Nikola secures fresh capital via shares

Nikola had already entered into an agreement to sell up to $300 million worth of shares to Tumim Stone Capital in June. Now the electric truck maker has signed a second purchase agreement with the investment bank, bringing the total to $600 million.

Since entering into the first agreement, Nikola has already sold nearly $47 million worth of common shares to Tumim, according to Reuters. Under the second purchase agreement, Nikola will have the right, but not the obligation, to issue and sell up to $300 million of additional common shares to Tumim. This is subject to a number of restrictions.

“The equity lines with Tumim, together with the estimated cash, will provide Nikola with access to approximately $800 million of liquidity by the end of 2021,” expresses Nikola CEO Mark Russell.

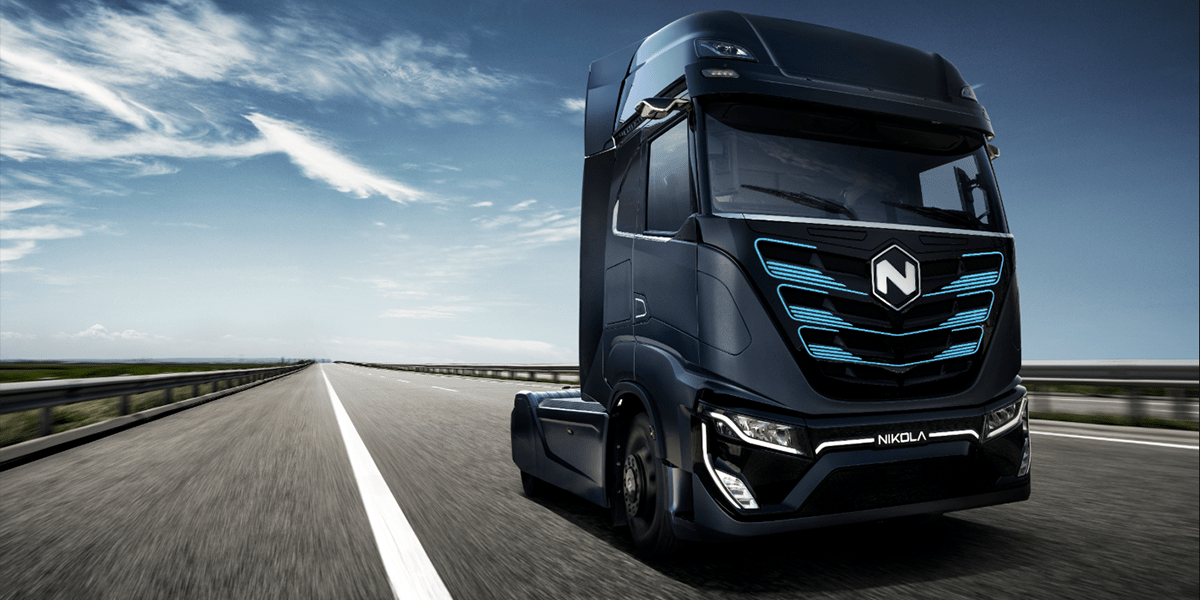

This is relevant because Nikola plans to start low-volume production of the battery-electric Nikola Tre in Ulm, Germany, later this year. For the Nikola Tre destined for Europe, the US start-up will supply the electric drive train, for example, while Iveco will supply the well-known S-Way platform including the driver’s cab. As reported, assembly will take place at the plant of Iveco’s parent company CNH Industrial.

The first examples are to go to selected customers in the USA. Next year, the Tre will also be deployed in Europe. Among others, the port of Hamburg is to become a pilot customer in Europe. In the medium term, production in Ulm is to increase to 3,000 vehicles per year.

After the introduction of the battery-electric Tre in North America and Europe, Nikola then plans to launch two FCEV trucks. Nikola entered the eMobility stage a few years ago with the latter drive concept. But behind Nikola lie uncertain times: After a short-seller attack last year, many investors lost confidence in Nikola, founder and CEO Trevor Milton had to resign – in the meantime, the New York State Attorney General’s Office has indicted Milton.

As a result, a planned investment by General Motors never materialised, and Nikola had to stop the Badger electric pickup project. Instead of cooperation, a memorandum of understanding was concluded according to which GM is to supply fuel cells for Nikola’s planned trucks – but only if both parties can agree on the conditions and Nikola pays in advance. Since Nikola, according to the latest information, purchases fuel cells from Bosch, no agreement could apparently be reached. Bosch itself had reduced its shares in December 2020 after a holding period expired.

As a result, Nikola had to realign itself under new CEO Mark Russell. In February 2021, the target for the current year was reduced from 600 to 100 vehicles for customer testing. In August, this target was revised downwards again, to 25 to 50 vehicles – due to “numerous” delays related to the procurement of parts.

0 Comments