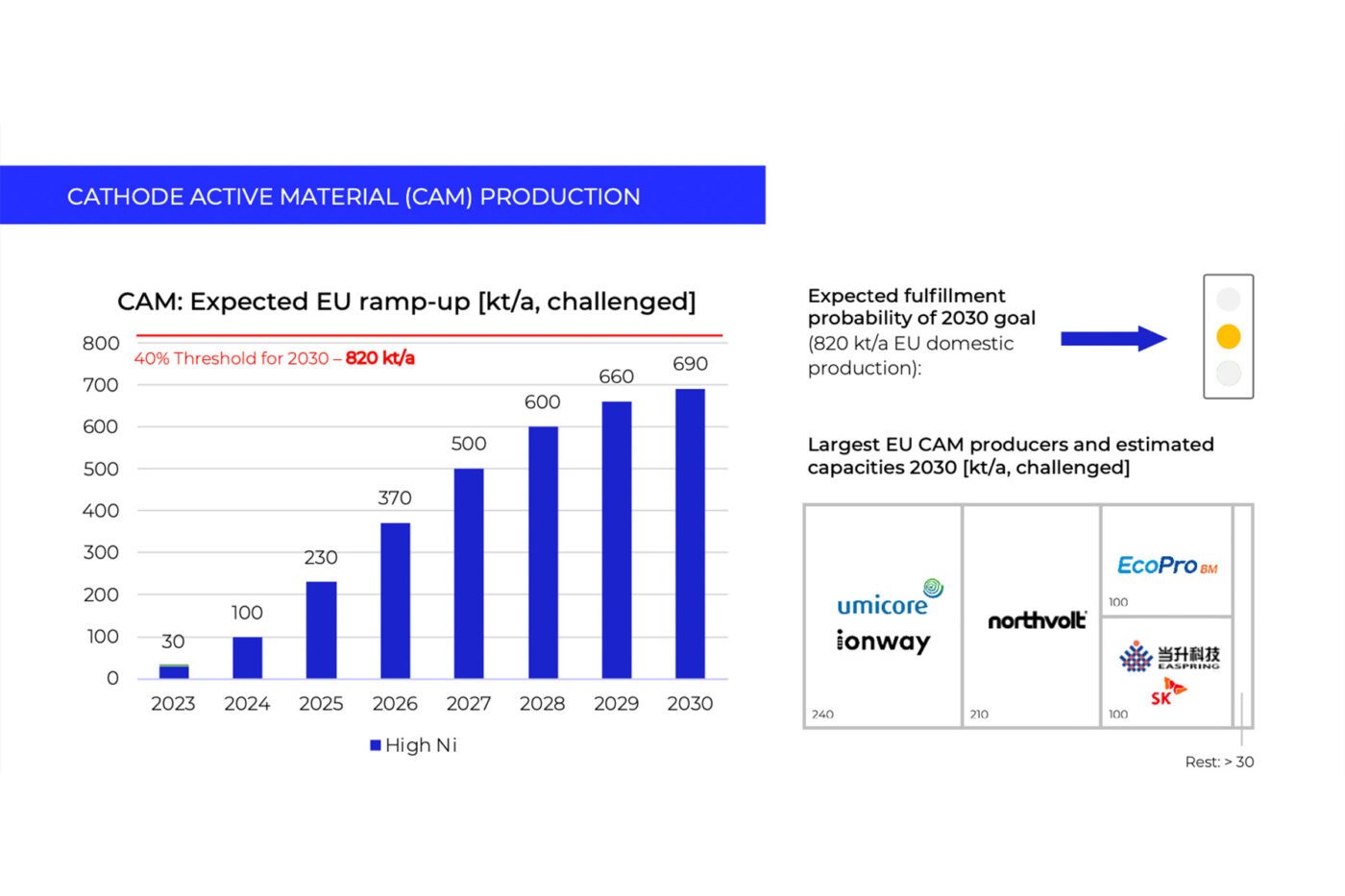

Regarding the production of active cathode material, the target seems achievable. According to announcements by companies such as Umicora, Northvolt, EcoPro BM, and others, the forecast for CAM production in 2030 is 690 kilotonnes. It’s not quite the 820 kilotonnes of the EU, but it’s not miles away either. However, virtually all the projects currently planned primarily involve producing nickel-containing cathode materials. Due to the cost advantages, P3 assumes that LFP and LMFP batteries will also increasingly gain momentum globally for low-cost vehicles. However, no LFP projects are planned in Europe. Freyr and the Finnish Minerals Group are looking into a collaboration but are also dependent on licences from the Taiwanese company Aleees.

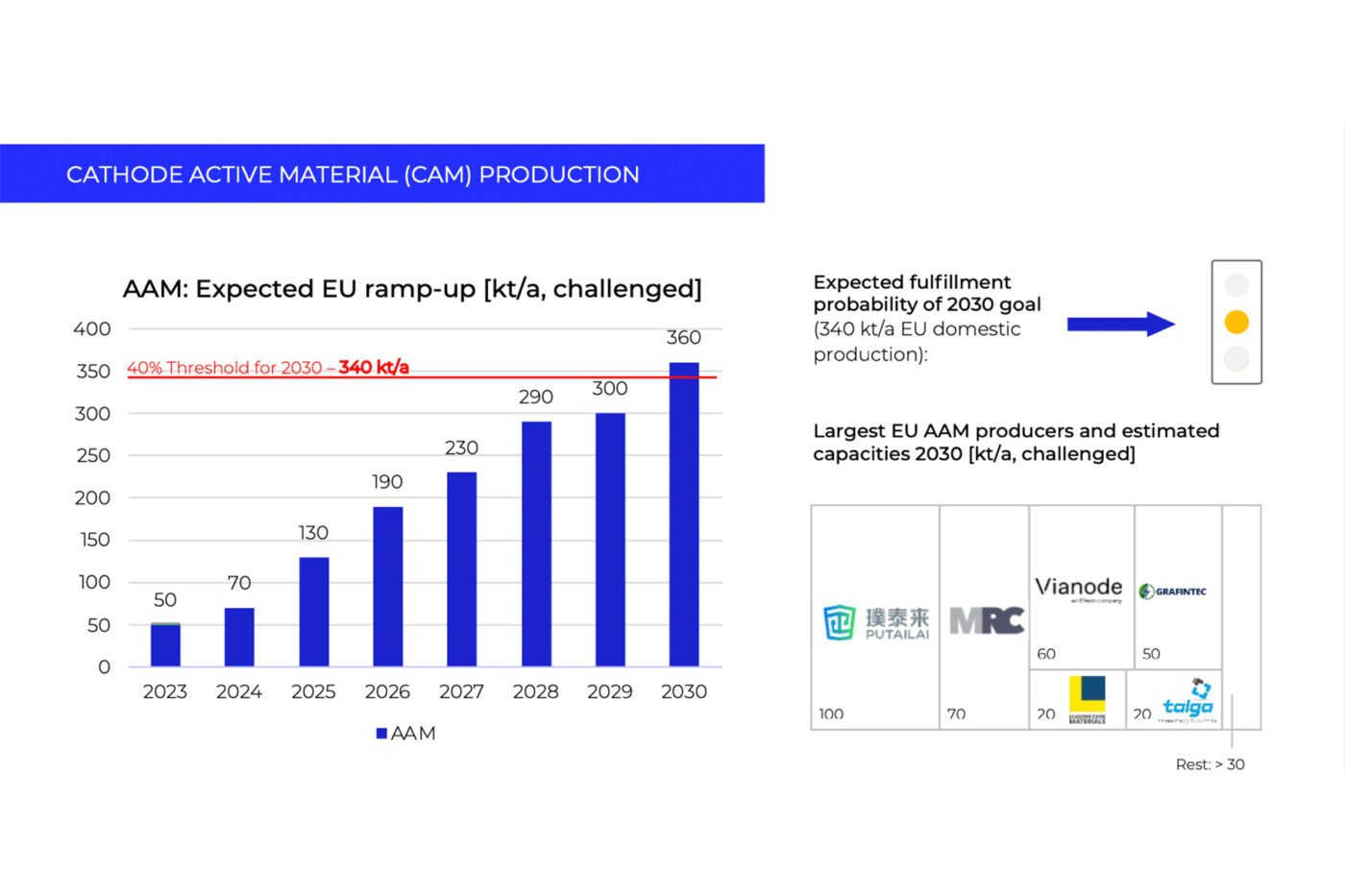

P3 also rates the situation for anode active materials (AAM) in 2030 as achievable. Although the forecast production of 360 kilotonnes in the target year exceeds the EU target of 340 kilotonnes, there is one major risk: the origin of the graphite. Although AAMs containing silicon will become more important, most battery cells will still rely on graphite in the anode in 2030 – and natural graphite comes mainly from China. Although production capacities for synthetic graphite in battery quality are gradually being built up by companies such as Vianode and Superior Graphite, the Chinese company Putailai is still likely to be the biggest player in the European market, with around 100 kilotonnes in 2030. “Although AAM sourcing has been so far reliant on China, and anode active material production in Europe is just at its start, the announced ambitious market entry and growth of graphite producers is expected to cause tight competition among the AAM manufacturers,” the analysis states.

In short: P3 assumes that the EU target production capacities for active cathode and anode materials specified in the legislation can be achieved. However, the big question mark is not the production and processing of the materials but still the origin of the raw materials. “Specific quotas for raw materials, covering extraction, processing, and recycling, reveal achievable goals for lithium but anticipate challenges for nickel due to limited local mining and processing activities,” the white paper’s management summary states rather soberly.

However, as the planned cathode production does not rely on LFP materials, as mentioned above, but on cell chemistries with a high nickel content, this raw material will play an important role in the future. Countries of origin today include Russia and Indonesia – the Indonesian government, in particular, is trying to build up a processing industry in the country based on its high nickel reserves. Exporting the raw materials to Europe is not a priority. “In forthcoming political discussions, the EU’s imperative lies in securing local End-of-Life and scrap materials, engaging in import agreement negotiations, and navigating the tension between enhancing battery lifespan and fulfilling recycling quotas,” says P3.

Lack of details makes it difficult to assess effectiveness

What does that mean for the development of a European battery industry? P3 recognises the “thoughtful intentions” but criticises the lack of concrete details in some areas. One example: “The act’s pursuit of an import substitution strategy falls short in addressing the fundamental challenge. Europe’s predominantly indirect exposure to bottlenecks in critical raw materials through global supply chains cannot be adequately resolved mainly through domestic mining and refining efforts. The legislation lacks sufficient details regarding international partnerships and their implications for specific objectives. The specifics remain unclear, although references are made to a raw materials club and partnerships.” And as it is clear that local raw materials are “assessed as insufficient for covering EU needs,” the EU must prevent the “unregulated loss of black mass” and secure all available material from scrap and used batteries. However, such export control measures are lacking.

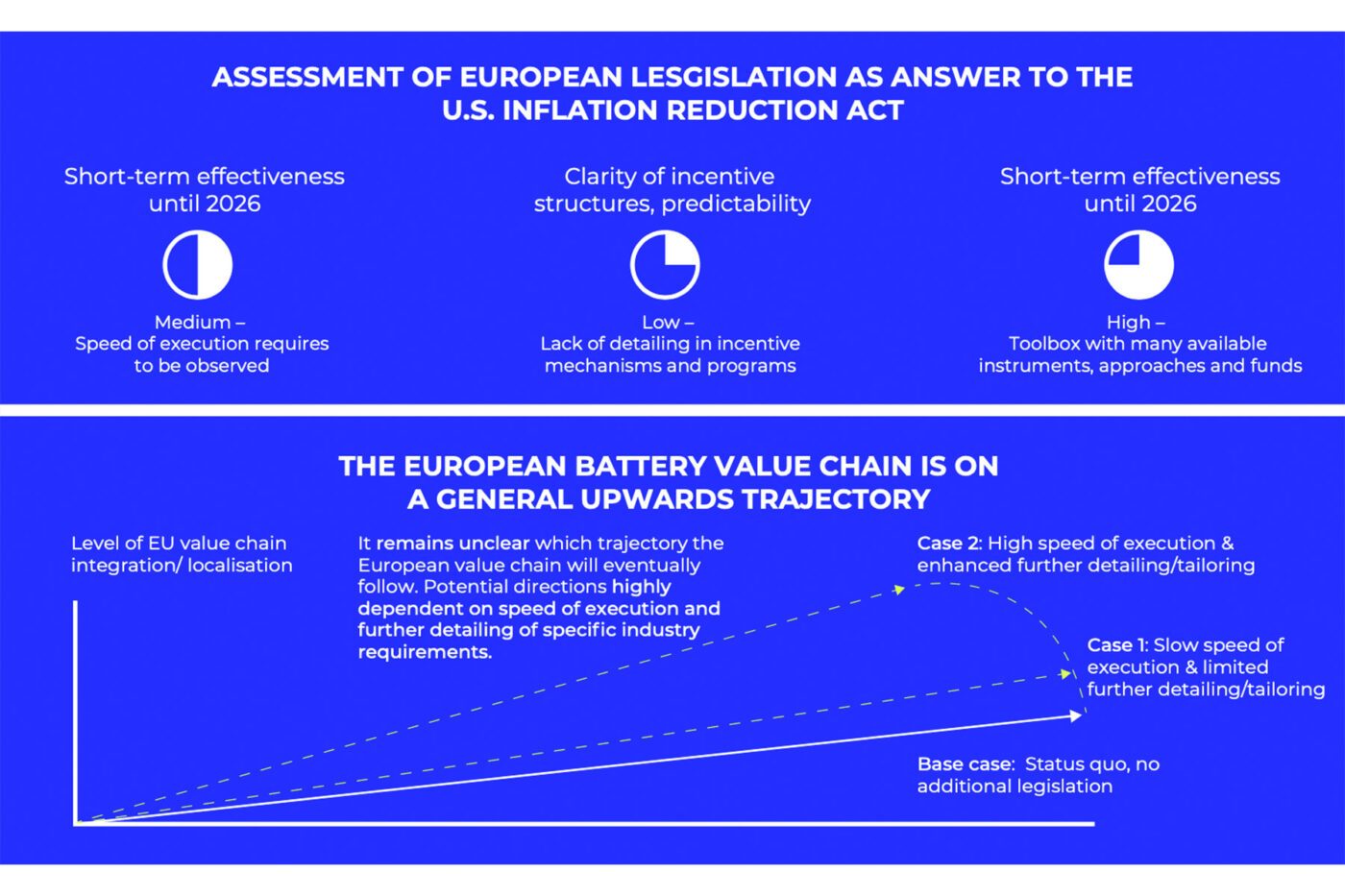

P3 rates the short-term effectiveness of the two laws as “medium” – the speed of implementation, in particular, needs to be monitored. However, there is a lack of clarity regarding the funding structures and their predictability for companies – which is why the benefits of the legislation are rated as “low.” “. Despite essential approaches, prompt execution of crucial matters, like expediting permitting speeds, is pending. The growth trajectory of the European battery ecosystem awaits decisions in the upcoming years,” the authors conclude.

Translation: Carla Westerheide

0 Comments