CAM study finds Germany & China staying on EV course

The Center of Automotive Management published its latest report on new electric car registrations in 2022. CAM found the EV markets in Europe and China grew against the globally declining market trend. There was a lot of movement, especially among the Chinese manufacturers.

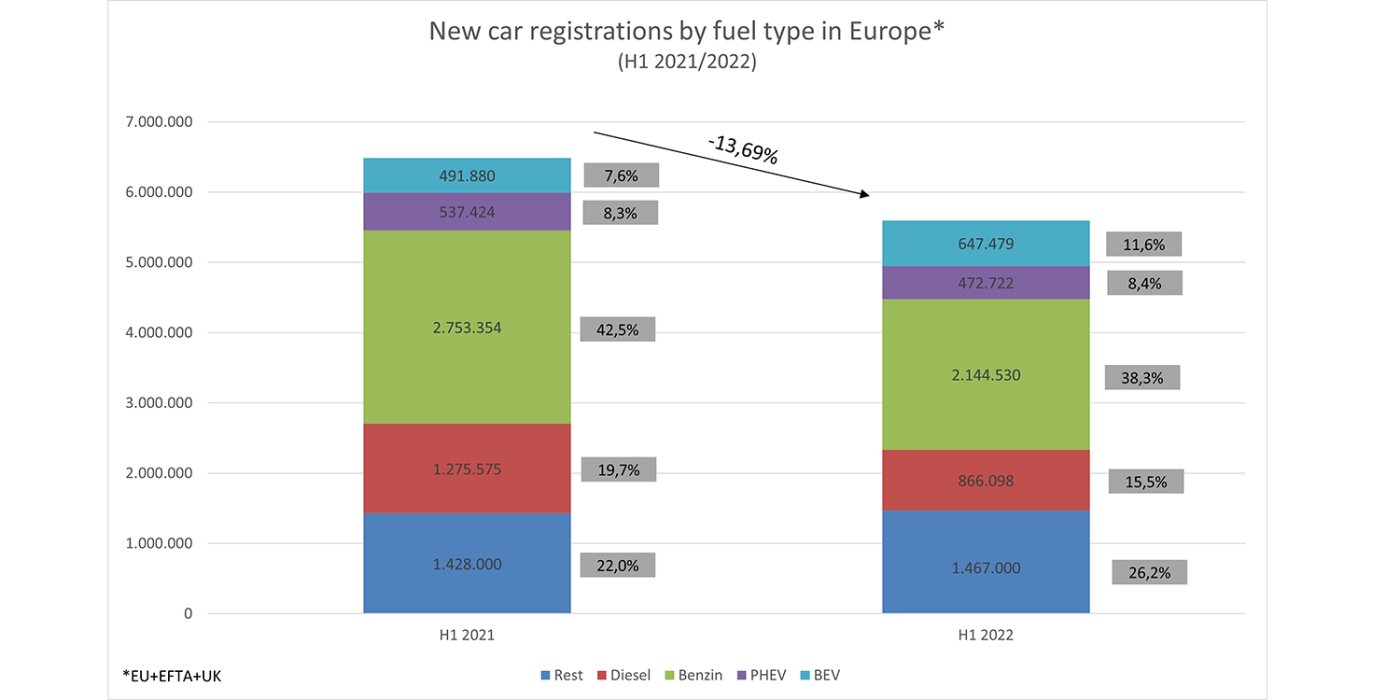

According to the report “Market and Sales Trends of E-Mobility in the Largest Automotive Markets in the First Half of 2022”, 11.6 per cent of all new registrations in Europe in the first half of the year were purely electric vehicles – in the same period in 2021, the figure was 7.6 per cent. In total, 647,479 BEVs were sold in Europe – according to the CAM definition EU, EFTA and UK.

While the purely electric cars in Europe were able to increase despite all the delivery difficulties, new registrations of the other drive types declined. PHEVs accounted for 472,722 new registrations (-12 per cent), while new petrol and diesel registrations fell by 22.1 and 32.1 per cent respectively.

Within Europe, Germany was the largest single market with 167,503 BEVs and an increase of 12.5 per cent. It was followed by the United Kingdom (115,249 BEVs, +56 per cent), France (93,344 BEVs, +28.7 per cent) and Norway (54,177 BEVs, +12.7 per cent). Germany is ahead, but the dynamics in the British Isles are currently different: In terms of BEV quota, the UK is already ahead of Germany (13.5 per cent) and France (12.1 per cent) with 14.4 per cent. In terms of BEV market share, however, Norway is the undisputed leader with 79.1 per cent – not only in Europe, but worldwide.

In absolute figures, the largest single market is still China. There, 1.95 million BEV passenger cars were sold in the first half of the year, which corresponds to an increase of 106 per cent. In the same period, an additional 534,000 PHEVs were newly registered (+168%). Total new registrations fell by 6.6 per cent to 10.355 million passenger cars in the first half of the year. Overall, pure electric vehicles already account for 18.8 per cent of new passenger car registrations in China.

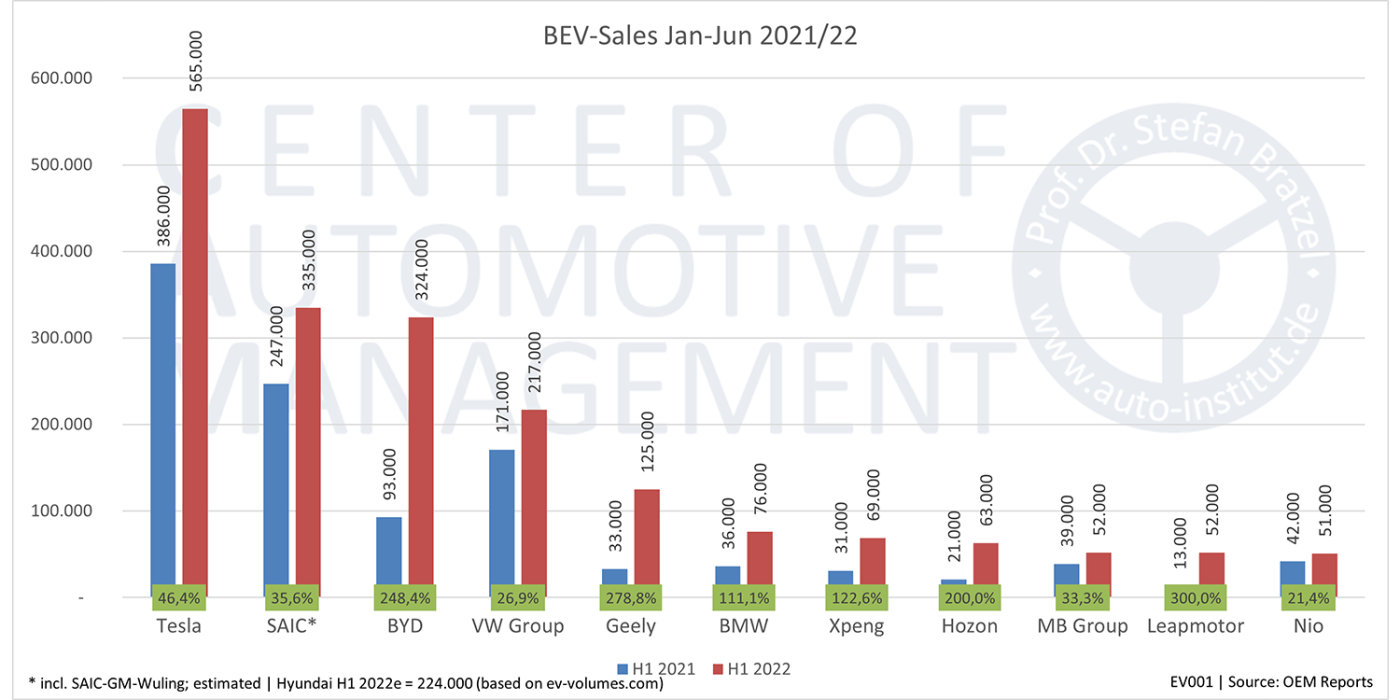

The sales dynamics were very similar among the largest carmakers: the twelve most important manufacturers considered by the CAM were able to almost double their BEV sales compared to the first half of 2021. However, as data is not yet available from all brands and markets, the CAM estimates sales at over 2.1 million passenger cars.

Tesla accounted for the largest share – almost a quarter of all 2.1 million BEVs – in the first half of 2022 with 565,000 passenger cars (+46 per cent). This already takes into account the production losses due to the Corona lockdown in Shanghai.

The Chinese manufacturers, in particular, are moving up behind Tesla: in the CAM evaluation, SAIC comes in at 355,000 BEVs, with BYD in third place with 324,000 BEVs. Compared to the same period last year, BYD was able to grow by almost 250 per cent. A near quadrupling of BEV sales is shown by the Geely Group with 125,000 electric cars, driven mainly by the BEV brands Geometry and Zeekr in China as well as Polestar and Volvo. According to the CAM, Xpeng as well as Hozon and Leapmotor also show strong growth, while Nio only shows “small increases” compared to the same period last year.

Among the German OEMs, the VW Group leads the way with 217,000 BEVs delivered (+27 per cent). As reported, BMW has delivered around 76,000 BEVs, Mercedes-Benz another 52,000 BEVs. Mercedes has thus fallen behind Xpeng (69,000 BEVs) and Hozon (63,000 BEVs) worldwide. According to the CAM evaluation, Leapmotor is on a par with Mercedes with 52,000 BEVs as well – and Nio only just behind with 51,000 units.

However, the BEV registrations of Hyundai-Kia and the Stellantis Group are missing from the evaluation. The CAM only mentions these two important carmakers in terms of eMobility sales in the outlook: Together with the “selected automakers”, Hyundai and Stellantis are expected to contribute the lion’s share of the total BEV sales forecast for 2022 of 6.5 million worldwide, with a total of around five million BEVs.

“Electric mobility is growing in all major automotive regions against the declining overall market. High growth rates are also expected in the current year 2022,” said study director Stefan Bratzel. “Car manufacturers that can already offer a wide range of pure electric vehicles and have robust supply chains can thus quickly gain market share and occupy an important position in the global automotive industry in the future. With the age of electromobility, the traditional industry structure and ranking of car manufacturers is increasingly changing in the process.”

With reporting by Sebastian Schaal, Germany,

Source: Info via email

0 Comments