Do ID.3 batteries cost VW under $100 per kilowatt hour?

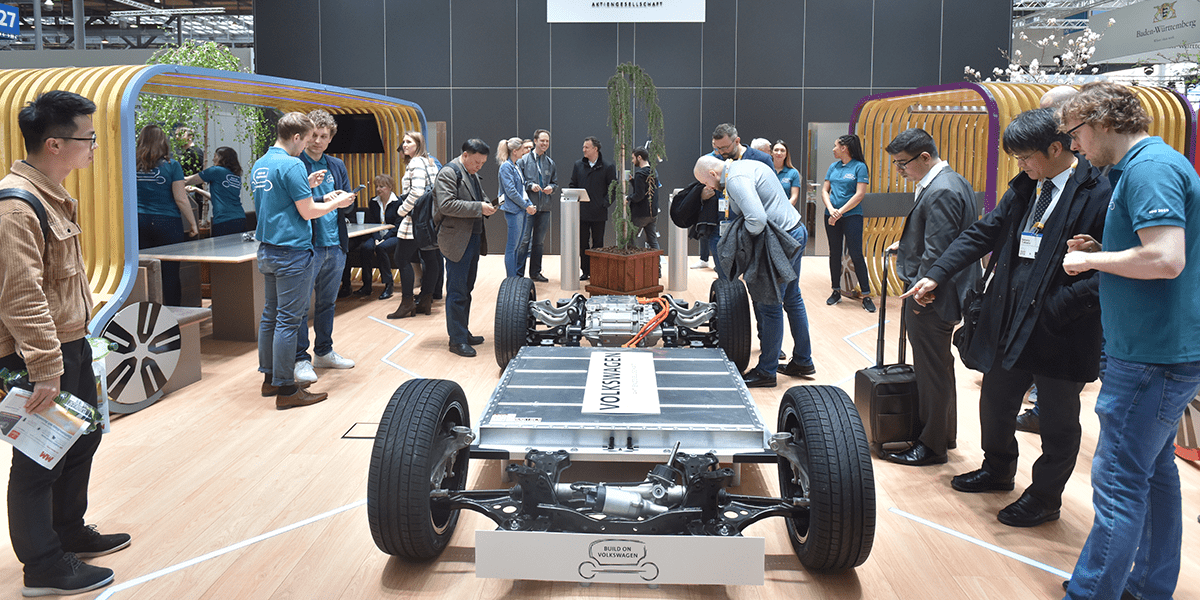

According to the New York Times, with its MEB platform, VW has already achieved costs of less than 100 US dollars per kilowatt-hour for the batteries in ID.3 due to economies of scale, years before expected. At the same time, VW negotiations with battery maker SK Innovation look shaky.

Although not expected for years to come, it seems electric cars can potentially already be made more cheaply than their combustion engine counterparts. Although the information came anonymously from the German car-making giant, it seems the Volkswagen is able to make batteries for its mass-market electric car, the ID.3 for less than $100 per kilowatt-hour due to their enormous economies of scale with their MEB platform. This marks the price-turning-point at which analysts have said a mass adoption of electric vehicles is invevitable.

In their lengthy review of the Volkswagen ID.3, the New York Times reported that, when asked about the battery rumours concerning VW battery costs, Ralf Brandstätter, COO for the division that makes Volkswagen-brand cars, simply grinned and said, “We are the company that will provide electromobility for all.”

Volkswagen has had to use a strategy of diversity in sourcing its battery cells in order to bring up the volume required for its mass-produced electric vehicles. VW very recently founded a battery cell joint venture with the Swedish company Northvolt, and the European companies are setting up a plant in Salzgitter will initially be able to produce 16 GWh and build up to 24 GWh per year. With this planned capacity, however, Volkswagen will only be able to serve a small part of their own electric car production’s demand. If the Group follows its current electrification strategy, it will have an annual demand of over 150 GWh in Europe by 2025. Similarly, large quantities of battery cells will likely also be needed by the German company in Asia. The purchase of cells from Asia will therefore inevitably continue on a large scale. VW currently purchases battery cells from the Korean companies SK Innovation, LG Chem and Samsung SDI as well as CATL from China. The partnership with CATL is currently limited primarily to electric cars produced in China, but with the planned CATL plant in Erfurt, the Chinese group could also become a VW supplier in Europe.

A recent report from the Korea Times suggests that the intended cooperation between Volkswagen and SK Innovation for the joint production of battery cells is becoming increasingly unlikely. The article suggests that the recent deal with Northvolt makes Volkswagen less keen. But SK Innovation seems unpeturbed.

“The talks over establishing the joint venture are ongoing,” an SK Innovation official said. “The reason it is taking a long time is that our deal if signed, will be a more comprehensive one on building a plant with an output greater than that of Northvolt. Though Northvolt came up with a visualised deal faster than us, we do believe that the chance of establishing the joint venture remains positive.” Some analysts are saying that it is unlikely that the plan will go ahead because of the additional burden of business uncertainties due to the legal dispute between SK Innovation and LG Chem.

nytimes.com, (battery cost) koreatimes.co.kr (SK Innovation)

0 Comments