ICCT reports some truck makers will easily meet EU CO2 targets

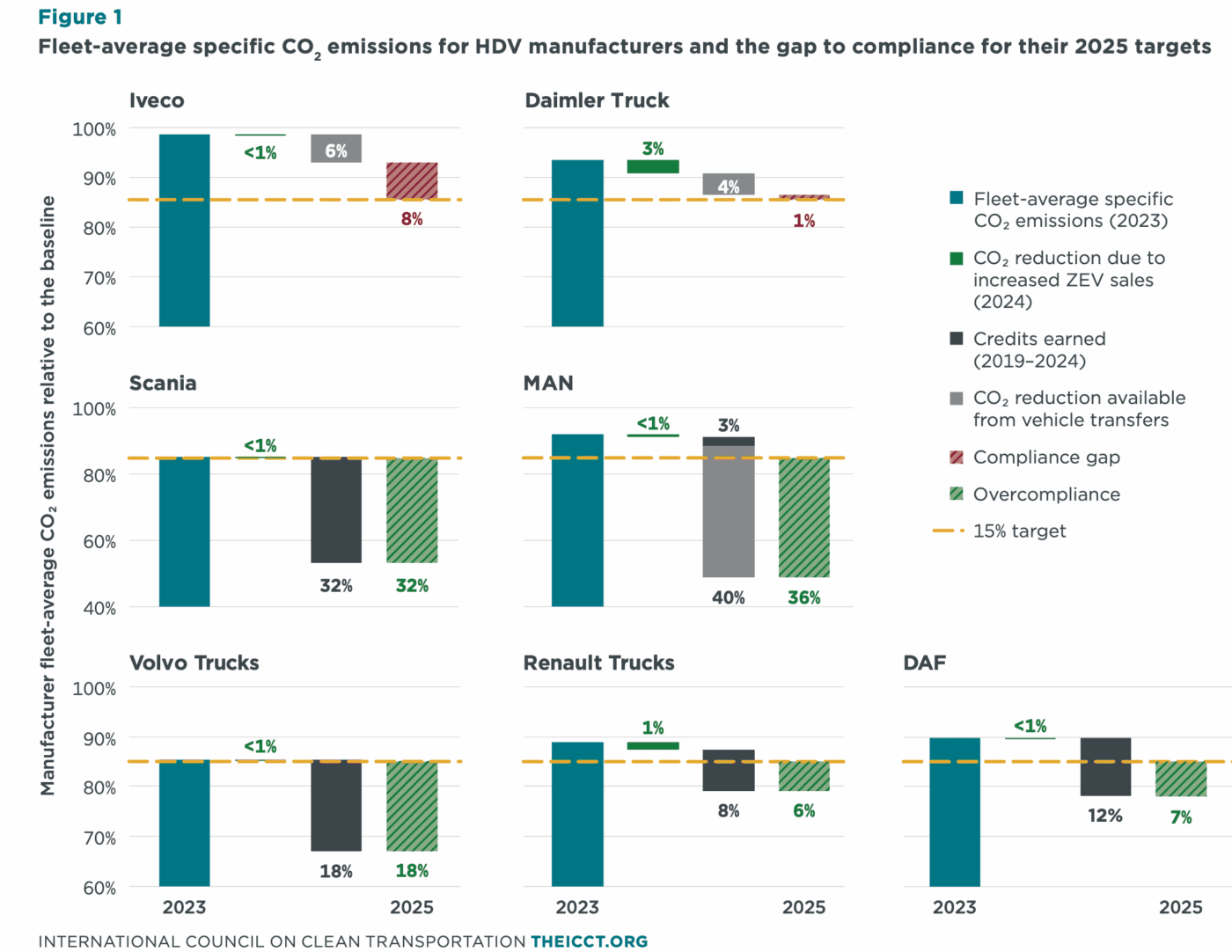

The CO2 standards for trucks and buses stipulate a 15% reduction in average emissions from new vehicles by 2025 compared to 2019. The ICCT report, called ‘Within Reach> The 2025 CO2 targets for new heavy-duty vehicles in Europe,’ shows that while Scania and Volvo Trucks will comfortably meet the 2025 EU-stipulated CO2 targets, Renault Trucks, DAF, and MAN can meet the targets thanks to early credits and compliance flexibilities. Iveco and Daimler Trucks have yet to close their compliance gap with the 15% target in the 2025 reporting period, extending from July 2025 to June 2026.

The publication, which is based on the latest official CO2 data from internal combustion vehicles and the latest data from national statistics on the sale of zero-emission (ZE) heavy-duty vehicles (HDVs), comes one day before the planned meeting between manufacturers and the European Commission in Brussels on 11 September.

In terms of market share, Daimler Truck is the largest manufacturer in this sector, with 19% of the EU’s truck market in 2024, Volvo Trucks with 15%, MAN and Scania each with 14%, while Iveco has 12%, DAF has 1 1% of the market share, and Renault Trucks has 8%.

Measures to meet targets

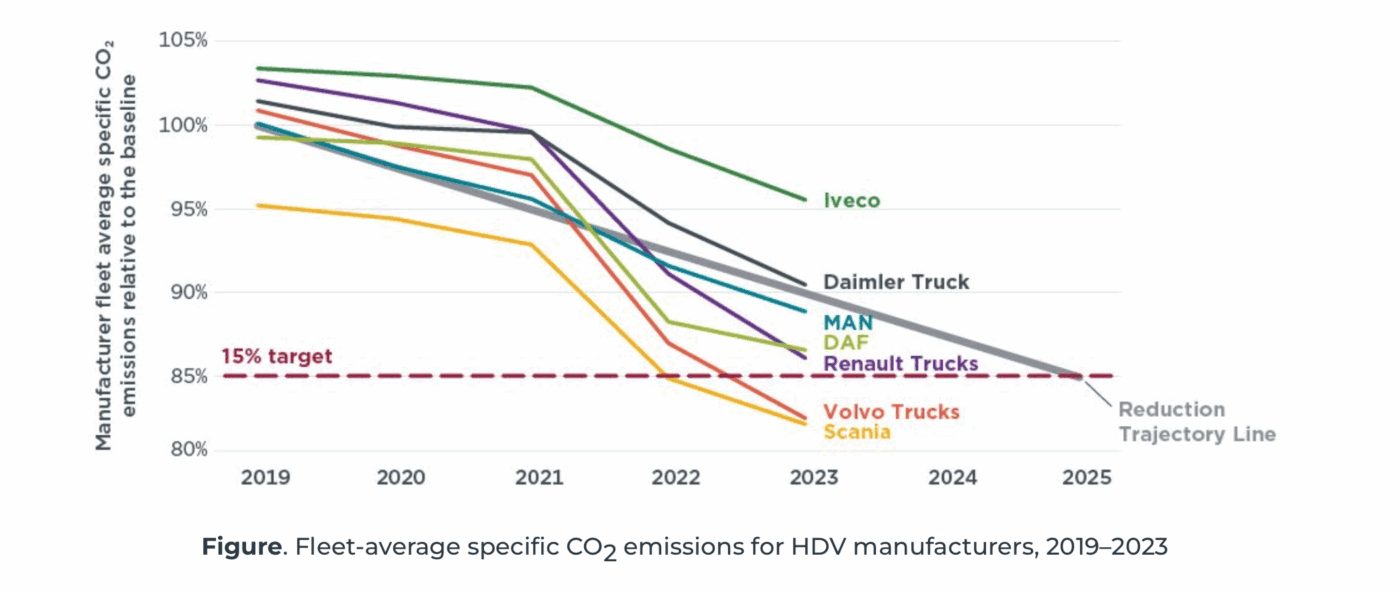

Manufacturers can achieve the CO2 fleet limits for 2025 with a mix of measures. Selling more zero-emission trucks (i.e. battery electric or hydrogen fuel cell electric trucks, BEVs or FCEVs) is the most obvious way. Making their combustion engines more efficient is also another important way for OEMs to meet targets. The ICCT points out, however, that manufacturers have so far relied heavily on improving the efficiency of their diesel engines as their main strategy for reducing CO2 emissions. According to data from the European Environment Agency, they reduced the average CO2 emissions of their fleets by 6 to 13 per cent between 2019 and 2023, almost solely through improvements in conventional vehicle technology. This not only involves engine improvements, but also aerodynamics, tyre technology and ADAS are levers that manufacturers can still pull.

Other mechanisms to meet EU CO2 stipulations can be made with credits acquired between 2019 and 2024 to offset non-compliance with the 2025 target. Companies can also calculate with vehicle transfers within parent companies, and to a certain degree, with limited electric truck transfers outside parent companies.

Volvo Trucks and Renault Trucks are both part of the Volvo Group, and MAN and Scania are both part of the TRATON Group. The CO2 standards allow for connected manufacturers to transfer HDVs as a compliance flexibility. This means these companies can freely transfer vehicles amongst each other within their groups. Scania has accumulated the largest share of credits of all manufacturers, which will benefit MAN in compliance.

Momentum gained or progress needed

The researchers established that Scania and Volvo Trucks will comfortably meet the 2025 target, having already reduced their fleet average CO2 emissions by 15% in the 2023 reporting period. Renault Trucks and DAF will also meet the 2025 target, thanks to early credit accumulation, as outlined above, in the 2019–2023 period due to the low CO2 output of their vehicles sold. MAN can already meet the 2025 target by relying on compliance flexibilities, as mentioned above, since Scania, also part of the Traton Group, has accumulated the largest share of credits of all manufacturers. Daimler Truck and Iveco face more challenging paths.

Daimler Truck will have to moderately improve its conventional vehicles or increase its zero-emission HDV share to reach the 2025 target. To comply, Daimler Truck will either have to increase its zero-emission HDV sales share to 3.4% by 2025 (up from 2% in 2024) or improve its diesel technology. The researchers surmised that a combination of these measures is expected. Iveco will be struggling the most to comply with EU CO2 standards for heavy-duty vehicles. Like Daimler Truck, Iveco will have to improve the average performance of its fossil-fuelled HDV, as well as increase its share of heavy-duty vehicles with electric motors.

In 2023, an ICCT report fuelled a new debate on heavy-duty vehicle emissions. In 2024, the EU Parliament approved stricter CO2 standards for trucks and buses. These targets roughly corresponded to the Commission’s original proposals and almost 1:1 to the provisional agreement between Parliament and Council. One change to the original proposal from the beginning of 2023 is that the target for 100 per cent zero-emission buses is no longer 2030, but the EU has granted an additional five years to achieve this goal.

The 2025 target is the first CO2-focused requirement that the EU has imposed on manufacturers. In this respect, it is uncharted territory for all companies.

theicct.org, theicct.org (report as PDF)

0 Comments