Market analysis: Electric buses keep booming in Europe

The electric bus boom in Europe continues, as the registration figures in 2021 show. After 2,210 electric buses in 2020, a further 3,282 electric buses (in each case excluding trolleybuses) were newly registered in 2021, with manufacturers competing for market shares. So who is leading the charge?

* * *

In contrast to coaches, business with scheduled and intercity buses is still going well. “And at a relatively high level,” as Wim Chatrou explains. The Dutchman has been analyzing bus sales data for 25 years. As a result, Chatrou CME Solutions’ documentation is in demand among manufacturers, market observers, and analysts, and Chatrou granted electrive exclusive insight into the numbers.

For his research, Wim Chatrou accesses registration data from the official authorities in each country, for example, from the RAI Data Center in the Netherlands (RDC) or the Kraftfahrt Bundesamt (KBA) in Germany. “The respective registration figures also include deliveries by manufacturer in each country,” Chatrou told electrive.

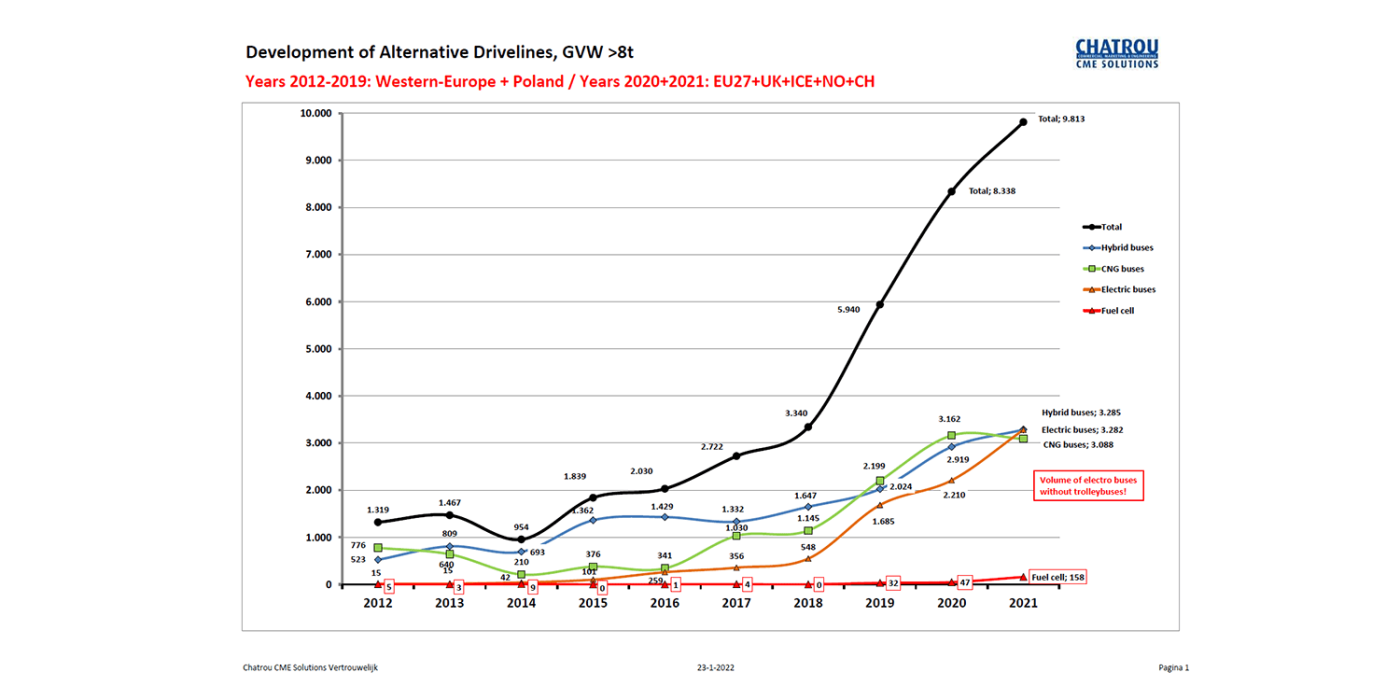

Of 14,990 new public buses registered in 2021 in the European markets (EU27 expanded with UK, Iceland, NO, CH), 59.4 per cent are already equipped with alternative drives. One of Wim Chatrou’s graphs visualizing the development of these powertrains from 2012 to 2021 shows a steady increase in newly registered electric, fuel cell, CNG and hybrid buses since 2017.

Last year, electric buses even overtook CNG vehicles. The share of battery-electric transit buses increased from 14.8 per cent in 2020 to 21.7 per cent in 2021. On the other hand, the percentage of natural gas buses (predominantly CNG, only a few Irizar/Scania buses with LNG are listed) dropped significantly, from 17.7 (2020) to 14.8 per cent (2021). In numbers, Chatrou CME Solutions allocates 3,282 new electric vehicles in 2021, while CNG buses come in at 3,088 units.

Hybrid buses, mostly mild hybrids, are still making slow progress: registrations climbed from 19.7 to 21.8 per cent or 3,285 vehicles. However, buses with fuel cells made a significant leap forward; after 47 vehicles in 2020, the statistics for 2021 report a total of 158 new entries in this segment. After a market share of only 0.3 per cent in the previous year, “hydrogen city buses” already achieved a share of 1.1 per cent in the alternative drive system segment in 2021, with a view to 14,990 city buses.

The market of suppliers is as manageable as their share. Only a few bus manufacturers serve this H2 segment, with Caetano, Safra, Solaris, Van Hool and Wrightbus. Two Elec City FuelCells from Hyundai also appear in the 2021 statistics. The Koreans have approved these as customer-driver trials and are testing their use with transport operators throughout Europe.

From 2012 to 2021, 259 hydrogen city buses were registered in Europe, with the largest suppliers during this period being Belgian manufacturer Van Hool with 96 buses, followed by Wrightbus from Northern Ireland with 71. Solaris from Poland delivered 38 units, Portuguese bus manufacturer Caetano came up with 24 buses, and Safra with 19. They were joined by four from Mercedes-Benz and VDL, two Hyundai vehicles and one from Solbus.

In Germany, 33 units were registered in the segment in 2021, as Chatrou CME Solutions has determined. This means the German government’s billion-euro hydrogen offensive is showing slow progress so far.

In the high-tech hydrogen country of Germany, there is a lack of domestic suppliers; Daimler Truck will decide whether to build on liquid or gaseous hydrogen for its bus division by 2024 and then offer corresponding buses. Because the battery-electric Citaro series is currently a bestseller, the eCitaro with H2 range extender has reportedly been put on hold for the time being. It is not due to come onto the market until 2024 at the earliest. Furthermore, Volkswagen AG ultimately holds back on hydrogen in the commercial vehicle sector with the German MAN brand in the city bus segment. This also applies to the company’s H2 combustion engines, which are being further developed.

Leading electric bus manufacturers

Also, looking at all alternative drives, German brands do not hold the most significant market shares in Europe. Mercedes-Benz is shining in terms of new registrations in Germany. However: Of 555 new electric buses registered in Germany in 2021, the eCitaro accounted for 251. The electric bus market rose from 350 new vehicles in 2020 to well over the 500 mark in 2021, with a whopping 45 per cent of all new electric buses in Germany last year bearing the star.

The volume of regular-service buses (and especially those with alternative drives) does not appear to be suffering from the pandemic; since 2019, the number has remained at a relatively high level. Alternatives have long since outgrown the niche, and regular-service buses with alternative drives are an integral part of manufacturers’ portfolios across Europe. In 2020, 8,338 new vehicles were registered for regular-service buses (urban and intercity segment) with alternative drives (hybrid, CNG, electric and fuel cell buses), and in 2021 the total was 9,813 vehicles.

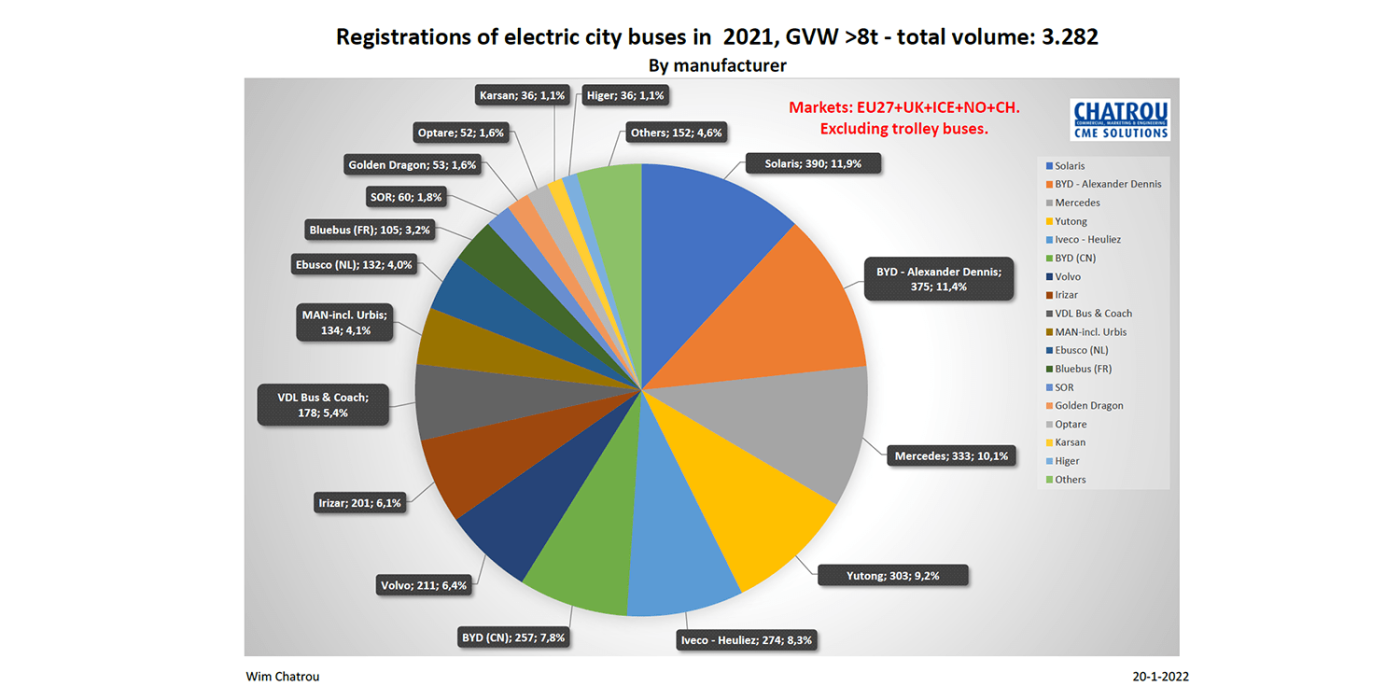

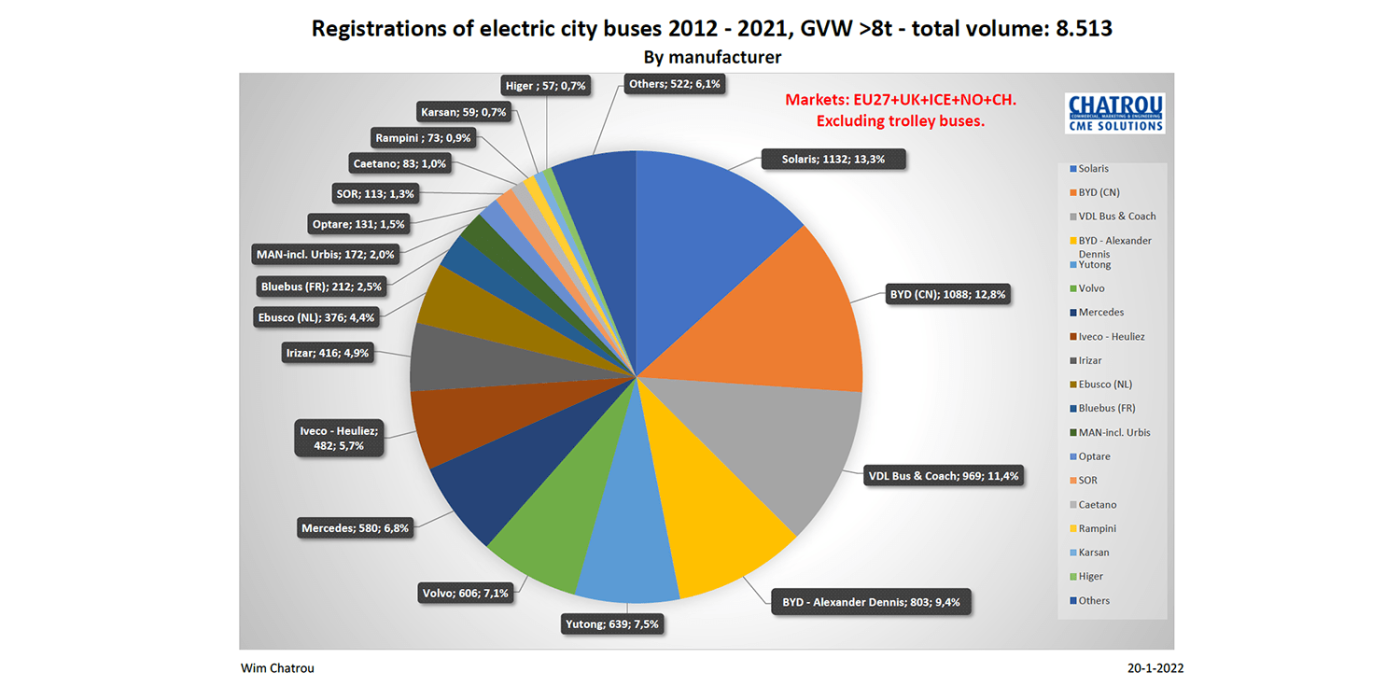

As the registration figures for buses in 2021 show, the electric bus boom continues. Chatrou reports 390 of 3,282 new electric buses for Solaris, bringing the Polish brand under the Spanish manufacturer Construcciones y Auxiliar de Ferrocarriles (CAF) to 11.9 per cent across Europe last year. Looking at the statistics from 2012 to 2021, Solaris is also in the lead, with 1,132 or 13.3 per cent in total.

Other reports often suggest the Chinese brand BYD holds first place in Europe. This is indeed the case if you add the electric buses of other brands built on an electric bus chassis from BYD to the company’s electric buses. In the United Kingdom, BYD cooperates with Alexander Dennis. In 2021, the combination accounted for 375 electric buses or 11.4 per cent. BYD-only-branded electric buses accounted for 7.8 per cent or 257 units in 2021.

Looking at the decade documented by Chatrou CME Solutions, a total of 1,088 electric buses are recorded for BYD alone from 2012 to 2021, and another 803 for ADL with BYD. Purely a matter of opinion, but in future, one will also have to ask how electric bus chassis offered by Mercedes-Benz or Volvo Buses should be included in the statistics. If BYD in the UK insists on cooperation with ADL, statistics should list these vehicles independently.

Yutong remains ahead of BYD

However, it should not be underestimated that the Chinese, like BYD, still captured a 7.8 per cent market share in 2021. Even more astonishing is that this only puts them in 6th place, behind Yutong. Quietly, Yutong took 4th place in Europe in 2021 by selling 303 electric buses. Over 100 vehicles each in Denmark and the UK show that business likes to be done on volume.

The Zhengzhou Yutong Group was founded as a joint-stock company in 1993, and in the early 2000s, with the help of a cooperation agreement with MAN, the Chinese succeeded in bringing buses up to international standards. As a result, global sales opportunities quickly improved. In 2005, Yutong Europe was founded in Iceland, and since 2013 Yutong has been on the market in Great Britain and Ireland.

And since 2019, at the latest, Yutong has arrived throughout Europe, not only as an exhibitor but also as a bus manufacturer for European customers. The Chinese have now learned what was not self-evident for years: they need their own design language. With the U12 electric bus, Yutong showed in Brussels that it has understood that in Europe, more emphasis is placed on geometric lines drawn with a pencil than on something free-form painted with a brush.

Even if it is not yet primarily vehicles from the U12 series, Yutong is selling just as well in France, Italy and Portugal as in Finland and Norway or even Poland. Yutong is not yet active in Germany, but BYD has found its first German customer in Bochum-Gelsenkirchener Straßenbahnen AG, which has had 22 electric buses from Chinese production in its fleet since 2020.

A look at the Chinese market shows how well the company has mastered the electric bus business there. Yutong registered 15,940 new electric buses in 2020 in China. BYD comes in at 9,125 electric buses, with CRRC in third place with 5,503 electric buses. However, BYD suffered a severe setback in its home market and recorded a significant drop in production last year. As a result, the company sold only 5,772 electric buses in China in 2021.

Reasons lay on the one hand in the changed subsidy policy of the Chinese government for the domestic NEV market and the Covid-19 pandemic resulting in postponed orders, as BYD explains. But, at the same time, BYD can also report a real milestone: the first electric bus was unveiled in 2012. In January 2022, ten years later, the Chinese manufacturer says it produced its 70,000th electric bus.

BYD built 70,000 electric buses within ten years

After all, 2.5 per cent of them have hit the road in Europe, BYD said. Despite declining production figures in 2021, BYD is determined to expand further in electric buses because the market is booming not only in Europe. Although the Chinese rely on different strategies in this regard, acting locally has always played a part, as the cooperation in the UK with Alexander Dennis or the assembly plant in France, which has now been closed again, show.

It remains exciting because with the politically desired hydrogen and new battery generations, the intercity and touring segments are next to electrify after the city buses. Europe is following a trend that can already be seen in China and the USA.

What about the German manufacturers? Mercedes-Benz moved up to No. 3 in the ranking of Chatrou CME Solutions statistics for Europe last year, and looking ahead from 2012 to 2021, the company is in 7th place with a market share of 6.8 per cent in Europe. And MAN? 10th place last year, 12th place and a market share of two per cent in the ten years covered. Both manufacturers currently only offer battery-electric city buses.

Last year, MAN presented a new overland generation, entirely conventional with a diesel engine. From 2023, this is to be followed by an efficient hybrid system with automatic start-stop; an electric variant has not yet been announced. The situation is different at Daimler Truck: The overland segment is left to the Setra brand. An exciting new series has been announced for 2023.

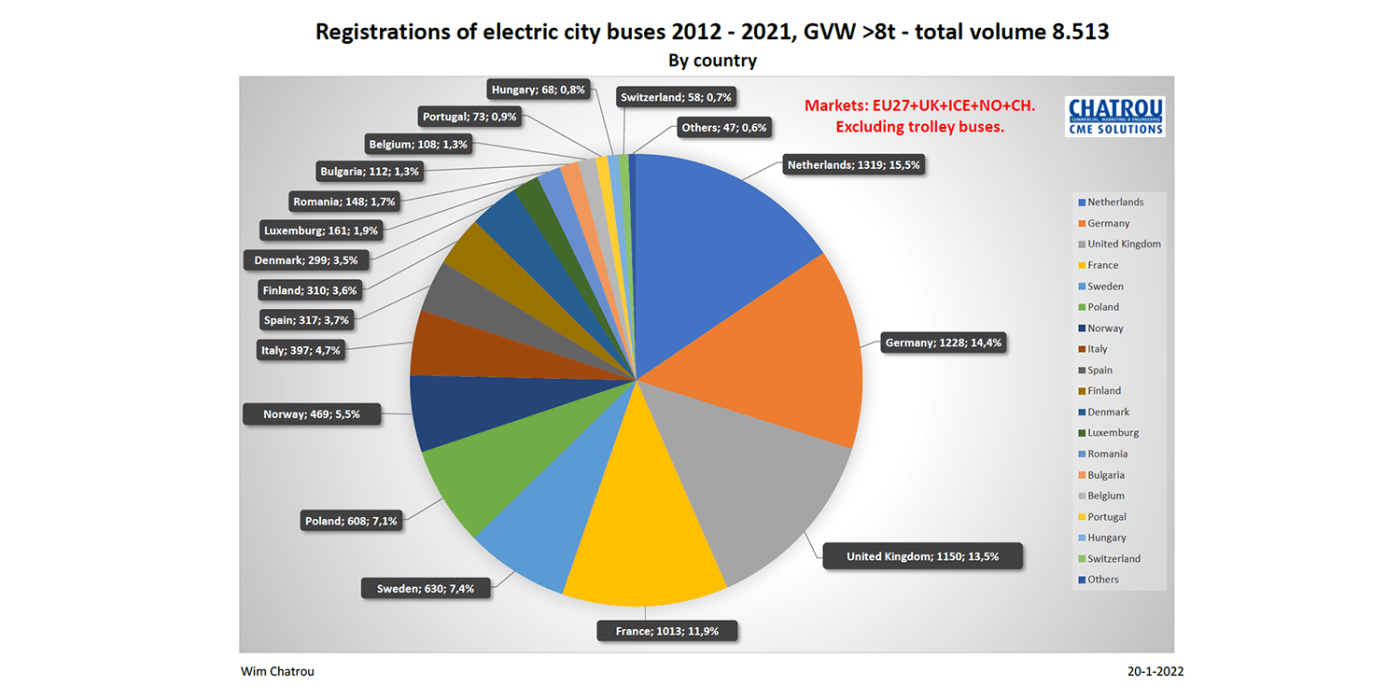

Zero-emission bus sales by country

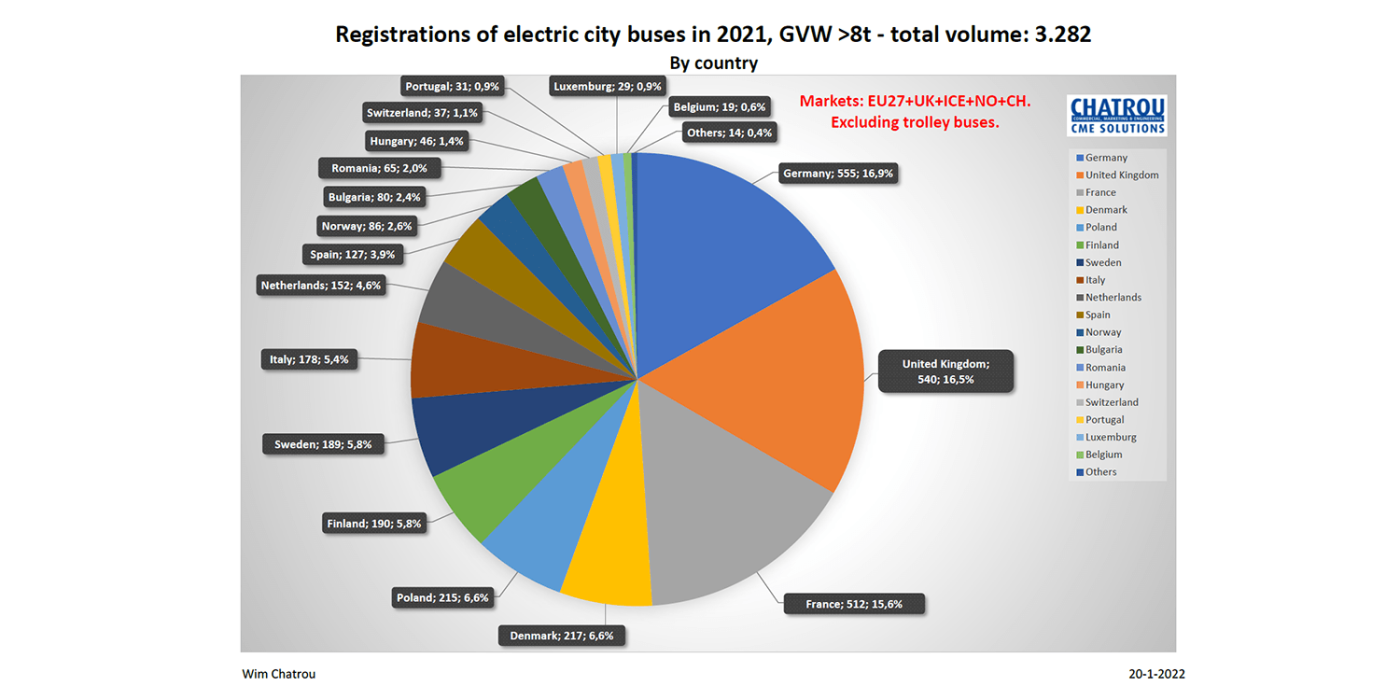

In addition to the manufacturers, it is also worth looking at the individual markets. Over the entire decade between 2012 to 2021, the Netherlands dominated the electric bus market with 1,319 vehicles or 15.5 per cent of the total 8,513 electric buses registered to date. Germany meanwhile reaches 2nd place with 1,228 e-buses and 14.4 per cent, closely followed by the United Kingdom with 1,150 e-buses and 13.5 per cent. Next up was France (11.9 per cent), Sweden (7.4 per cent), Poland (7.1 per cent), Norway (5.5 per cent), Italy (4.7 per cent), Spain (3.7 per cent) and Finland (3.6 per cent).

2021 brought change, however. The European electric bus leader, the Netherlands, fell to 9th place with only 152 new electric buses, while Germany took first place with 555 new electric buses or 16.9 per cent. Second place in 2021 was taken by the United Kingdom with 540 vehicles or 16.5 per cent, with France following in third place with 512 electric buses and 15.6 per cent. The 2021 ranking is then completed by Denmark (217/6.6 per cent), Poland (215/6.6 per cent), Finland (5.8 per cent), Sweden (5.8 per cent), Italy (5.4 per cent), Netherlands (4.6 per cent) and Spain (3.9 per cent).

After ten years of intensive market observation and analysis, it is clear to Wim Chatrou that the electric bus business remains quite an exciting one: “Manufacturers keep changing places in the individual countries, and the top positions in Europe are fiercely contested.” And further, he emphasizes, “The figures for 2021 say nothing about the order backlog or what still needs to be delivered in 2022 or later.” Here, manufacturers will present their order intake in the current year and show how well their products are received in the growing electric bus market if orders and options are communicated accordingly.

Guest author: Rüdiger Schreiber.

Localisation and translation: Nora Manthey

1 Comment