CAM report: Geely, VW and BYD are the most innovative EV manufacturers

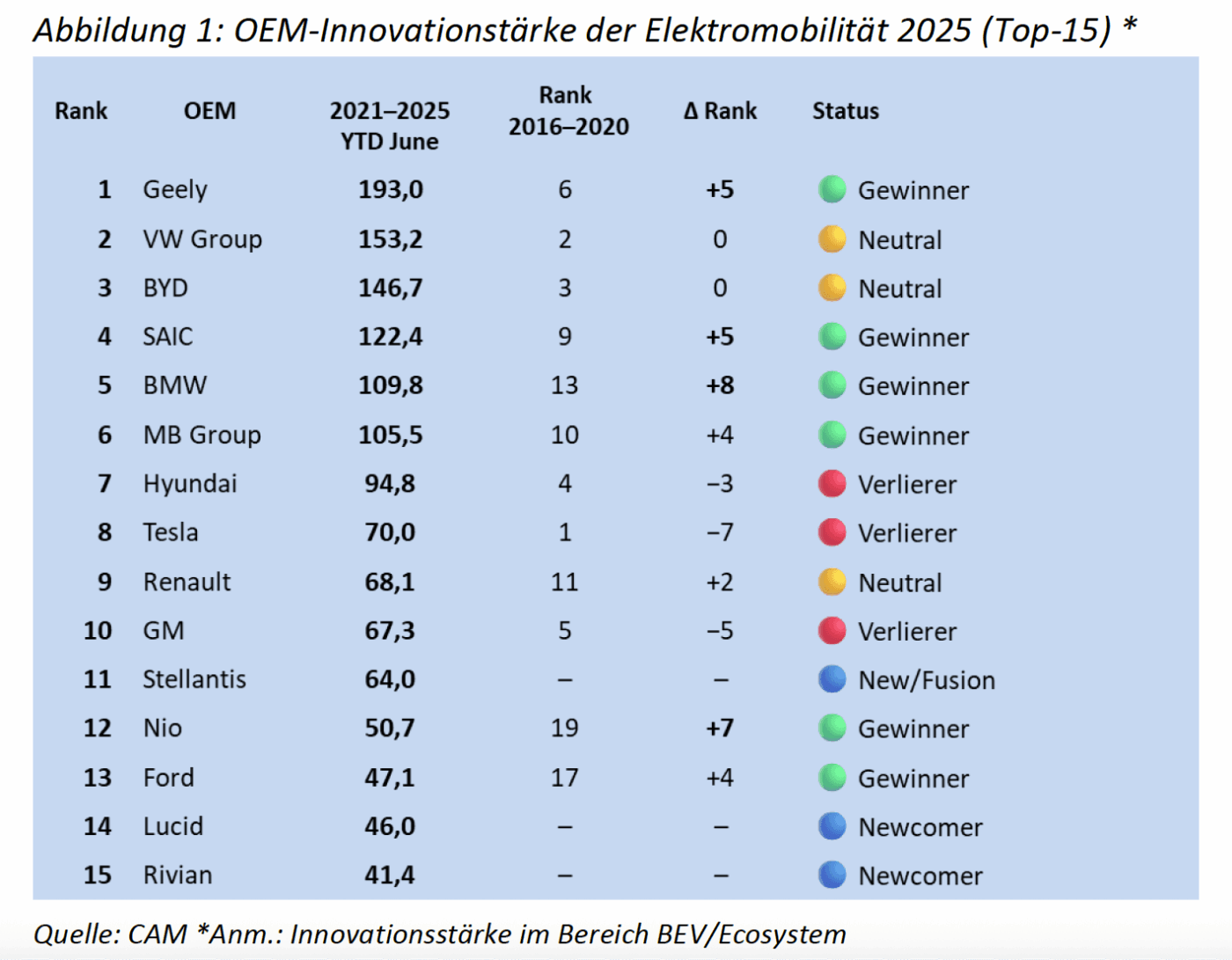

The Centre of Automotive Management (CAM) at the University of Applied Sciences for Economics (FHDW) in Bergisch Gladbach, Germany, is renowned for its regular analyses of the electric vehicle market. Led by Prof. Dr. Stefan Bratzel, the team has examined which series innovations the world’s leading manufacturers have recently introduced in the field of battery-electric vehicles (BEVs). Each innovation is assigned a score, a cumulative index value (innovation strength)—based on its maturity (series vs. concept), originality (world-first vs. company-first), customer benefit, and degree of innovation (low vs. high).

Methodology: The evaluation focused on the ‘CAM Triad’, comprising range, energy consumption, and charging power, which are considered the key customer-relevant performance parameters in electric mobility. Additionally, segment penetration (e.g., the first introduction of electric drivetrains in specific vehicle segments) and other innovation-relevant developments in electric mobility were taken into account. These include advancements in battery technology, charging control, and related system components. The ranking only includes innovations that were available for order by end customers between 2021 and 2025 in at least one relevant global passenger car market (particularly Europe, the USA, China, or Japan). A total of 713 series innovations in BEVs were recorded and evaluated.

China and Germany dominate the ranking

The analysis revealed that the Chinese Geely Group, with brands such as Lotus, Polestar, Volvo, and Zeekr, currently holds first place: based on 72 innovations, the group achieved a score of 193 index points. In second place is the German Volkswagen Group (153 index points), followed by the Chinese manufacturers BYD (147 index points) and SAIC—with brands like Maxus and MG—(122 index points) in third and fourth places. German manufacturers BMW (110 index points) and Mercedes-Benz (106 index points) occupy fifth and sixth places, respectively.

While the top six consists solely of Chinese and German manufacturers, the top 10 is completed by companies from France, South Korea, and the USA. Hyundai ranks seventh, Tesla eighth, Renault ninth, and General Motors tenth.

CAM highlights specific examples of innovations that contributed to the success of the top-ranking manufacturers: Geely, for instance, improved range and battery performance through continuous optimisations across brands like Zeekr and Polestar, including new battery systems and efficiency enhancements across multiple model generations. BYD set benchmarks in charging power and system integration with high-performance battery systems and a megawatt charging solution for EVs.

The VW Group focused on the industrial scaling of electric mobility and scored points with range and efficiency improvements in high-volume models such as the ID. family. BMW strengthened its innovation position through systematic range optimisations and efficiency measures in electric premium vehicles, such as the new electric SUV iX3, based on the Neue Klasse platform, as well as other BEV model ranges. Mercedes-Benz scored with innovations in the EQS and, more recently, in the all-electric CLA.

Focus on series-ready innovations drives sales

“The models from German car manufacturers now exhibit high innovation strength in electric mobility and can compete technologically with the equally highly innovative Chinese manufacturers,” said study leader Stefan Bratzel stated. “Innovation strength in electric vehicles is a key early indicator of future sales development in the BEV segment. Manufacturers that consistently focus their innovation activities on series-ready, customer-centric solutions lay the foundation for sustainable sales growth in an increasingly competitive market.”

Innovation strength is a necessary but not sufficient factor for market success in the early phases of innovation. Competitive vehicle pricing is also essential. “Accordingly, cost-reduction and scaling programmes along the value chain will play a crucial role for German automotive manufacturers in the future,” Bratzel added.

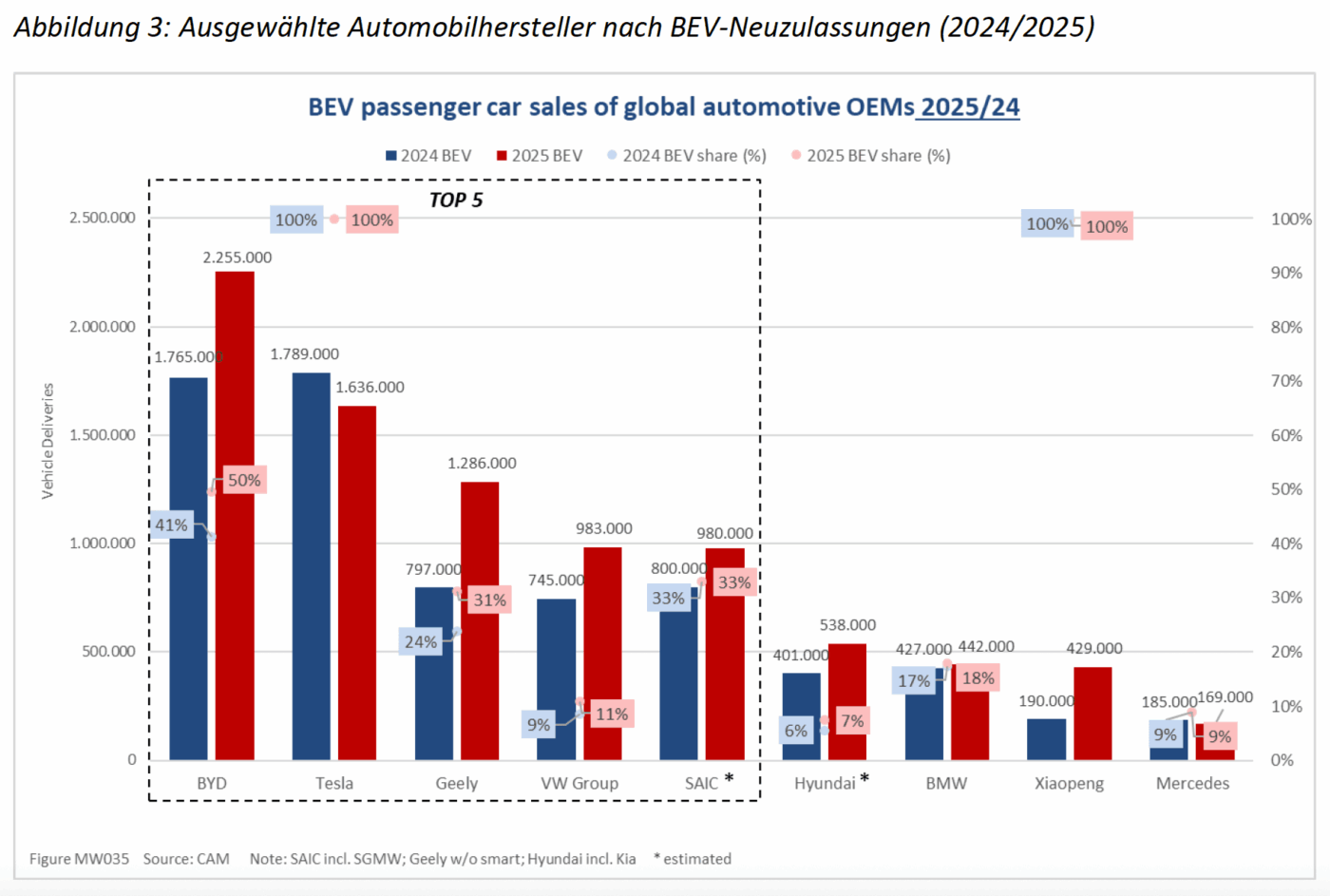

CAM also investigated whether there is a correlation between innovation strength and sales figures. Indeed, manufacturers with high and continuously growing innovation strength predominantly exhibited above-average sales dynamics in the BEV segment in 2025, while those with stagnating or declining innovation performance more frequently experienced market share losses.

Tesla Is the Biggest Loser

Tesla, which ranked first in the innovation ranking for the years 2016 to 2020, has now dropped to eighth place. It also emerged as the biggest loser in terms of sales figures between 2024 and 2025, with deliveries declining by 9.1 per cent to around 1.6 million electric vehicles.

In contrast, the innovation ranking leader Geely (including Volvo and Polestar) achieved strong growth, increasing its BEV sales in 2025 by over 60 per cent to 1.29 million units, driven by a broad model range and high market penetration in China. The share of BEV sales at Geely rose to 31 per cent. BYD, meanwhile, increased its BEV passenger car deliveries from around 1.8 million (2024) to 2.26 million vehicles in 2025 (+28 per cent) and simultaneously raised its BEV share of total sales to around 50 per cent. The VW Group also saw a 32 per cent increase in BEV sales, reaching around 983,100 units.

Source: Information via e- mail

1 Comment