China’s EV battery market grows by 40 percent

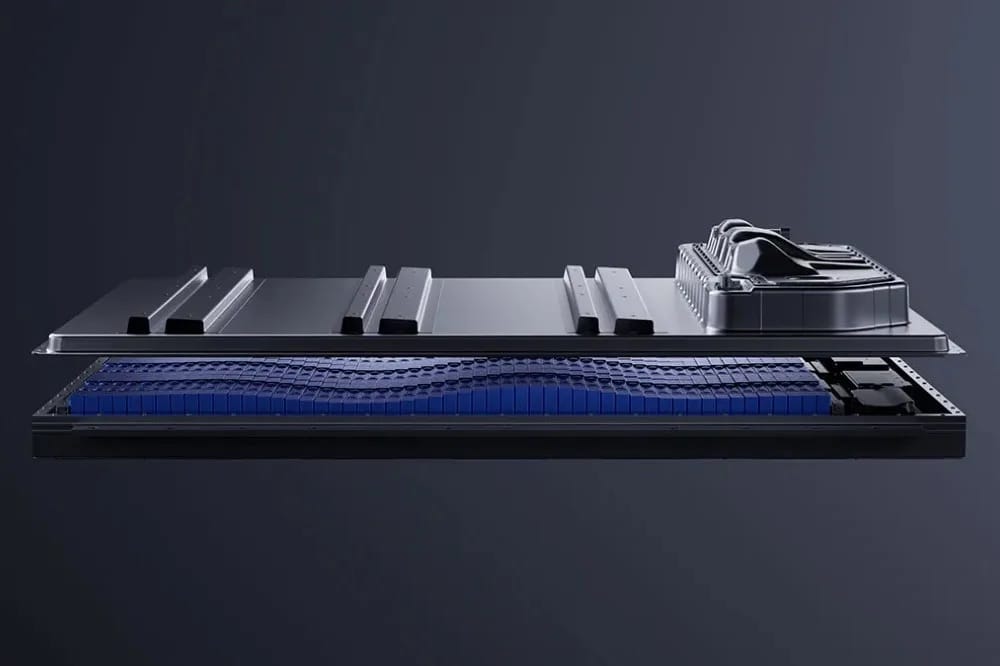

Lithium iron phosphate (LFP) battery chemistry has firmly established itself as the standard technology in China’s EV sector. Some car manufacturers, most notably BYD, have relied exclusively on LFP batteries from the outset. Others, such as Xpeng, have significantly expanded their LFP model ranges or completely overhauled their portfolios.

Even in premium vehicles, nickel-manganese-cobalt (NMC) batteries are no longer the default choice in China. Instead, they are increasingly being replaced by the more robust and cost-effective LFP cells, which – thanks to technological advancements – are gradually overcoming earlier limitations.

This shift is also reflected in the battery market: in 2025, LFP cells accounted for 625.3 GWh, or 81.2 per cent of China’s total EV battery market—a 52.9 per cent increase compared to 2024. Consequently, NMC batteries made up just 144.1 GWh, equivalent to 18.7 per cent of the market. The declining relevance of NMC batteries in China is further highlighted by their minimal growth of only 3.7 per cent, a remarkably low figure in the rapidly expanding Chinese EV market, for the reasons outlined above.

As charts from the portal CN EV Post, based on data from the China Automotive Battery Innovation Alliance (CABIA), show, China’s EV battery production in 2025 exceeded the previous year’s figures every month. This was not the case in 2024, when production in February, for example, was lower than in 2023. In 2025, February was once again the weakest month due to the multi-day celebrations around the Chinese New Year, yet production was significantly higher than in 2023 or 2024.

In December 2025, battery production nearly reached the 100 GWh mark, peaking at 98.1 GWh. Typically, production declines sharply at the beginning of the year, so no new record is expected in the first quarter. Even in December, LFP cells dominated the Chinese market, accounting for 81.3 percent of the volume, or 79.8 GWh. NMC batteries held an 18.6 percent market share. While the 18.2 GWh produced for NMC batteries in December set a new monthly record, the production level for NMC cells in China has remained stagnant since 2022—unlike LFP cells, which have seen substantial growth.

Two companies are primarily driving this growth: CATL and BYD. With 333.57 GWh of battery cells produced for electric vehicles, CATL remains the market leader in China with a 43.4 percent share, even though its market share has slightly declined from 45.1 percent in 2024. BYD follows with 165.77 GWh and a 21.6 percent market share—also a slight decrease from 24.7 percent. While other manufacturers have gained some market share from the two leaders, they have not significantly threatened their dominance. Companies like CALB, Gotion High-Tech, Eve Energy, Sunwoda, and Svolt Energy hold only single-digit market shares.

CATL’s dominance is even more pronounced in the NMC battery segment: of the 144.1 GWh produced, 101.6 GWh, or 70.9 percent, came from CATL. No other company achieved a double-digit market share: LG Energy Solution (13.75 GWh, 9.6 percent), CALB (12.73 GWh, 8.9 percent), and Svolt Energy still hold notable shares, but the market drops off sharply beyond these players.

In the LFP market, CATL is also the largest manufacturer, albeit with a much smaller lead over BYD. CATL’s 231.9 GWh corresponds to a 37.1 percent market share, while BYD follows with 165.7 GWh and a 26.5 percent share. In the LFP segment, Volkswagen partner Gotion High-Tech ranks third ahead of CALB, but with 42.9 GWh and a 6.9 percent market share, it lags significantly behind the top two.

cnevpost.com (overall market), cnevpost.com (by company)

0 Comments